Your steady step up from savings and a smart way to diversify beyond stocks.

Say hello to Versa Malaysia Bond (AHAM Bond Fund).

🔍 What exactly is this offering?

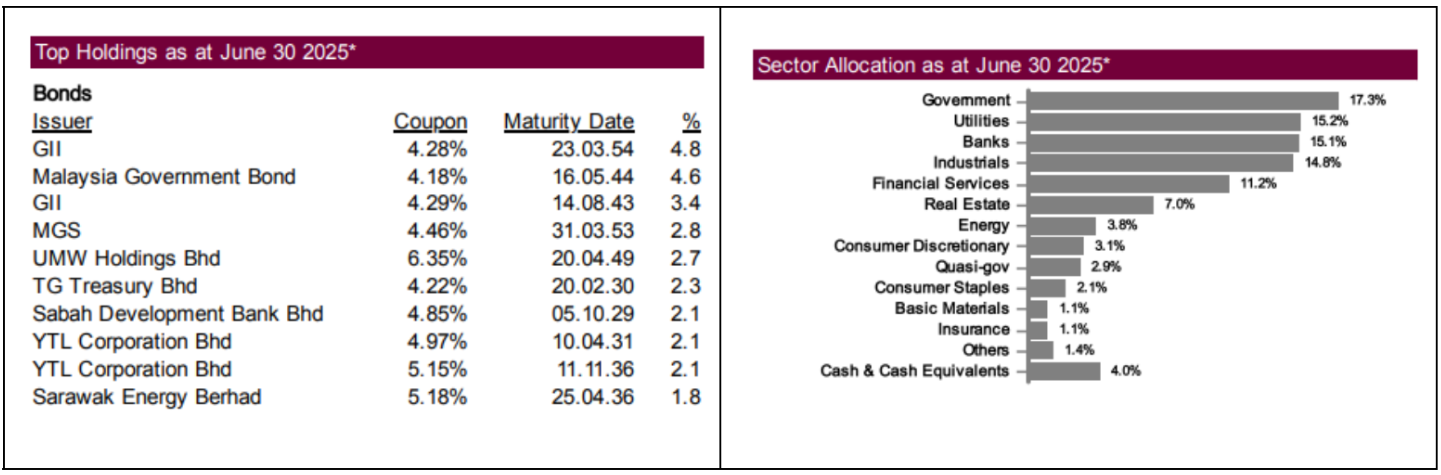

The Versa Malaysia Bond, also known as AHAM Bond Fund (managed by AHAM Asset Management Berhad), is a low-risk offering that primarily invests in bonds such as government bonds (e.g. MGS and GII) and high quality investment-grade (IG) corporate bonds.

These are fixed income instruments as they pay steady interest, making them ideal for those looking to earn, grow and preserve capital over a longer term.

This offering aims to give investors a regular income stream over the medium to long term by investing a minimum of 70% in bonds and a maximum of 30% investment in fixed deposits and money market instruments.

🧠 Think of it like this:

Imagine you’re lending money to the government or trusted companies. In return, they pay you interest income and your investment grows.

📈 What does the offering invest in?

*Top holdings and sector allocation as at 30 June 2025 based on AHAM Bond Fund | Fund Fact Sheet. All allocations are subject to changes according to the fund manager’s discretion.

📈 How has the offering performed?

1-Year Total Return: +5.1%

Year-to-Date (YTD) Return: +3.0%

Source: AHAM Bond Fund Fact Sheet as at 30 June 2025

🧠 Advantages of Versa Malaysia Bond as an offering

📈 Compounding returns

With monthly income being reinvested automatically, your returns can compound over time. The longer you stay invested, the more your money snowballs.

🪜 Smooth, stable growth

Bond offerings are less volatile than stocks, but still fluctuate. Staying long-term helps smooth out short-term bumps and lets your investment capture more consistent gains.

🔒 Ideal for wealth preservation

This is an offering built for people who want stability with better returns than savings, not for quick flips.

📊 Is it different from a Money Market Fund?

