We aim to help you

Build your retirement fund, save on taxes

Let's find out how much tax savings you can save with your estimated annual taxable income!

![]() Annual taxable income is the total of your annual income after deducting personal tax reliefs

Annual taxable income is the total of your annual income after deducting personal tax reliefs

ENTER YOUR ESTIMATED ANNUAL TAXABLE INCOME

RM

GET INCOME TAX SAVINGS OF

RM 0

If you invested RM 3,000 in PRS based on your 0% tax bracket. (Note that this can only be claimed on the following year when you file your income tax)

That’s

packs of nasi lemak!

Enjoy Income Tax Relief

Claim up to RM3,000 in income tax relief, growing your personal cash flow.

Expand Your Retirement Plan

Experience the flexibility of voluntary contributions and diversify your retirement income with ease.

Explore our offerings

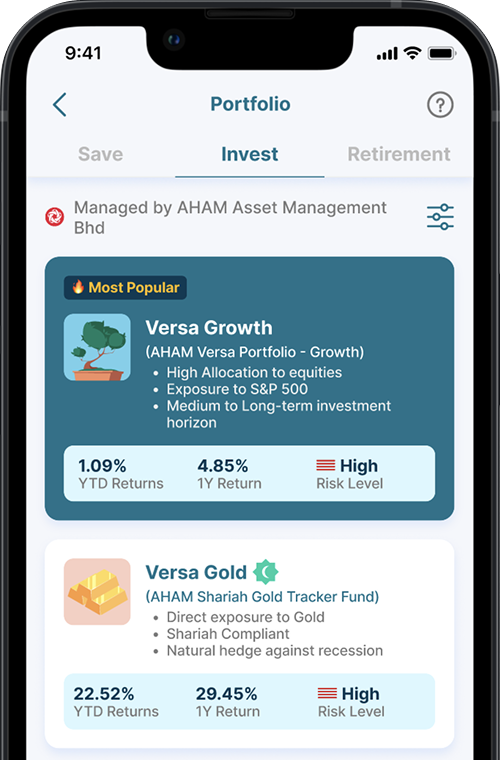

Choose from an array of funds to meet your retirement needs, goals and risk appetite:

Explore Our Other Solutions

Versa Save

Earn higher returns than your traditional savings account from just RM10!

Recent Articles

Recent Articles

Frequently Asked Questions

If you are a new Versa user interested in Private Retirement Scheme (PRS), you will have the option of investing in PRS during our onboarding process.

For existing users, you can begin onboarding by answering one question about your monthly household income. After that, approval will take approximately 5 days. Once approved, you can start investing in PRS and enjoy the benefits of our retirement scheme!

Yes, you may invest in multiple PRS funds at the same time.

Yes, under PRS, there are different rules regarding the cash outs of funds based on two separate accounts: Account A and Account B.

For Account A, cash outs can only be made upon reaching the retirement age specified by the PRS provider.

Whereas for Account B, you are allowed for one cash out per calendar year. However, if you are below 55 years old, this withdrawal from Account B is subjected to an 8% tax penalty, unless the purpose of the withdrawal is specifically for housing or health-related expenses.

The Versa platform does not charge any fees to their user. However, there are management fees, trustee fees and fund-level fees paid to the fund managers, which differs based on the portfolios.

Please refer to respective prospectus.

The minimum contribution limit for Private Retirement Scheme (PRS) in Malaysia is RM 100. As for the maximum contribution limit, there is generally no specific maximum limit set for PRS contributions per transaction. However, it is important to note that the maximum contribution amount may be subject to the limits imposed by FPX (Financial Process Exchange), which is RM 30,000.

You can track the performance of your PRS investment in our app’s fund overview dashboard.