With investing becoming more mainstream, you may be curious to start investing yourself. It’s easy to be drawn into popular investing such as cryptocurrencies and NFTs. But that doesn’t mean we need to follow them to be successful in investing.

Like a thumbprint, we are all unique with different financial situations and goals. It’s important to tailor our investment plan to ourselves; rather than relying on the strategies used by other investors.

So how exactly do we start?

Step 1: Review your current financial situation for the best investment plan for yourself

The first step is understanding your present financial situation. This way, this can lay out the foundation of how much you can invest and your risk tolerance. You can do this by budgeting to evaluate your monthly disposable income and determine how much you can reasonably afford to invest.

It’s important to also ensure that you have built a good financial foundation. Ask yourself: do you have an emergency fund and enough funds to pay off any existing debts?

Step 2: Set your investment goals

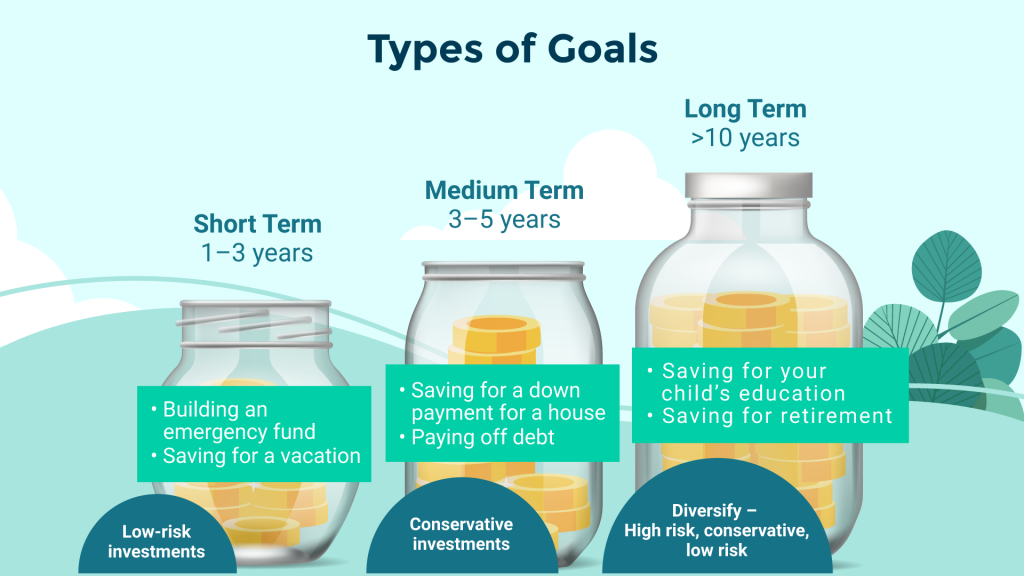

This step is key to ensure your purpose when investing. Without it, investors tend to chase higher returns, leading to making riskier investments. Investment goals can be categorised as short, medium and long term.

Short term goals need low risk investments as they need to be achieved within a short period of time. Stocks or mutual funds, which tend to fluctuate greatly, may not give you the return you need in the short term.

Medium term goals often overlap between short term and long term goals. We can’t always tell when the goals can be achieved. Perhaps saving up for a car is taking much longer than planned. Like short term goals, stick to conservative investments. But you need to step up the risk to improve your returns.

Long term goals usually look at the bigger picture. With more time gives more flexibility. You can invest in growth assets – which tend to fluctuate more but produce higher returns over time. Since you have time to weather short-term ups and downs in the market, the risk is lessened. Once you approach the time where you need your money, switch to more conservative investments. This way, you reduce the risk and meet your goals on time.

Step 3: Determine your risk tolerance for your investment plan

Understanding your risk tolerance can help you design a portfolio that will benefit you in the long run. So how exactly do you determine your risk tolerance?

A cliché we often see is the “age-based” risk tolerance. The younger you are, the more risks you can take as your portfolio has time to recover from any losses. On the other hand, an older person who is nearing retirement age would have a lower risk tolerance.

That’s not all though. Your net worth and funds that you can allocate for high-risk, high-reward investments need to be considered too. That is why you need to establish your current financial situation in the first stage. An investor with a high net worth can assume more risk.

Finally, your investment goals can also determine your risk tolerance. For example, if you are saving up for your retirement, how much risk are you willing to take with those funds?

Step 4: Decide what to invest in

With many investment options, one may find it overwhelming. Your budget, goals, and risk tolerance will guide you towards the right investments. They will help you narrow down your options when researching investments.

Take into account the following:

Return — What are the expected returns? Does it come from income or capital growth?

Time frame — How long do you need to invest to get the expected return?

Risk —What are the types of risk? Are you comfortable taking on these risks?

Access to cash (liquidity) — How long will it take to cash in on your investment?

Cost to buy and sell — How much will it cost to buy and sell the investment?

Tax — How much tax will you pay on the investment earnings?

You can start off by investing with a small sum. Once you have gotten a feel of investing, scale up to a larger sum.

One key step in investing is to diversify your portfolio. Avoid putting all your money into one investment or asset class. You risk losing everything if that particular investment does not perform. By allocating your assets to different investments, you can maximise your growth and ensure stability.

Step 5: Track and rebalance your investments

This is the last step here but it is only the beginning of your amazing investing journey! Once you have made your relevant investments, study and track their performance and rebalance. At this stage, educate yourself and keep updated to ensure that you make the best choices for your investments.

For example, your investments are performing well. So you can choose to move your investments to lower investments instead of riskier ones. This will reduce any chances of losses and ensure you meet your investment goals in time.

If your investment plan is in good shape, you’ll want to consider rebalancing your portfolio. That means buying or selling assets in your portfolio to maintain your target asset allocation.

It’s always better to start investing now than later

With the threat of inflation, investing your funds is crucial to ensure you are not losing out. If you’re still at the planning stage, consider making a low risk investment like Money Market Funds in the meantime. It offers higher interest with liquidity so you can withdraw your cash anytime – such as Versa Cash/i . This way, you have time to plan while letting your capital grow overtime.