Yup! Here are some important differences between both offerings:-

Money market funds (MMFs) invest in short-term, highly liquid instruments. Their primary aim is capital preservation and stability. As a result, they typically offer lower yields, but with minimal risk and high liquidity, making them ideal for parking cash or meeting near-term financial needs.

Fixed income/bond offering invest in a broader range of debt instruments, including government bonds, corporate bonds, and sukuk. These offerings carry more interest rate and credit risk compared to money market funds. But in return, they offer the potential for higher income and better long-term returns. Bonds also play a strategic role in diversifying portfolios during periods of market volatility.

| Feature | Bond Offering | Money Market Fund (e.g. Versa Save) |

| What it invests in | Bonds (govt + corporate) | Short-term debt instruments |

| Risk Level | Low | Very Low |

| Returns | Higher, but can fluctuate | Lower, very stable |

| Ideal Use Case | Driver of total returns through regular income Mitigates volatility as part of an overall diversified portfolio | Park cash for short-term goals/needs |

💬 It’s a clear step up for those who want higher returns than MMFs or FDs, while still keeping risk low.

*Note: Investment in a bond offering or money market fund is not the same as placement in a deposit with a financial institution. There are risks involved and investors should rely on their evaluation to assess the merits and risks involved of the investment.

Frequently Asked Questions

📬 How does income distribution work?

Income distribution of an offering can be from multiple sources such as interest income from deposits, dividend income from stocks, coupon income from bonds, premium income from options / derivatives, gains from disposal of fund holdings or other form of income / gains.

That money is paid out to you either as cash in your bank, or reinvested as more fund units (For Versa Users, this will be automatically reinvested).

Versa Malaysia Bond pays out income every month from the interest it earns. This income is automatically reinvested, meaning it buys more fund units for you.

Your NAV (unit price) may drop slightly when income is paid out but this is normal, and not a loss. Over time, these reinvested units can compound your returns.

📢 Note: It’s not “dividend,” because that usually refers to profits from stocks. Here, you’re earning interest income, not business profits.

🧠 Wait… What’s “Credit Profile” and “Maturity Date”?

When you invest in a bond offering, two things matter:

- How strong the borrower is (Credit Profile)

- How long they’ll take to repay the bond (Maturity Date)

🔒 Credit Profile:

A credit rating reflects the borrower’s ability and willingness to repay their debt on time. Issued by credit rating agencies, it serves as an indicator of the issuer’s financial strength and creditworthiness. Bonds are typically rated on a scale from AAA (highest quality) to D. The closer the rating is to AAA, the lower the risk of default.

💡 As at end-June, over 60% of the Fund are made up of AAA & AA-rated bonds

⏳ Maturity Date:

The maturity date is when a bond’s principal is repaid to the investor. It marks the end of the bond’s term and when the issuer must fully settle their debt.

💡 The Fund Manager has the flexibility to invest across both short-term and long-term bonds. Short-term bonds support capital preservation and liquidity, while long-term bonds typically offer higher yields to enhance income.

This flexible approach allows the offering to adapt to changing market conditions while managing risk and delivering consistent returns.

*Source: AHAM Bond Fund | Fund Fact Sheet as at 30 June 2025

Extra Benefits with Versa

- 💰 0%* Sales Charge

- 📱 Fully Online via the Versa App

- 🚫 No Brokerage Fees

* Investors should be aware of other fees including management fees and other charges that may apply. For further details on all fees and expenses, refer to the Fund’s prospectus.

WARNING STATEMENT

Investors are advised to read and understand the contents of the AHAM Bond Fund’s Prospectus dated 22 November 2022, and the corresponding PHS before investing. There are fees and charges involved when investing in the Fund. Investors are advised to consider and compare the fees and charges as well as the risks carefully before investing. Investors should make their own assessment of the risks involved in investing and should seek professional advice, where necessary. The price of units and distribution payable, if any, may go down as well as up and the past performance of the Fund should not be taken as indicative of its future performance. The Securities Commission Malaysia has not reviewed this marketing/promotional material and takes no responsibilities for the contents of this marketing/promotional material and expressly disclaims all liability, however arising from this marketing/promotional material.