When managing your personal finances, it might feel challenging at the start. Many individuals struggle to keep track of their money going in and out if they don’t have a budget plan. Depending on your lifestyle and any unforeseen circumstances, these additional costs can also add up, which can make it difficult to work toward financial goals.

Using the 50/30/20 budgeting approach is one effective way to build better money management habits. This framework helps individuals organise their income into clear categories, making it easier to manage spending and plan ahead. This approach encourages awareness and balance which helps people allocate their money each month.

This guide explores how the 50/30/20 budget rule works, how it can be applied in your daily life, and how budgeting can support short-term financial goals in Malaysia while laying the foundation for long-term financial planning.

Money Management in Malaysia: What Is Budgeting?

Budgeting is the process of planning how income is allocated toward different expenses and financial priorities over a specific period, usually on a monthly basis. The main purpose of working out a budget for yourself is to understand how much money is coming in, how much is being spent, and where adjustments may be needed.

Budgeting makes it easier to stay on top of regular expenses such as rent, food, transport, and everyday living costs. When you understand where your money is going, you become better at making financial decisions and avoid overspending.

For many people, budgeting also helps in balancing short-term needs with future planning. By organising expenses and setting clear limits, budgeting can support short-term financial goals, such as managing monthly commitments or building an emergency fund.

What Is the 50/30/20 Budget Rule?

The 50/30/20 budget is a commonly used budgeting framework that helps individuals organise their monthly income into three broad categories: needs, wants, and savings or financial goals. This structure allows for a simple and straightforward way of managing your money while maintaining flexibility to suit different lifestyles and income levels.

Under the 50/30/20 budget rule, income is generally divided as follows:

- 50% for needs, which typically include essential expenses such as housing, utilities, transportation, and basic groceries.

- 30% for wants, covering non-essential spending such as dining out, entertainment, or discretionary purchases.

- 20% for savings and financial goals, which may be allocated toward short-term priorities or longer-term planning needs.

By using this rule, you’ll be able to:

✋ Stop being THAT broke friend who lives paycheck to paycheck

🕒 Start paying for essential expenses like rent and utilities ON TIME

🎯 Build financial security and hustle towards long-term financial goals

So when that sweet paycheck comes in, do…

✅ Check your paycheck: Read thoroughly and make sure that all the details and paid amounts check out.

✅ Pay yourself first: Self-love is the best love 💘 Be sure to pour some love for future you by setting money aside for your savings or investments to grow your wealth over time.

🌟 Pro tip: Arrange this to be automatically transferred the day you get your paycheck with our auto debit feature!

✅ Think of your emergency fund: Put money aside specifically for this fund! It is key in helping you pull through any unexpected bumps in the future.

✅ Update your budget: Listing out your essential monthly expenses and potential expenditures can work as your month-to-month financial roadmap. A hack to sorting this out? Using the 50/30/20 rule, duh.

Why the 50/30/20 Budget Is Popular

The 50/30/20 budget is favoured for its simplicity. By grouping expenses into 3 main categories, it makes budgeting easier to plan out, especially for those who are new to managing their personal finances. This reduces complexity and helps individuals get started without feeling overwhelmed.

The 50/30/20 budget rule does not require tracking every single expense in detail. Instead, it provides a high-level framework that can be adjusted based on income levels, lifestyle choices, and changing financial priorities. This makes it suitable for different life stages and financial situations.

This approach to budgeting also encourages better financial awareness. By clearly separating essential expenses, discretionary spending, and savings or financial goals, individuals can more easily identify where their money is going each month. This awareness supports healthier money habits and helps prevent situations where spending consistently exceeds income.

How the 50/30/20 Budget Applies in Malaysia

You can use the 50/30/20 budget as a reference point and adjust it depending on living costs, income levels, and personal circumstances. Expenses such as housing, transportation, food, and utilities often take up a significant portion of monthly income, particularly for those living in urban areas.

