Fixed deposits can be a great place to put your money if you can lock away your cash for some time. After all, it’s safe and guarantees returns.

That is what many of us might have believed up until COVID-19 happened which brought fixed deposit rates to an all-time low. As of 2021, FD rates are at 1.75%. This is a huge decrease compared to the 3-5% p.a. rate a few years ago.

Despite the low rates, fixed deposits can still be an option for those who want safety and guaranteed returns. But before you consider using a fixed deposit, there are a few things you should take note of.

Avoid using fixed deposits for your emergency fund

Emergency funds need to be easily accessible to you and fixed deposits are anything but that as they lock away your money for some time. For an emergency fund, liquidity is more important than earning high returns. If you face an emergency and have to make an early withdrawal, you would risk losing a large portion of your interest, even if it is only a few days before your maturity date.

For an emergency fund, consider a savings account or a digital cash management tool like Versa that allows you to withdraw your money whenever you want to without any penalties.

Avoid using fixed deposits to beat inflation

Although fixed deposits are a safe investment, we would not recommend putting your money in a fixed deposit account for any longer than 1 year. This is because of inflation. Inflation is the general increase in prices every year, leading to a rise in the cost of living. In other words, back then, your parents could get a bowl of curry mee at RM 1. But today, you would have to pay up to RM 6 for that same bowl of curry mee.

Inflation may not appear to have a huge impact on the price of your expenses when you look at it on a year-to-year basis. But, don’t forget that inflation reduces the value of your money every year. Over time, this has a huge impact on your investments. Currently, the inflation in Malaysia, measured by the consumer price index (CPI), increased 4.7% in April 2021 to 123.1 as compared to 117.6 in April 2020. When inflation is higher than the interest rate, theoretically, the returns you earn from FD would not be enough to compensate for price increases in the economy. Therefore, locking up your money in a fixed deposit for the long term may not be worth it.

What about using a fixed deposit for short-term investments?

Fixed deposits can be useful for short-term investments like making a downpayment on your house or car. Since these are purchases that you usually plan for beforehand, it’s a great way to earn some interest on your savings before making the purchase. But that means you have to make sure your fixed deposit matures in time to make the payment. So, if you’re going to buy a house in 12 months, you would have to get a 12-month fixed deposit.

The downside to that is you won’t have the flexibility to decide when to use your funds as it would have to match the withdrawals. If you suddenly decide that you want to buy a house before 12 months, you would lose all your hard-earned interest by making an early withdrawal.

So when exactly can I use fixed deposits?

Fixed deposits may be suitable for when you are going to retire or are retired. At that age, you may not be keen on investing in anything too risky as it would be difficult to recover from huge losses.

Consider an alternative that gives the best of the both worlds

With Versa, you don’t have to make a trade-off between liquidity and returns. Versa gives you daily interest up to 2.46% p.a (inclusive fees), a potentially higher rate than fixed deposits, and the flexibility to withdraw anytime without losing the interest you have gained. In that case, you can use Versa for your emergency fund, short-term investments, and even long-term investments.

Here is how Versa compares with Fixed Deposits:

Easy onboarding

Signing up for Versa can be done on your mobile phone and takes less than 10 minutes. You can also sign up for fixed deposits online but only if you own an account with the respective bank. If not, you have to physically go to the bank and bring your required documents to apply.

Convenient and low risk

Usually most people would go around looking for different banks and comparing the fixed deposit rates, which can be time-consuming. Versa saves you the hassle of searching for banks as it invests in Affin Hwang Enhanced Deposit Fund, a money market fund which mostly invests in multiple Malaysian bank’s fixed deposits. Therefore, it is safe and low risk.

Higher overall returns than FD

Versa projects a return of 2.46% p.a. with a minimum deposit of RM 1. Your deposit will continue to compound when the unit price of the fund increases. Plus, there is no lock-in periods! Whereas, FD only gives you interest based on your initial deposit.

