Did you know that according to the Malaysian Department of Insolvency, over 95,000 individuals have declared bankruptcy between 2014 and 2018?

For the average Malaysian, achieving financial independence has become almost impossible.

What is Financial Independence?

Financial independence can be defined as being able to lead our lives without worrying about financial hardships caused by circumstances beyond our control. What’s more, financial independence gives us the freedom to choose what to do with our life.

Bank Negara’s 2018 report showed the country’s household debt stood at RM1.18 trillion. Residential housing loans accounted for 53.2% or RM628bil of total household debts, while the remaining 46.8% were for personal consumption including motor vehicles, credit cards, and personal finance.

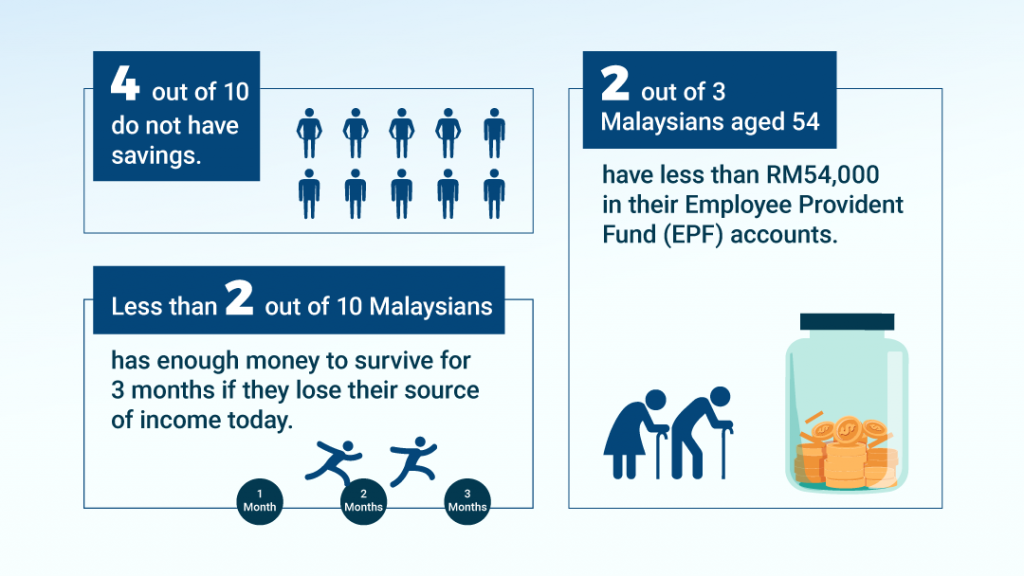

In AKPK’s Financial Behaviour and State of Financial Well-being of Malaysian Working Adults survey, 1 out of 5 working adults did not manage to save any money over the last 6 months. 3 out of 10 working adults had to borrow money to buy essential goods. 1 out of 3 Malaysians are not comfortable with their financial knowledge, 52% say they face difficulties raising RM1,000 for emergencies.

With the ongoing pandemic costing people their jobs, it is almost certain that the numbers have increased significantly since this study was conducted in 2018.

These startling findings raise two questions: why do Malaysians find it challenging to achieve financial independence and how do Malaysians achieve that status?

Reasons Malaysians find it challenging to achieve Financial Independence

Unnecessary Expenses

A pandemic has changed our spending habits – whether we realised it. Our lifestyle has changed as we remain home, leading to an increase of online purchases – from food to household items. This stems from the convenience and wanting to meet the minimum purchase for free delivery. Raise your hand if you added an unnecessary item to your shopping cart to get free delivery.