For example, expenses such as rent or mortgage payments, public transport or fuel costs, groceries, and basic household bills will fall under the “needs” category. The next portion of discretionary spending falls under the “wants” category, which varies from person to person depending on their lifestyles. Finally, the “savings” category is usually for short-term financial goals such as travel plans or special occasions.

The key focus remains understanding spending patterns and maintaining balance across essential needs, lifestyle spending, and future planning. Applying the 50/30/20 budget in Malaysia encourages awareness of local financial realities while still providing a structured approach to managing monthly finances.

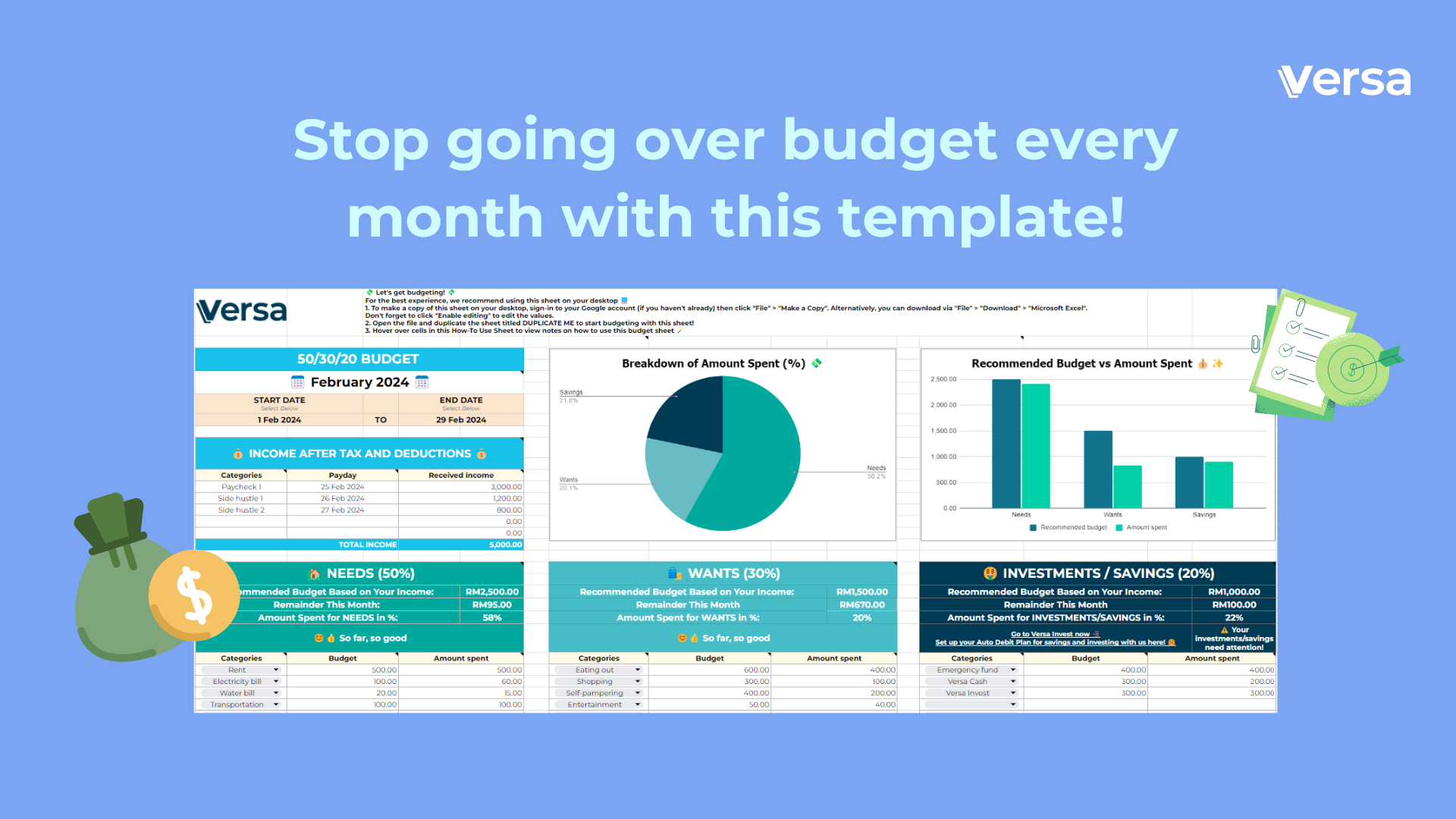

How to Use the 50/30/20 Budget Sheet Template

Using a budgeting template can make it easier to apply the 50/30/20 budget in a consistent and organised way. A budget sheet helps translate the framework into practical steps by allowing individuals to track income, categorise expenses, and review their spending on a regular basis.

