With inflation, many of us are worried. While living costs rise, our income can’t keep up. What is inflation, the causes, and what should we do?

In this article

What is Inflation? ?

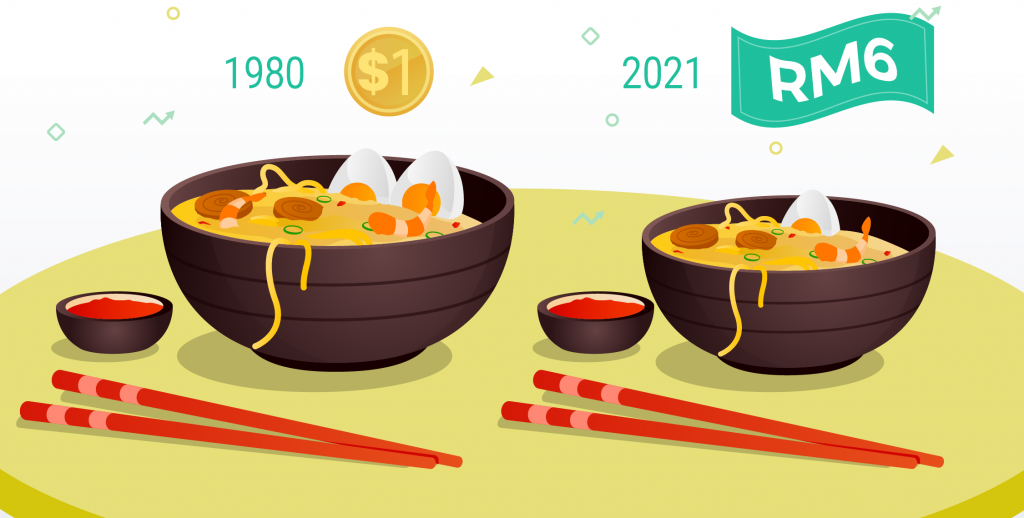

Inflation is when the overall cost of living increases. Do games, foods, or groceries cost a bit more than a few years ago? You can put that down to inflation.

There are lots of reasons why inflation happens. In 2022 and Malaysia specifically, inflation happens due to:

- Wage growth

The purpose of raising the minimum wage is to improve the overall standard of living for minimum wage workers. The increase in minimum wage also meant an increase in labour cost for employers. As businesses seek to protect their margins, it created a snowball effect that led to higher product prices and subsequently overall cost of living for Malaysians.

- Higher demand amid economic reopening

Oh how we rejoiced when the lockdown was lifted. Little did we know that when consumers returned to restaurants, shops, etc.; businesses had to race to meet demand. As business roared back, global supply chains struggled to fulfill the spike of demand.

With demand up and supplies down, costs jumped. And companies had to pass along those higher costs to consumers by charging higher prices.

- Russia – Ukraine War

In 2020, no one would have predicted the Russian invasion on Ukraine and the subsequent effect on the economy. Russia and Ukraine together supply more than a quarter of the world’s wheat. The on-going war has led to a wheat shortage, driving up prices of a wide range of food from pasta to cereals. It’s not just that. These countries also export sunflower oil and corn which are essential to make livestock feed; thus increasing the prices of meat as well. These several factors have caused energy and food prices across the world to rise.

- Importing goods

Malaysia is a net importer of food and this means higher imported inflation. Animal feed and fertilisers are increasing in price; therefore this contributes to higher food prices.

What can we do amid Inflation? ?

Financial experts would advise us to continue investing to hedge against inflation. Unfortunately for us, the markets are declining quicker than you could say kacang panjang kacang pendek. At this point, alongside the uncertainties of the market’s future, would it be worthwhile to invest?

So the question becomes: should I invest or save? Here’s our take:

1. Get to know your goals ?

One key aspect about managing your finances is to have a set of goals.

Ask yourself: What are your short term goals and long term goals? How soon do you want to access your cash? What are your current financial priorities?

By planning ahead, you have a clear idea of where you want to be financially. This lets you decide your next step with your finances.

>>> We discuss how timelines affect your goals here

2. Have 3 – 6 months of savings ?

Before making any huge financial decisions, it’s important that you have a stable financial foundation.

By saving 3 to 6 months worth of your monthly expenses, this will act as your emergency fund. This way you can pay off any unexpected expenses such as a job loss or medical emergency. Remember: don’t invest your emergency fund! Park it somewhere safe and accessible because you’ll never know when you need it.

3. Have enough spending cash in your bank account ?

It’s important to have money which you can access anytime.

Make sure your balance is around the same amount of your monthly expenses. This way you can pay off essentials first – for example: loans, credit card debt, bills, and groceries.

4. Start cutting costs ✂

When it comes down to it, we need to go back to basics.

One of the biggest expenses that can come up to a lot is meals.

To save time and money, give cooking at home a go:

Buy in bulk – If you plan to cook long-term, buying in bulk gives you the most bang of your buck as the items are sold at a discount.

Meal planning – Being busy is simply a part of #adulting. By the time we reach home at 7PM, the last thing we want to do is cook a meal from scratch. Meal planning encourages us to make mindful grocery purchases. To save yourself from spending an hour in the kitchen everyday, meal prep over the weekend. On workdays, you can take out your meal prep and whip up a filling, home cooked meal in 10 minutes such as soup noodles, fried rice, or pasta.

Make use of coupons and cashbacks – Coupons and cashbacks offer a great opportunity to make purchases at a discount. You can find them online or readily available on certain online shopping sites. Avoid making unnecessary purchases just to use the coupon/cashback. It may be tempting but you may spend more than intended. So, if there’s nothing else you need to buy, the best thing to do is ignore it.

>>> Did you know that there are many unnecessary expenses in our life that can be cut out easily?

5. Invest for the long run ⏳

By long run, we don’t mean 2 years or 5 years. With the current market conditions, the next best move is to invest for the next 10 years and more.

Historically speaking, the market as a whole trends upwards in the long run. The longer you are in the market, the likelier you are to see a healthier return. Since not even experts know when the market’s best days will be, the only way to guarantee the best returns is to stay invested – even through the lows.

If you’re uncertain about continuing to invest, give our next tip a try:

6. Don’t let your current savings stay idle ?♂️?

With inflation on the rise, your savings are already making losses – just by sitting in your bank account. We may not be able to fight against rising inflation but it’s not too late to start hedging. How? Start saving in accounts that yield consistent returns at a very low risk, such as Versa Cash. With monthly returns, you can offset the potential losses caused by inflation.