You started saving with Versa Cash. But where does your money and how do you earn your returns?

“I like the security of Fixed Deposits (FD), but hate the lock-in. What if I spot a great deal or have an emergency?”

“I don’t have the time and don’t know how to plan my FD placements.”

“I’ll invest after I’ve saved enough or know enough.”

Does this sound like you? If it does, check out Versa Cash.

Versa lets you save with a minimum deposit of RM10, earn return rates on par with FDs, and gives you the flexibility to withdraw all your earnings anytime.

How? Let us break this down for you! ?

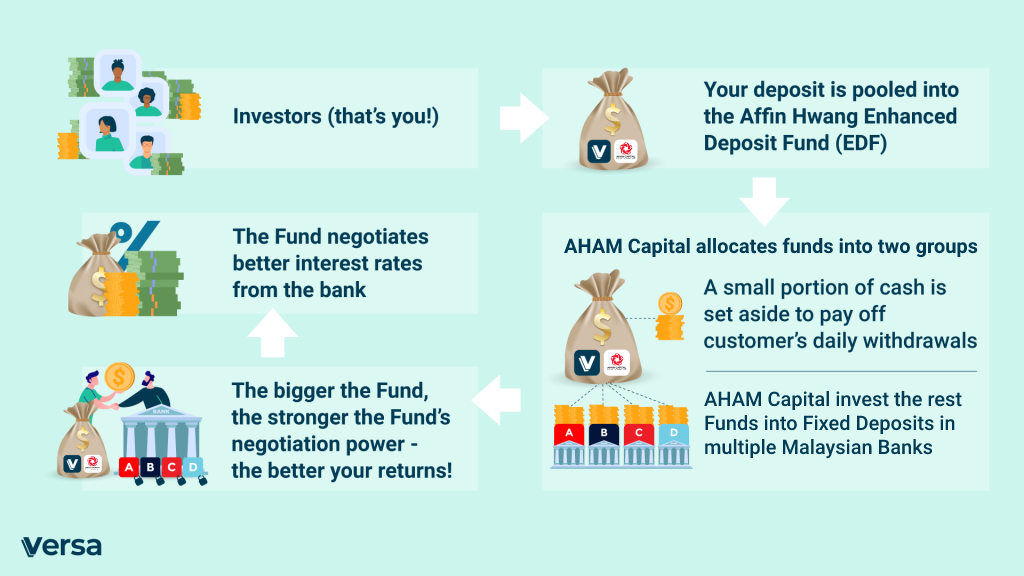

When you deposit in to Versa Cash, you’ll instantly become part of a group of investors. Your funds will be pooled into the large cash pool contributed by other investors. Let’s call this the Versa Cash Fund.

The Versa Cash Fund goes into a money market fund called Affin Hwang Enhanced Deposit Fund (EDF) which is managed by AHAM Capital Asset Management (formerly known as Affin Hwang Asset Management). Affin Hwang Enhanced Deposit Fund (EDF) only invests the fund into Fixed Deposits, making it safe and low risk.

Wait, if it only invests in Fixed Deposits, how are we getting the flexibility to withdraw?

Good question! Here is how we solve this problem:

By depositing into multiple deposits.

The fund manager (AHAM Capital Asset Management) allocates the Versa Cash fund into two groups, funds invested in multiple bank’s Fixed Deposits, and sets aside a very small portion of cash to pay off customer’s withdrawals.

In short, the fund manager strategically places the Versa Fund to give you interest rates on par with Fixed Deposits along with the flexibility to withdraw from the cash portion.

But how is the fund able to return high interest rates?

The Versa Cash Fund gives your deposit a fighting chance to negotiate higher rates. The Fund Manager will negotiate with multiple banks to offer higher interest rates for the fund.

The bigger the fund, the stronger the fund’s fighting chance, the better the rates that we can return to you! Imagine it as haggling at the Sunday market, the more the Fund Manager buys (in this case, place larger deposits with banks), the more discount (interest) the Fund Manager gets.

One of the key differences between Fixed Deposits is that money market funds are not protected by PIDM. However, the Versa Cash Fund places / diversifies your funds in multiple Fixed Deposits of multiple Malaysian banks. So, if one bank were to go under, it would only slightly affect the return of the fund.

Psst! AHAM has a great track record. In the past 10 years, they never had a negative return but have instead outperformed their benchmark. Morningstar, a reputable Investment Research website has given Affin Hwang Enhanced Deposit Fund the greenlight by rating it 4 out of 5 stars!

You might want to start safe and small, so let Versa ease the journey!