You finally have financial independence, you can spend your money on the things you want, and that’s exciting. However, learning how to manage money in your 20s feels like another item in the overwhelming list of properly adulting. Your 20s is a time when you know everything there is to be your self-reliant adult. That includes all the financial aspects of life too. And it’s crucial that you learn how to manage money properly in your 20s so that you’ll not be spending your 30s and 40s trying to correct your financial mistakes of your 20s.

There’s a lot to learn, so it’s good to start with the most basic but most important aspect of personal finance; your spending habits. How much money you make is important; however, how much you spend is far more important. You don’t have much control over how much money you make in the short term. When it comes to spending, though, you have all the control.

Here are some ways on how to manage your money in your 20s

Create a budget

Creating a budget is a lot similar to exercise, you know it is beneficial, but you are either too lazy or not motivated enough to do it. A budget helps you keep a record and track your cash flow. You’ll be surprised that creating a budget can help create financial awareness, reveals terrible spending habits, and helps prioritize your goals.

While creating a budget might seem like tedious work, there are plenty of online resources and apps that can help you, but if you like it old school, then an excel sheet would do the trick.

The 50-30-20 method is a helpful place to start budgeting if you’re a newbie. Simply divide your budget into three ways: 50% towards living expenses and essentials, 30% towards flexible lifestyle spending, and 20% towards your financial goals.

Tip: Ask yourself this: “Do you know how much money you spent last month?”. By doing this, you’re able to question yourself and identify areas that you have been spending money.

Create a debt repayment plan

The chances of you having either a student or car loan are high. That’s the most basic loan that most of us apply for and currently are stuck with it, well, at least till we pay it off. The best way to get started with paying off outstanding loans is by creating a debt repayment plan.

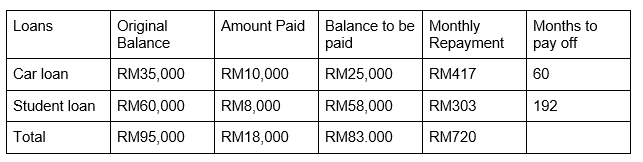

But the biggest question here is, how do you create a debt repayment plan? It’s actually pretty simple. You could just use an excel sheet and list all the outstanding loans you have, include the original amount, the amount paid, months to pay off and all the other relevant information you feel is appropriate to be included. This would help you keep track of your loans at your fingertip.

The faster you get rid of debt, the more disposable income you’ll have.

Example of a debt repayment plan:

Tip: Always pay your loans on time to not get served with a late payment interest. Having a late payment history could also affect your credit score.

Credit Cards

Credit cards are a two-way sword, and they can be your best friend or your worst enemy. If you’re someone with high discipline and self-control, then yes, credit cards are a great tool, especially when it’s loaded with rebates and loyalty points as you’re able to get the best out of it. However, if you easily get tempted, and you can see yourself swiping the credit card without self-control, then maybe it’s not ideal for you to have a credit card. Owning a credit card means you get to be on time, paying it back, or being prepared to be served with a late payment interest. High-interest credit card debts can ruin your finances over time, leeching away your savings.

Tip: If you’re still planning to get a credit card, decide on an amount you’re allowed to swipe, stick to it and only use it for emergencies. This way, you’ll be more in control of your expenses.

Investment

When you have a sufficient amount of savings, it is time to take up it a notch and consider investing it.

There are many types of investment plans in the market, such as short-term, long-term, savings plans, and mutual funds. However, before going all out on investment, you should consider these few factors:

- Appetite for risk

- Your time available to monitor your investment

- Why you’re investing

Having the ability to invest in your 20s is excellent as one of the main investing factors is time. You’re giving yourself a reasonable amount of time that allows you to capitalize on all that growth.

Tip: If you’re thinking about investing and not quite sure how to get around investment to talk to a financial planner, that could help you straighten things out as there plenty of investment types, and you don’t want to get into the wrong one.

Disclaimer: The article linked in the paragraph is from 2018, however, it gives a comprehensive overview of the investment plans available in the market.

Get Insured

You do many things to ensure that you’re in your best physical abilities, whether working out at the gym or going for that weekend hike. However, when you’re young, you expect the least to happen to you. Still, things don’t always go according to plan, and sometimes our body tends to fail on us, resulting in medical treatment and occasionally hospitalization.

Applying for insurance, especially when you’re young, provides you with the advantage of paying low insurance premiums and saving you from unexpected medical bills significantly when the medical fees rise.

Tip: When signing up for an insurance plan, try getting a plan that comes with a saving option; this way, you’re medically covered and also saving at the same time.

Employee Benefits

Maximize your earned income in the form of benefits. Most of us tend to focus more on the salary that we forget about employee benefits because it doesn’t seem much a priority. Salary is important, but so are employee benefits. It includes health, dental, vision, and many more that cannot burn a hole in your pocket in times of need.

However, most of the employee benefits are optional; not all organizations would provide the same benefits package. For example, having the added advantage of a parking allowance allows you to save up a certain amount of money every month, especially when parking rates are expensive.

Tip: Always check if the company you’re about to join provides you with any kind of employee benefits, and try to negotiate for employee benefits if your salary is lower than what you expected.