When we talk about gold investment, it conjures images of grandma’s gold necklaces hidden in her drawer or gold bars in a businessman’s vault at home.

But did you know that there’s more to it? Today, trade tensions, wars and concerns about the economic and political outlook have encouraged investors to reexamine gold as a traditional hedge.

Here, we’re gonna explain how gold investments work and what exactly makes it attractive to investors.

In this article:

- Why should you invest in gold?

- What is Versa Gold?

- What set Versa Gold apart from conventional bank gold investments?

Why should you invest in gold?

Gold preserves wealth

Unlike currencies and other assets, gold has been able to maintain its value throughout the ages. People tend to fall back on gold during times of crisis, which means it always has some value as insurance against tough times. Until today, gold is used as a way to pass on and preserve wealth from one generation to the next.

Gold as a safe haven

Historically, people have held on to gold to survive many collapsing empires, political turmoil, and collapse of currencies. Gold’s resilience during those periods of financial and geopolitical uncertainties has led it to be seen as a safe haven for investors.

Gold has historically been an excellent hedge against inflation, because its price tends to rise when the cost of living increases. Over the past 50 years, investors have seen gold prices soar and the stock market plunge during high-inflation years.

Gold as a diversifying investment

Smart investing is about minimising risk while making higher returns in the long-run. To do this, the general rule is to park your money into different assets of varying risks and returns. This is called diversifying.

The key to diversification is to invest in assets that are not closely correlated to one another. Gold prices have low correlation with the movement of stock prices and other financial assets. This is underpinned by the fundamentals of demand and supply.

Gold is not just a luxury purchase, but it is also a coveted metal in the production of electronic devices (think your mobile phone, laptops, and TV) and a safe haven for investors during recessionary periods.

These diverse sources of demand give gold a particular resilience: the potential to deliver returns in good times and in bad.

Pain points of purchasing physical gold

While gold is seen as a stable asset to add to a well-balanced and diversified portfolio, there are many challenges that lie behind investing in physical gold.

In its physical gold form, it becomes more complicated to sell. This makes it inconvenient for investors that need to liquidate their gold investments quickly for reasons such as for emergencies or to transfer investments into higher yielding assets.

This leads to another challenge which is the high markup from the gold dealers. As dealers intend to earn the highest profit margin, investors will need to expect dealers to sell gold at a higher price. The same goes when you sell the gold. Dealers may offer a lower price than its value, affecting your expected returns.

Finally, investors will need to consider storage and insurance costs. These add-on costs inevitably lessen your returns margins. This also makes gold less accessible to people who cannot afford to store and insure their gold. On the other hand, keeping your gold in your house and uninsured would expose you to higher chances of theft and possibly unneeded stress.

Versa Gold enables all Malaysians to enjoy the benefits of investing in gold without dealing with the headache that comes with it.

What is Versa Gold?

Versa Gold is a Shariah-compliant fund that closely tracks the performance of Gold price. The underlying fund of Versa Gold is the Affin Hwang Shariah Gold tracker fund.

100% backed by physical gold

The Fund’s investments are held in physical gold that is safely stored in a secure vault.

Closely tracks movement in gold prices

The Fund offers potential returns from the investment into gold.

Shariah-compliant

The Fund ensures that its operation fully abides to the principles of the Shariah Law.

Asset diversification

Just like any gold investments, Versa Gold has low correlation to other assets classes – equities, bonds and real estates. This makes it a good alternative asset to add to a portfolio – especially during uncertain and turbulent economic times.

What sets Versa Gold apart from conventional bank gold investments?

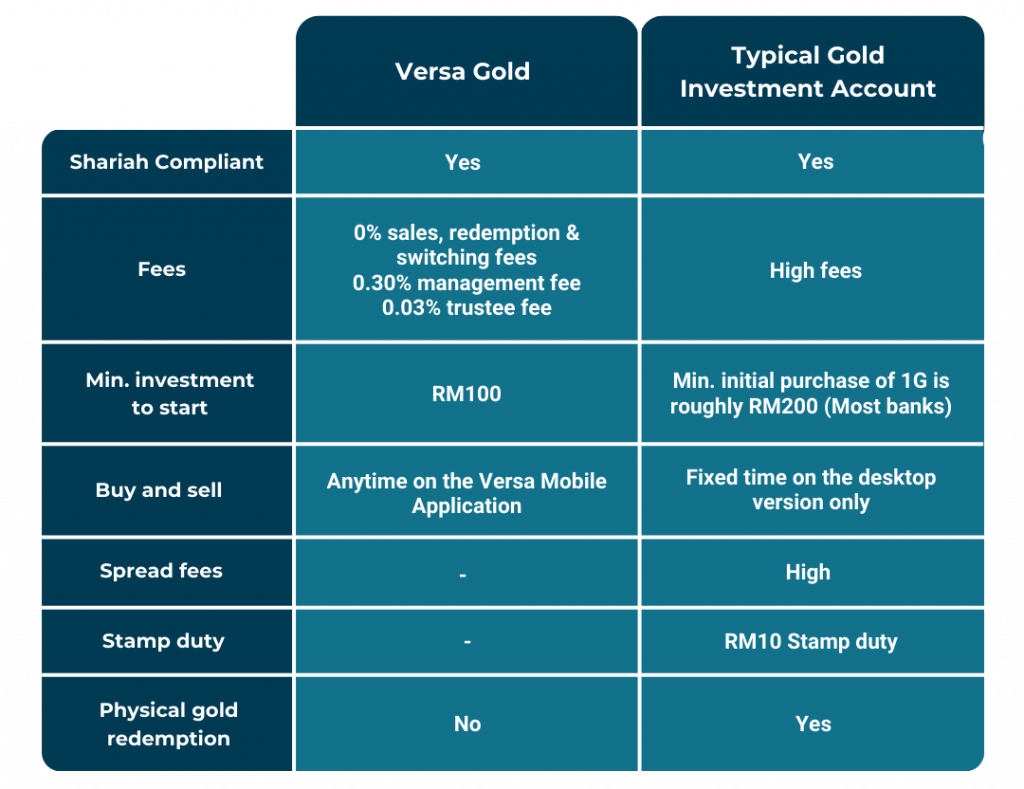

It’s important to understand what sets Versa Gold apart from conventional bank gold investments.

Versa Gold focuses on market accessibility. In other words, we want to make investing in gold easy and accessible to all Malaysians. Therefore, the minimum investment required to start is just RM100. Meanwhile most gold investments accounts require new investors to make a minimum first purchase of 1g at roughly over RM250.

Moreover, Versa Gold offers low and transparent fees: 0% sales, redemption and switching fees; 0.30% management fee; and 0.03% trustee fee. While conventional gold investment accounts allow only fixed times to buy and sell on the desktop version only, Versa users can buy and sell anytime on the app.

Unlike traditional gold investment accounts, Versa Gold does not offer physical gold redemption for investors.

Update your app to start investing in Versa Gold today!

Disclaimer: The information contained in this article is provided for general informational purposes only, and should not be construed as investment or tax advice. As with any form of financial products, there are risks involved and investors should rely on their own evaluation to assess the merits and risk of the investment.