As your parents must have said before, money doesn’t grow on trees.

But, it can grow when planted in the right places – places that earn you return.

Earn More Without Working More

You’re here because you want to make more money and reach your financial goals, right?

Sure, you can work harder, put in more hours, get a promotion, or start a side hustle. But these require a lot of time and effort.

If you want a way to make your money work for you, you need to start thinking about passive income.

The Easiest Way to Earn Passive Income

There are many ways to earn passive income, such as renting out a property or setting up a digital product. But perhaps the easiest way to get started is to earn return.

You might remember learning about simple and compound return back in school. As a refresher, think of return like a thank you gift you get when you lend others money. When you have a savings account, you’re ‘lending’ the bank money and thus, they reward you with return. Yay!

Say, you have RM1,000 in your account and the return rate is 5% per annum. At the end of the year, you will have RM1,050 in your account. This is a thank you gift of RM50. With simple return, you will continue to be rewarded an extra RM50 every year, based on your initial deposit of RM1,000.

That’s great and all, but you can do better.

The Power of Compound Return

Compound return is essentially return earned from return earned previously.

Let’s go back to the RM1,050 you have in your account at the end of the year. With compound return, you will have RM1,102.5 (instead of RM1,100) at the end of the second year because the return are now calculated based on your new increased balance. That is 5% x RM1,050 instead of RM1,000. This gives you a return of RM52.5 instead of RM50.

This continues to snowball over the years and speeds up your earning journey!

As the table shows, by depositing only RM1,000, you can unleash the power of compound return to earn an extra RM628.89 by the end of year 10. That’s more than half of what you put in. Just imagine how much you could earn if you continued to make deposits every month or if you patiently waited 40 years to withdraw your money. In fact, that’s how the EPF (with a rate of 5.2% for 2020) works!

How to Make the Most of Compound Return

A few factors determine how much compound return you can earn.

- Money Invested

The more you invest and have in your account, the higher the return you earn.

- Return Rate

The higher the return rate, the faster it takes to grow your money.

- Compound Frequency

This is the number of times per year when the return are calculated – such as daily, monthly, or annually.

Because compound return is calculated based on your latest balance (investment + return), the more frequent the compounding periods, the more you earn.

Pro Tip: Look for investment avenues that give you daily return!

- Time

The longer your money sits in the account, the greater the return.

Rather than withdraw your money and #treatyourself when you’re 60; why not invest now and let your future self enjoy more to spend!

As you can see, you can earn an extra RM27,180.47 (RM60,399.89 – RM33,219.42) just by investing 10 years earlier!

Here’s Another Example

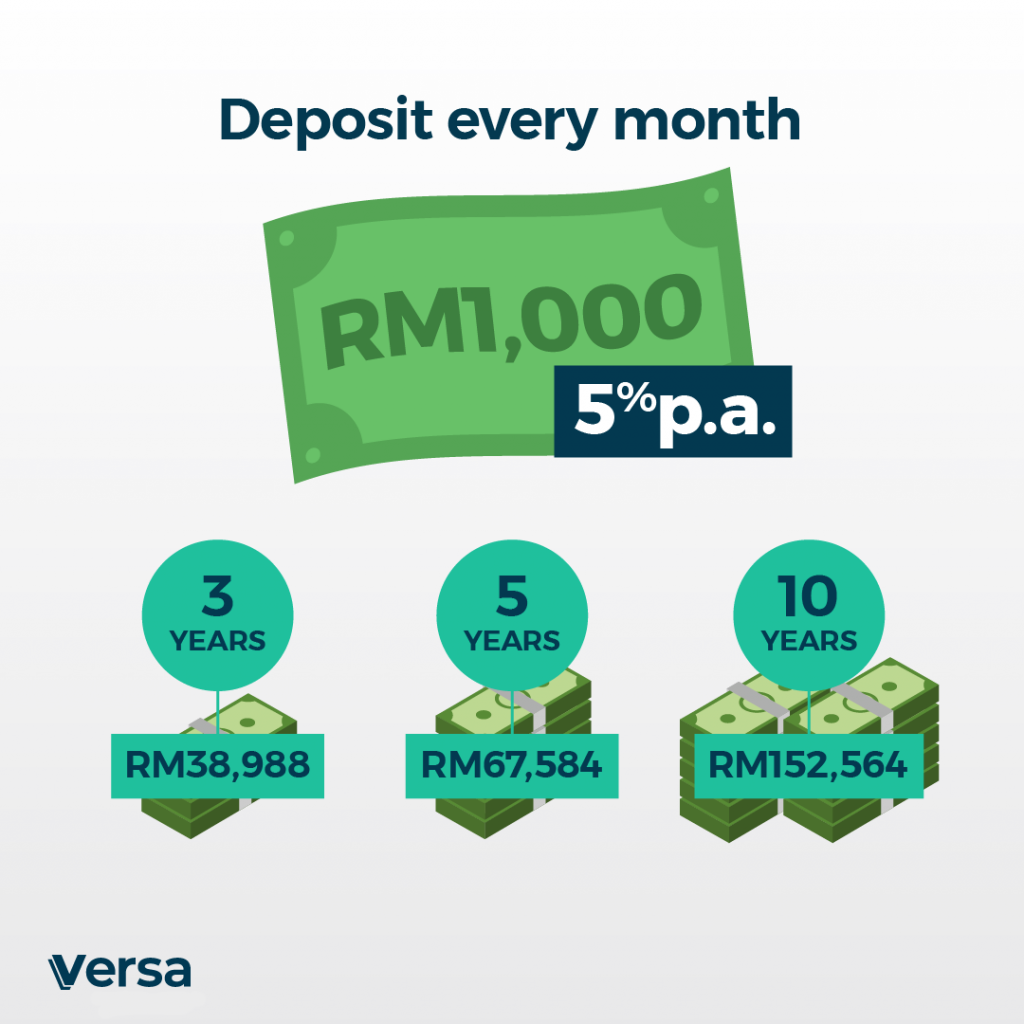

If you start with an initial investment of RM1,000 and commit to adding RM1,000 to it every month (with an annual return rate of 5%) ?

This is why it is important to start as early as possible. No matter your age, the best time to start is now.

How to Start Growing Your Money Today

By now, you’re probably all excited and ready to experience the powers of compound return for yourself. That’s great!

The big question is how can you start earning compound return?

There are several ways – moving your money into savings accounts, fixed deposits, your EPF, and money market funds.

Versa Invest is a digital wealth management platform that gives you the chance to diversify your investments and grow your wealth. In 2023 alone, Versa Growth, one of Versa Invest’s funds, reported an astounding 17.5% return p.a.! Think of how much you could have earned then!

So, how will you start making the magic of compound return work for you?