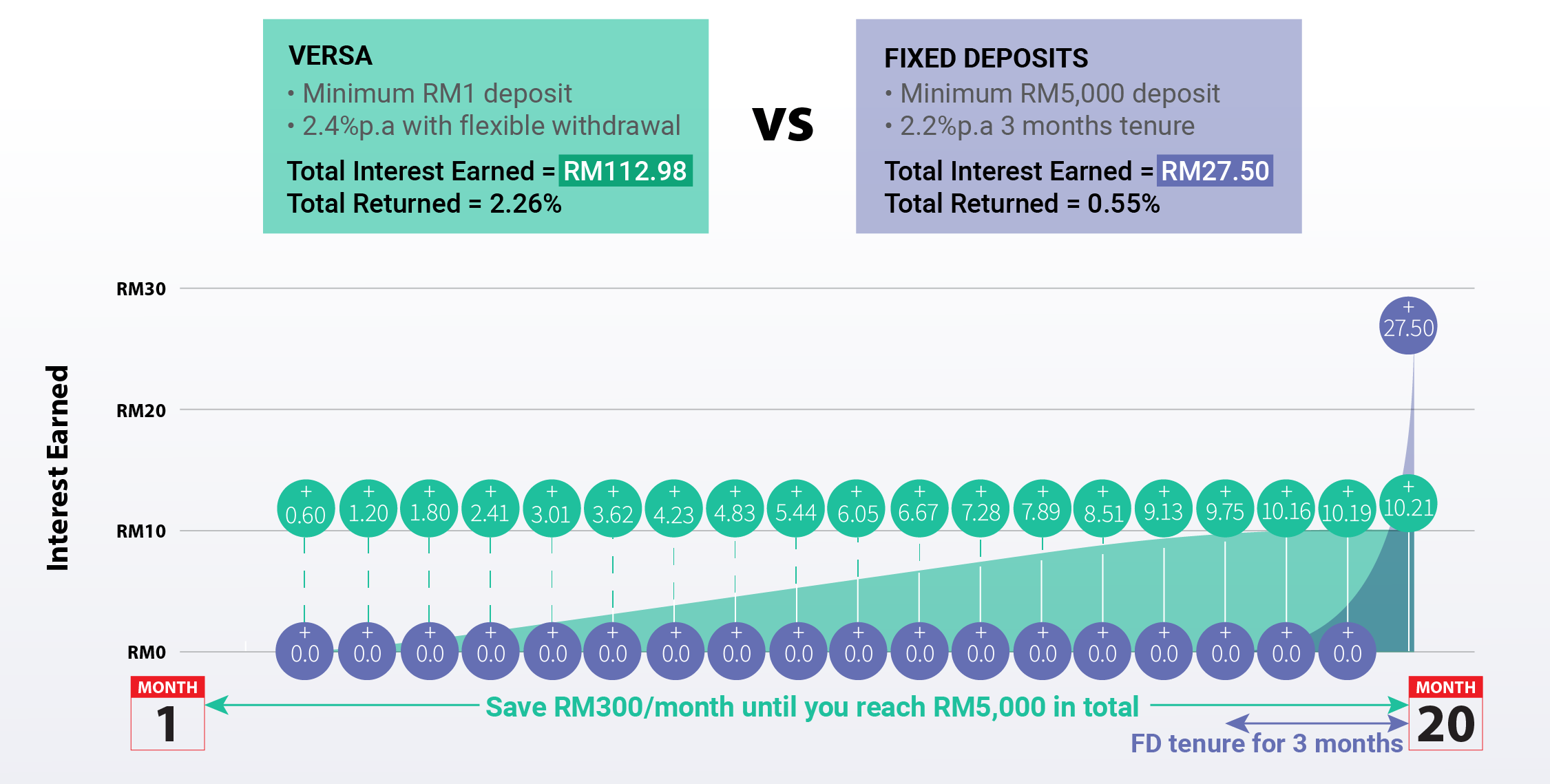

Here’s how much you can earn with Versa compared to FD:

If you’re someone who is working towards a short-term RM5,000 savings goal and you can only save RM300 /month. Below graph shows how much more you could possibly earn with Versa in compounded interest as compared to FD.

