Stand to Double Your Savings (“Campaign”) – Terms & Conditions

1.0 Eligibility:

- This Campaign is open to all Versa application users holding a Malaysian citizenship, aged eighteen (18) and above (“User” or “Users”) subject to the Terms and Conditions herein.

- The following User(s) shall not be eligible for the to participate in this campaign:

- Permanent, contract, part-time, temporary employees of Versa and their immediate family members. “Immediate family members” is defined as father, mother, brother, sister, spouse, children and adoptive relationships;

- Employees of agencies, partners and consultants with ongoing engagements with Versa during the Campaign Period.

- All User(s) must deposit the required Fresh Funds to participate in this Campaign. “Fresh Funds” means additional funds on top of User(s) current balance as of 8 November 2022, that do not originate from any Versa account.

- In the event a User is found to be ineligible or discovered to have committed fraud and/or abuse of system, such as withdrawing to redeposit into Versa Cash, and/or any other scenario deemed as fraud or abuse of system by Versa, at any point of time during or after the Campaign Period as stated below, Versa reserves the right at its sole discretion to disqualify the said User(s) and to cancel/withdraw/recall any reward and/or returns granted to the User(s), failing which, the User(s) agrees and undertakes to indemnify Versa for the value and costs of such credit & incentives. Versa shall have the right to initiate any action it deems necessary against the said User(s).

2.0 Campaign Period:

- Unless otherwise notified by the Versa, the Campaign will be conducted from 9 November 2022, 0001hr (Malaysia time) to 28 January 2023, 1159hr (Malaysia time) (“Campaign Period”), both dates inclusive

3.0 Campaign Prize:

- The Campaign Prize are as follows:

| Prizes | Number of Winners | |

| Grand Prize | Up to a maximum of RM30,000 | 1x winner |

| Highest Depositor Prize | RM888 | 1x winner |

| Consolation Prize 1 | RM50 | 3x winners |

| Consolation Prize 2 | RM100 | 3x winners |

| Consolation Prize 3 | RM150 | 3x winners |

| Consolation Prize 4 | RM288 | 3x winners |

| Consolation Prize 5 | RM388 | 3x winners |

- The User that is selected for the Highest Depositor Prize is the User with the highest cumulative deposit of Fresh Funds into Versa Cash throughout the Campaign Period.

- The Grand Prize amount will follow the total balance in the User’s Versa Cash account on the day User is notified and will be capped at a maximum of RM30,000.

Example: User A has a balance of RM15,000 in his/her Versa Cash account on 1 Feb 2023 and was notified that he/she is the Grand Prize winner on the same day. User A will receive the Campaign Prize of RM15,000 from Versa, which follows the balance in the User’s Versa Cash on the day of the announcement.

- All Campaign Prizes will be deposited into the User(s)’s Versa Cash account in the form of units.

4.0 Campaign Mechanics:

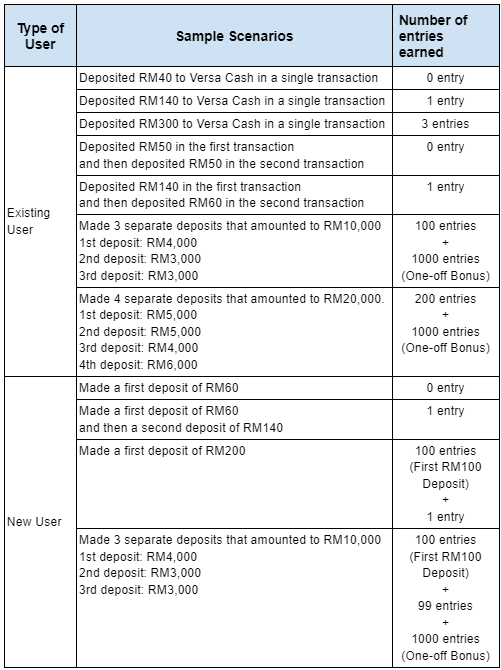

- To be eligible for this Campaign, User(s) are required to deposit a minimum of RM100 Fresh Funds in a single transaction into Versa Cash during the Campaign Period.

- Every RM100 deposit of Fresh Funds in a transaction into Versa Cash will earn the User(s) one (1) entry during the Campaign Period.

- If the User(s) deposits a total amount of RM10,000 Fresh Funds cumulative into Versa Cash throughout the Campaign Period, the User(s) is eligible for an additional one-off bonus of one thousand (1000) entries.

- For User(s) that have successfully completed account registration and onboarding but have never made a deposit into any Versa funds regardless of the amount (“New User”), the New User(s) is eligible for a one-off bonus of one hundred (100) entries when he/she makes a minimum first deposit of RM100 in a single transaction into Versa Cash. Every subsequent deposit of RM100 will earn the User(s) one (1) entry during the Campaign Period.

