In today’s dynamic world, the appeal of passive income is growing. Many are attracted to the idea of earning money with minimal ongoing effort, but exploring the various options can be overwhelming. In this article, we’ll explain passive income by defining it and outlining the different types available. Together, we’ll dive into the pros and cons of popular income sources like real estate investments, dividend stocks, and digital products, offering insights to help you make informed financial decisions. Come learn about the benefits and challenges of each option now so you can choose the right path for your financial future!

Understanding Passive Income

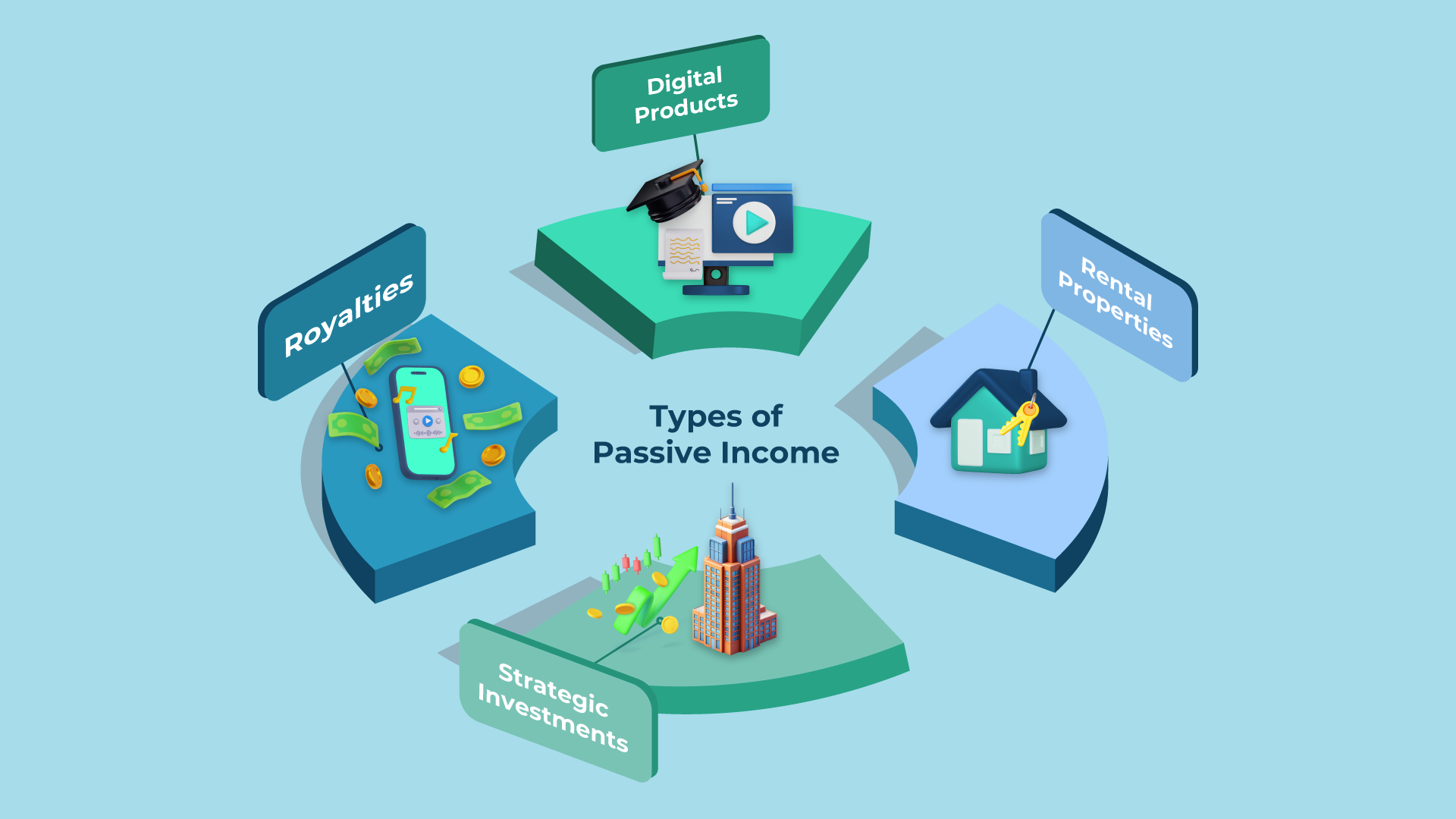

Achieving financial independence and building wealth often hinge on understanding and leveraging passive income. Passive income is generated from investments or businesses that require minimal ongoing effort to maintain, providing a steady income stream. This can include royalties from intellectual property, freelance earnings that supplement traditional income, rental properties, digital products, and various financial investments.

Definition and Types of Passive Income

Passive income refers to earnings that demand little day-to-day involvement once established. Common sources include:

1. Digital Products:

⚬ Examples: e-courses, apps, and downloadable content.

⚬ Benefit: One-time effort can lead to ongoing sales.

2. Rental Properties:

⚬ Examples: Residential or commercial real estate.

