With everyone staying at home these days, I’m sure many of us have been guilty of doing a lot of online shopping. After all, it has become so convenient to check out without thinking twice. However, have you ever stopped to think about what you’re actually spending your money on?

Being intentional about your spending can help you save money in the long run and spend on purchases that are truly worth it. Here are a few tips on how to control your spending:

Set a money spending limit on a prepaid card

Let’s be real, simply telling yourself, “I need to spend less” is easier said than done. You would need to have a lot of discipline. What you can do instead is set a spending limit when you deposit your cash into a prepaid, debit, or credit card. You could also reserve the card for a specific type of expense such as takeaway/delivery or monthly subscriptions (Netflix, Spotify).

Knowing that there is a fixed amount of money to spend helps you be more intentional about what you spend on. Also, it is a lot easier to control your spending when there is something physically limiting you from doing so.

Control your spending by differentiating needs and wants

Although these terms are self-explanatory, it can still be hard to distinguish between them. Note that a need is something essential for survival while a want is something you can survive without.

Let’s take grocery shopping as an example. Do you tend to make impulse purchases at the checkout counter? This is because grocery stores are strategically organized in a way that makes you spend more.

Manage your spending with a checklist of things you need

The next time you go grocery shopping, list down the things that you need in your phone or on a piece of paper and calculate the total cost. That way, you can spend wisely and also save time as you’ll immediately know which aisles you need to go to. Figuring out a budget and seeing the numbers written down is also a good way to hold yourself accountable.

“Does this mean I can’t buy the things I want?“

Of course not, it is perfectly fine to treat yourself once in a while but do it within your means. Because the truth is, there is always going to be a new and better product that you’ll want, and you can’t be spending your money on every one of them.

Make a list of wants that are within your budget

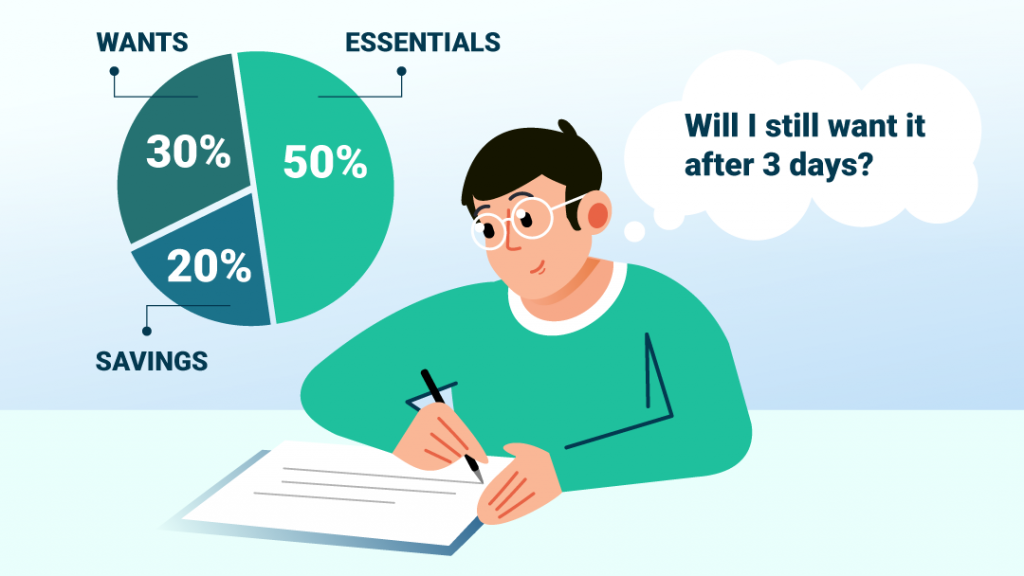

Set a budget first, you can start with the 50/30/20 Rule. Next, make a list of your wants and include the cost beside it. Then, wait 3 days before deciding on a purchase. The rule of thumb is that if you still think it’s necessary after 3 days, then go ahead.

Are your purchases really worth it?

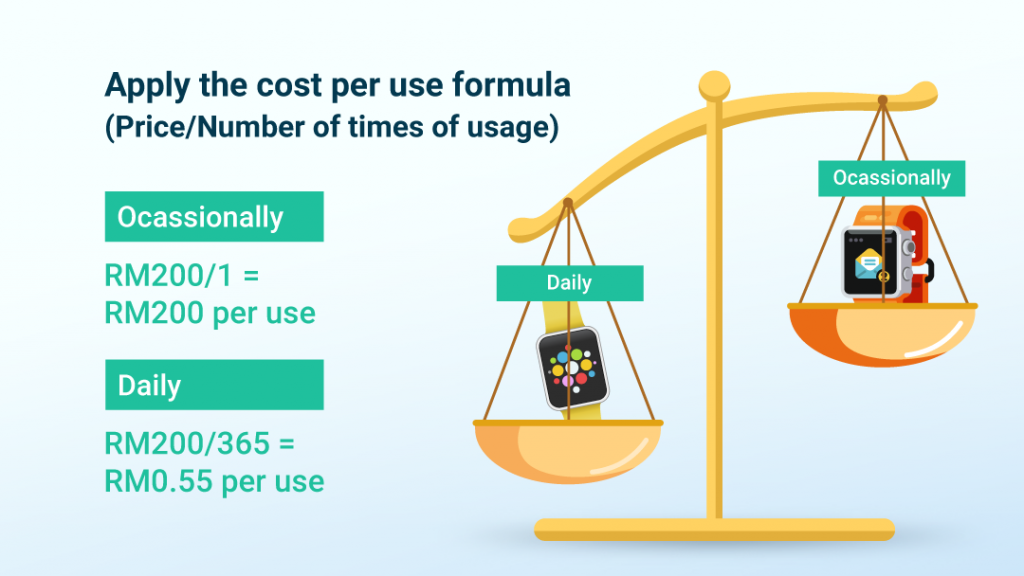

One way to determine the value of your purchase is by using the cost per use formula. Let’s say you buy an outfit that costs RM 200 for a one-time occasion, this is the cost per use:

Price/number of times of usage

RM 200/1 = RM 200 per use

Whereas, when you buy a pair of good quality jeans, there’s a higher chance you’ll wear them more often and for a longer time.

RM 200/365 = RM 0.55 per use

You can use this formula for your list of wants as well. When making purchases, consider better quality items that you can keep long-term to get the most out of your money. Remember that less is more.

Need a little more motivation in managing money?

If you need a little push and motivation to start saving, consider using Versa . When you save your money with Versa, you can earn daily returns on par with fixed deposit rates. Rest assured that you have the flexibility to withdraw your money anytime without penalties, and there are no fees.

Managing your money is a process that takes time and discipline but is not impossible. With a little effort and determination, you can take control of your finances and cultivate better spending habits!