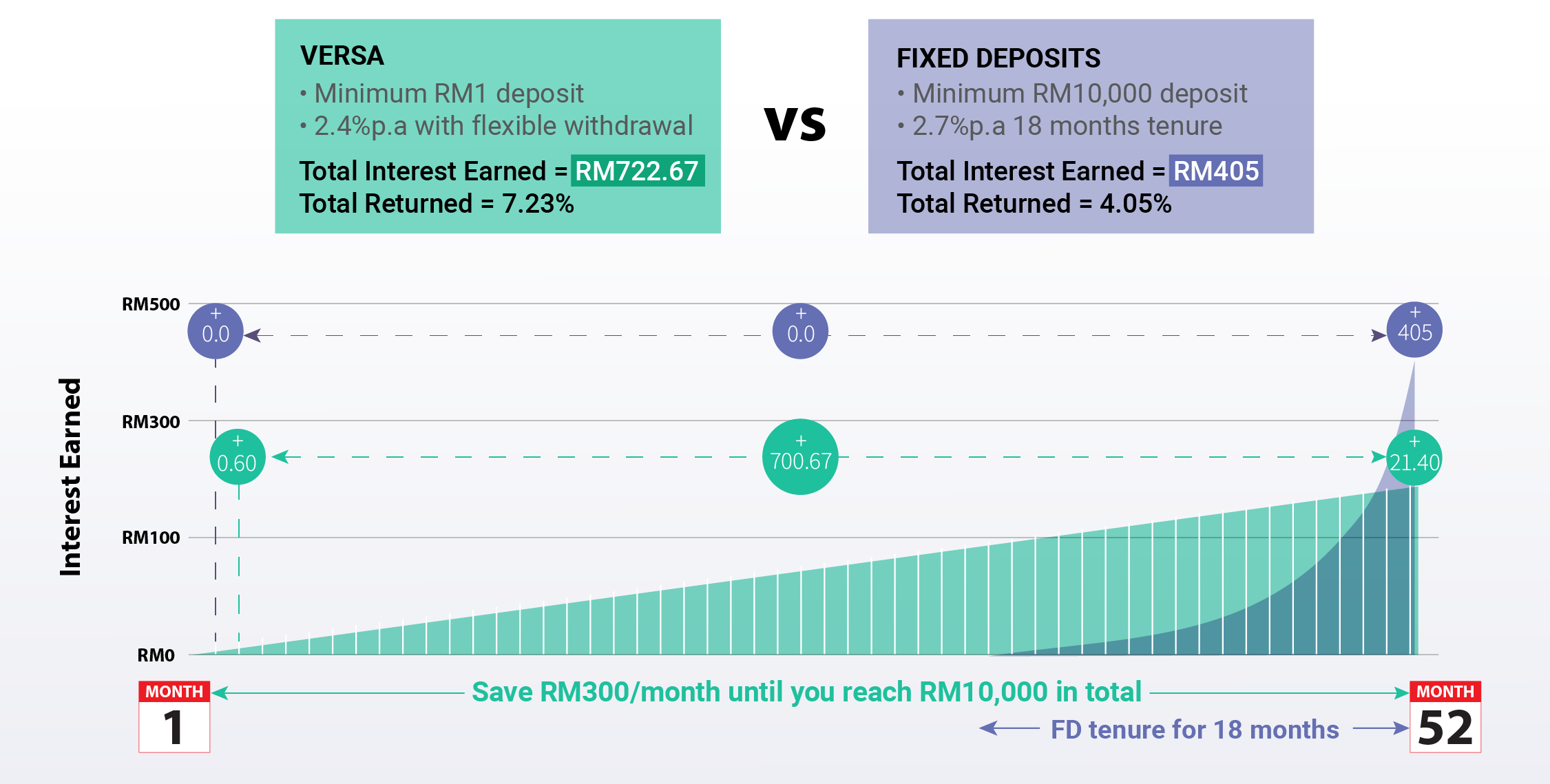

Although you could put your funds in a fixed deposit account with a higher interest rate (2.7% p.a) than Versa. But the minimum deposit will be much higher (RM10,000) as compared to Versa’s low minimum deposit. Ultimately, a higher minimum deposit means a longer tenure (18 months). But if you look at the graph below, the total interest earned from FD is still lower if you were to put your money in Versa.

You may have to put your money for a longer time in Versa to reach the same amount, but this way, your money is not losing out on potentially higher returns.

At the end of the day, many of us like to stick with what we’re familiar with, like fixed deposits. But don’t let the fear of “lack of knowledge” stop you from exploring better alternatives. It is more important now than ever that we become smarter at cash management and Versa is the perfect place for risk averse people to start their investment journey.