Versa’s 50/30/20 Budget Sheet Template is designed to support this process by providing a simple structure that can be customised to suit different financial situations.

💻 For the best experience, we recommend using this sheet on your desktop!

To make a copy of this sheet on your desktop:

👉 Sign in to your Google account (if you haven’t already) then click “File” > “Make a Copy”.

👉 Alternatively, you can download via “File” > “Download” > “Microsoft Excel”.

✍️ Don’t forget to click “Enable editing” to edit the values!

Encouraging Budgeting Habits Around Your Paycheck

Budgeting becomes more effective when it is aligned with income cycles. For many Malaysians, this means reviewing and updating their budget when a monthly paycheck is received. Establishing a consistent routine around income helps ensure that expenses, savings, and financial priorities are addressed early in the month.

When reviewing finances after receiving income, individuals may consider:

- Checking income details, such as salary amounts and deductions, to ensure accuracy.

- Setting aside funds for financial goals early, rather than waiting until the end of the month.

- Allocating money for an emergency buffer, which can help manage unexpected expenses.

- Updating the budget sheet, listing both fixed and variable expenses to serve as a financial roadmap for the month.

Building this routine supports better money management basics and reduces the likelihood of unplanned spending. Over time, aligning budgeting habits with income cycles can help individuals stay more consistent and organised in managing their personal finances.

Build Better Budgeting Habits in Malaysia with the 50/30/20 Budget

Budgeting is an important foundation for managing personal finances more effectively, and the 50/30/20 budget offers a simple framework to help organise income into clear, manageable categories. By focusing on awareness rather than restriction, this approach encourages individuals to understand their spending patterns and make more intentional financial decisions.

When applied consistently, the 50/30/20 budget rule can support better money management basics, help manage everyday expenses, and provide structure for planning ahead. In Malaysia, where living costs and financial priorities can vary, using this framework as a guide rather than a strict rule allows for flexibility while maintaining balance.

Whether used as a starting point or a regular reference, budgeting tools such as a 50/30/20 budget sheet can help build sustainable financial habits over time. The key lies in consistency, regular review, and adapting the budget to reflect changing needs and circumstances.

Here’s to brewing your money game as strong as a double shot espresso ☕

Frequently Asked Questions

1. What is the 50/30/20 budget rule?

The 50/30/20 budget rule is a budgeting framework that divides income into three categories: 50% for needs, 30% for wants, and 20% for savings or financial goals. It is designed to provide a simple structure for managing spending and planning finances.

2. Is the 50/30/20 budget suitable for everyone in Malaysia?

The 50/30/20 budget is commonly used as a guideline rather than a strict rule. In Malaysia, individual circumstances such as income level, cost of living, and personal responsibilities may require adjustments. Many people use the framework as a reference point and adapt it to suit their financial situation.

3. How can the 50/30/20 budget help with money management?

By clearly separating essential expenses, discretionary spending, and savings, the 50/30/20 budget rule helps improve awareness of where money is being allocated each month. This visibility supports better decision-making and stronger money management basics.

4. How often should I review my budget?

Budgets are most effective when reviewed regularly. Many individuals choose to review their budget monthly, especially after receiving income, to ensure expenses and financial priorities remain aligned.

5. Can budgeting support short-term and long-term financial planning?

Yes, budgeting plays a role in both short-term and long-term planning. A structured budget can help manage immediate expenses while also supporting broader financial goals over time, including long-term financial planning in Malaysia.