- Any successful deposits into Versa Invest will not qualify User(s) for entries throughout the Campaign Period.

- Sample scenarios as below:

- All User(s) that successfully meet the conditions of the Campaign shall be eligible for a chance to win the Campaign Prize. The winner selection will be done using a randomised system throughout the Campaign Period, except for the Highest Depositor Prize as stated in clause 3.2.

- All shortlisted User(s) will be contacted by Versa via phone call for further verification, to qualify them as a winner of the Campaign Prize.

- Versa will make a maximum of 3 attempts to contact the shortlisted User(s) for verification. In the event that Versa is unable to contact the User(s) after 3 attempts for any reason whatsoever, Versa reserves the right to select the next User(s) where the same process of selecting the winner will be repeated until a winner is identified.

- User(s) will only be entitled to win one (1) Campaign Prize throughout the Campaign Period, unless the User is eligible for the Highest Depositor Prize.

- The winners will be announced following the schedule below:

| Campaign Prize | Winner Announcement Dates |

|

Consolation Prize 1 3 winners |

24 Nov 2022 |

|

Consolation Prize 2 3 winners |

08 Dec 2022 |

|

Consolation Prize 3 3 winners |

22 Dec 2022 |

|

Consolation Prize 4 3 winners |

5 Jan 2023 |

|

Consolation Prize 5 3 winners |

19 Jan 2023 |

|

Highest Depositor Prize 1 winner |

2 Feb 2023 |

|

Grand Prize 1 winner |

2 Feb 2023 |

- Versa’s decision on all matters related to this Campaign shall be final and binding, including the selection of the winners. No inquiries by the User(s) will be entertained.

5.0 Miscellaneous:

- The Campaign Prize will be deposited into the User(s)’s Enhanced Deposit Fund (Versa Cash account) within 30 working days from the date of winner announcement. In the event of a delay, Versa will communicate with the User(s) via email, app inbox message, phone call or any other means deemed suitable by Versa.

- The User(s)’ Versa account must be active when Versa deposits units into the User(s)’s Enhanced Deposit Fund (Versa Cash account). Versa reserves the right to void the Campaign Prize after it has been deposited in the event the Versa account becomes dormant or inactive.

- Versa reserves the right to make further verifications and request for further personal identification details and documents, as well as the right to disqualify or withdraw the User(s) eligibility for the Campaign Prize at any time, including the period after the Campaign Prize has been awarded to the User(s), should there be any non-compliance to the agreed terms and conditions.

- Versa reserves the right to use the names, addresses, photographs, information and documents of the User(s) and/or winners as materials in advertisements and other form of publicity for the current and future marketing purposes from time to time without prior notice to the User(s) and/or winners and the User(s) and winners shall not claim ownership of the material. Participation in the Campaign constitutes their consent to such use, without further notice, payment, or consideration.

- By entering or participating in the Campaign, User(s) hereby fully and unconditionally agree and accept all the Terms and Conditions herein contained and agree that the decisions of Versal regarding the Campaign and all matters relating to or in connection thereto are final and binding and no such queries, appeals or correspondences will be entertained.

- Versa reserves the right to cancel, shorten, extend, suspend or terminate the Campaign at any time prior to the expiry of the Campaign Period without prior notice to the User(s). For avoidance of doubt, any cancellation, extension, suspension or termination of the Campaign Period at any time prior to the expiry of the Campaign Period shall not entitle the User(s) to claim any compensation from Versa for any and all losses or damages suffered or incurred by the Users as a result of the said cancellation, extension, suspension or termination. Versa also reserves the right to amend, modify, delete or change any of the Terms and Conditions herein contained at any time at its absolute discretion with adequate notice. Continued participation in the Campaign following any such changes and/or amendments shall constitute unconditional acknowledgement, understanding, agreement, and acceptance of such changes in respect of the Terms and Conditions.

- Versa shall not be held responsible or liable for any claim of loss or damage to property or personal injury or loss of life by the User(s), and/or any party resulting from or arising out of or in connection with this Campaign or the rewards given under this Campaign.

- These Terms and Conditions prevail over any provisions or representations contained in any brochure or other promotional materials advertised under this Campaign.

- Versa is the final authority to decide on the interpretation of these Terms and conditions and as to any other matters relating to this Campaign.

6.0 Personal Data:

- By participating in this Campaign, User(s) are deemed to have agreed and consented to the collection, processing, use, disclosure and retention by Versa of their personal data in the manner as set out in the Personal Data Notice given pursuant to at https://versa.com.my/privacy-notice/