Lack of Financial Education

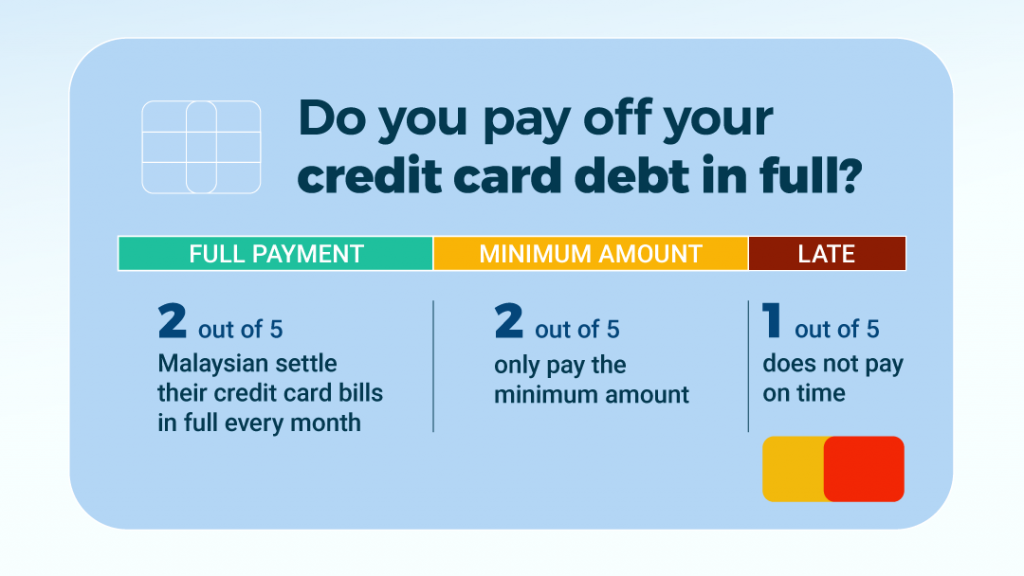

Surveys conducted on Malaysians’ spending reflected poor financial management, as many Malaysians failed to manage their cash flows effectively. This issue stems from the lack of emphasis on financial literacy in school and even in the workplace.

A smart way to increase your financial literacy is through following financial experts on social media. There are many local social media pages keen on educating Malaysians on financial literacy in bite-sizes. These include The Simple Sum, Ringgit on Fire, and Versa. Another step towards being more financially literate is tuning in to podcasts. It’s an easy way to absorb information – suitable to tune in during car drives or background sounds while you work. A few recommended podcasts are BFM 89.9: The Business Station and Millenial Money.

Loss of Regular Income

The pandemic has hit Malaysians especially hard. Unemployment rates are soaring and many are facing uncertainty about their future. Don’t lose hope yet. There are alternative solutions to this plight which we looked into, so if you’re keen, keep reading.

What Can Malaysians Do To Achieve Financial Independence?

Set a Goal

Ask yourself, what exactly are you aiming for? Every individual defines financial independence differently. Is financial freedom being able to retire by your 40’s? Or is it owning a house?

Before setting a plan, you need to identify the level of earnings needed to stop working for the rest of your life. Without a strategy, you may end up saving aimlessly and unable to achieve your end goal.

Budget, Jangan Tak Bajet

No matter how small your budget is, use it to track things like housing costs, food costs, and transportation. By visually seeing these numbers, it helps you identify your spending habits and cut down costs. The key is sticking to your plans long-term. Remember: every spare ringgit and cent can be used towards your financial independence goal.

Invest in Yourself

Saving money is one thing, but why not take one step further? Have your money generate more money. Once you start saving a good amount in your savings account, use it to bring you more income. There are several options such as investing it or using the money as capital to start your own online business. Homemade products – ranging from soap to resin jewelry – have grown increasingly popular as consumers enjoy personal touches to their purchases. You can also utilise social media platforms, like Instagram and Facebook, to promote your products as these are being expanded to be an online marketplace.

Avoid Debt

The reason is simple: debt limits your choices. Avoid consumer debt. Consumption can be good for the overall economy and we are 100% for self-care, but it’s not worth going into debt over instant gratification. Instead, lead a lifestyle under your means so that you have more earnings to set aside.

Most importantly, pay off your debts as soon as possible. It’s acceptable to have longer-term debt – for example, a mortgage or university loans – as these are unavoidable. However, avoid taking out more debt to cover existing debt as it will only lead to a vicious cycle.

Get that Insurance

A smart spender knows the importance of preparing for a rainy day. Savings and investments may be insufficient to cover sudden expenses like accidents or health problems. According to CompareHero.my, 90% of insured Malaysians are under-insured. An inadequate insurance plan is insufficient in protecting you and your family from financial ruin in case of emergencies. Therefore, choose the best plan for you and your family.

Take the Road to Financial Independence with a safe and low-risk option like Money Market Funds (MMF)

Every ringgit you save today represents more than a ringgit in the future if you put that money into a MMF. To get started, allocate a small monthly transfer into a separate high-interest earning fund until it covers at least three months’ worth of spending. The account should have no penalties for sudden withdrawals, allowing you to withdraw the money anytime in case of an emergency.

A good place to start is with Versa, a secure digital cash management platform offered in partnership with AHAM Capital Asset Management that lets you earn interest daily. By using Versa, you can get into the habit of saving money every month from as low as RM 1. You also have the option to withdraw anytime and you will still earn interest for the duration your money was in. While financial independence is difficult to achieve, we can still take control of our finances and become equipped with financial literacy.