⚬ Benefit: Provides regular cash flow through tenant rent, often covering mortgage payments and other costs.

3. Royalties:

⚬ Examples: Income from books, music, patents, or other intellectual properties.

⚬ Benefit: Generates income whenever these assets are commercially used.

4. Strategic Investments:

⚬ Examples: Real Estate Investment Trusts (REITs), dividend stocks, savings accounts, and bonds.

⚬ Benefit: Offers sustainable earnings aligned with financial goals.

Pros of Different Passive Income Streams

It has been shown that having different passive income streams is important for wealth building, financial independence, and creating a secure path to economic stability.

As such, they provide income stability and opportunities for you to diversify your investments. For more information, check out the Pros and Cons of Different Passive Income Streams.

Let’s examine more benefits of having different passive income streams:

1. Benefits of Real Estate Investments

Real estate investments, especially rental properties, offer benefits like passive income, financial independence, and effective asset management.

These properties provide a stable cash flow, giving investors regular monthly income and building equity over time. The potential increase in property value adds to the appeal, offering opportunities for substantial long-term returns.

Additionally, tax benefits, such as deductions on mortgage interest and property depreciation, reduce the overall tax burden. These factors help you create a diversified income stream that aligns with your financial goals, supporting a secure path to wealth accumulation.

2. Advantages of Dividend Stocks

Investing in dividend stocks is a good way to generate passive income and work towards financial goals through regular returns and long-term wealth growth.

These investments provide regular income through stock dividends, allowing you to earn money without selling your shares. Many companies that pay dividends have strong fundamentals, leading to potential capital growth over time. This adds extra potential profit while benefiting from consistent dividend payments, aiding wealth accumulation and retirement planning.

Including dividend stocks in a diversified investment strategy can reduce risk, as they often have lower volatility than non-dividend stocks. As a result, investors benefit from steady cash flow and build more stable and resilient portfolios, crucial for achieving financial independence and economic stability.

3. Pros of Creating Digital Products

Creating digital products is a smart way to generate passive income, providing financial stability and efficient time management, while also allowing for growth through online advertising. This approach supports financial freedom by transforming one-time business profits into long-term revenue streams.

By developing e-books, online courses, or specialised software, individuals and entrepreneurs can reach a global audience, far beyond their local area. This expands their earning potential and provides the flexibility to manage their time effectively, freeing them to pursue other interests or projects.

Once these digital assets like e-books, online courses, and apps, are created, they often require little maintenance, making them ideal for building a steady income stream. Online marketing and distribution, including strategies like affiliate marketing and online advertising, make it easy to attract customers, ensuring ongoing revenue from their creations.

Cons of Different Passive Income Streams

Of course, passive income streams have their drawbacks too, such as market risks that can impact income stability and potential challenges that can slow progress toward financial goals, possibly leading individuals back to relying on traditional income sources.

1. Potential Risks of Real Estate Investments

While real estate investments can be profitable, they also come with risks like market changes that can affect the income from rental properties, requiring effective risk management strategies.

These market changes can lead to lower demand, impacting rental income and overall returns. Investors often deal with property management challenges, such as maintenance issues, tenant turnover, and the need to comply with local regulations. Financing can also be difficult, especially when interest rates fluctuate.

To protect their income, you can engage in risk mitigation by:

- Diversify your property portfolios

- Conduct thorough market research before buying

- Establish clear management procedures to streamline operations and reduce disruptions

2. Drawbacks of Dividend Stocks

While dividend stocks can offer passive income, they also have downsides, such as market risks that may lead to lower dividends and a possible need to return to non-passive income sources.

You should understand that dividends can be cut due to various reasons like economic downturns or poor company performance, affecting their financial plans. Market volatility can influence stock prices, making it hard to rely only on dividends for steady income.

This dependence on stock performance might discourage some from fully adopting dividend investing as a long-term approach.

Therefore, understanding the balance between risk and reward is essential for those considering adding these stocks to their portfolio, as sudden market changes might require reassessing their overall investment strategy.

3. Challenges of Creating Digital Products

Creating digital products involves challenges like time management, ensuring quality content, and developing effective online advertising strategies to sustain passive income.

These challenges continue beyond the initial setup, presenting ongoing difficulties in a constantly changing digital market. Competing with many similar products can be tough, often needing unique marketing strategies to establish a niche.

The time required to build a solid product can also take away from other projects, so finding a balance is essential. Without addressing these issues, the potential for passive income may decrease, affecting economic stability and financial growth.

Ready to explore the power of passive income?

Versa Dividend+ and Versa REITs can help!

● Versa Dividend+: An investment fund that invests in Malaysian and Asia-Pacific companies with a focus on dividend-paying stocks, aiming to provide investors with both regular income and the potential for long-term capital growth.

● Versa REITs: Gain diversified exposure to a range of commercial, industrial, and retail properties across multiple countries, with the potential for consistent income, a hedge against inflation, and diversification within your investment portfolio.

Jump into Versa and harness the power of passive income today!

Should you have any questions, please do not hesitate to reach out to us here. 💬