Tap into India’s Growth Story with Versa India Equity

India is transforming at an unprecedented pace — from a booming digital economy to a rising middle class with growing appetite for premium products and lifestyles.

Structural reforms, massive infrastructure investments, and a youthful, tech-savvy population are reshaping India into one of the world’s most exciting growth stories.

What is Versa India Equity?

Versa India Equity offers you a simple, efficient way to invest in India’s dynamic market. It is also known as the AHAM World Series – India Equity Fund (MYR-Hedged), a feeder fund that channels its investments into the Franklin India Fund (Target Fund), managed by Franklin Templeton — one of the world’s leading asset managers.

By investing, you gain an efficient way to tap into India’s dynamic market with an initial investment of RM1,000.

What is a feeder fund?

A feeder fund is a type of fund that allows investors to pool their money and invest almost entirely into another fund, known as the target fund.

The target fund is professionally managed by experienced fund managers, who make day-to-day investment decisions such as selecting which stocks, bonds, or other assets to buy and sell.

By investing in a feeder fund, you can access a larger fund and tap into the investment expertise of other global fund managers and strategies for your portfolio.

Why Consider Versa India Equity?

🔹 Affordable Access: Start investing with just RM1,000

🔹 Strong Track Record: The Franklin India Strategy has delivered resilient performance, recording annualised total returns of 9.58% over 3 years and 21.00% over 5 years respectively*.

Source: AHAM Capital, Franklin Templeton, as at 31 March 2025. The Franklin India strategy refers to the Franklin India Strategy – I (acc) USD share class. Past performance is not indicative of future results.

Actual performance may differ from the figures shown. Investments in foreign currency-denominated funds are subject to currency fluctuations, which may affect both the value of your investment and returns.

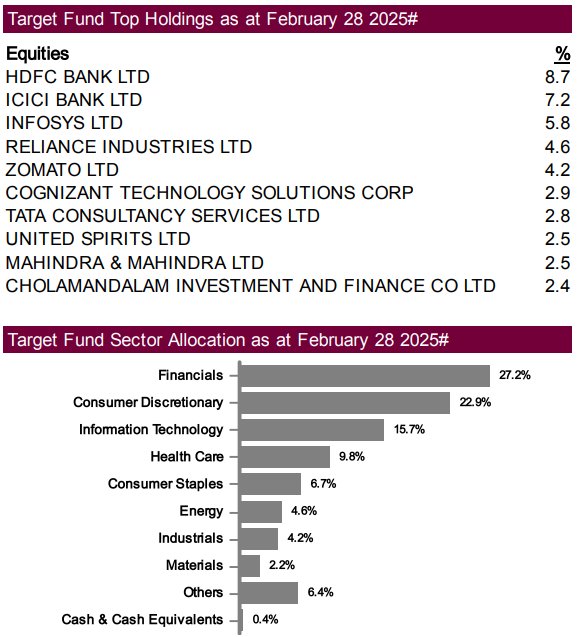

🔹 Diversified Sector Exposure in the Target Fund (as at 28 February 2025):

(*The portfolio is actively managed. Holdings, sector weights, allocations and leverage, as applicable, are subject to change at the discretion of the investment manager without notice.)

🔹 Expert Fund Management: Benefit from the experience of Franklin Templeton’s seasoned investment team.

India isn’t just a buzzword; it’s a powerhouse.

What’s driving India’s current growth?

For a decade, it has proudly held the title of the fastest-growing major economy, with an average GDP growth of 6.5% (2006-2025). And the momentum isn’t slowing down! The International Monetary Fund predicts a solid 6.5% growth for 2025 and 2026, fueled by a thriving services sector and a manufacturing boom.

- From 5th to 3rd: Did you know India’s already the 5th largest economy? Projections show it leaping to 3rd by 2028, surpassing Japan and Germany! 🚀

- Strong structural growth drivers: India’s young workforce, government infrastructure investments, and stable economy support long-term growth. 👩🏭

- India’s strong global position: A domestic-focused economy lessens impact from global trade issues, and growing foreign investment boosts growth. 🌍

(Sources: IMF, EY Insights, Trading Economics, The Economic Times of India)

Why invest in Versa India Equity?

💪 Structural strength: India’s long-term growth story remains solid thanks to a young, expanding workforce, increasing investments, and stable macroeconomic policies.

🎢 Opportunity in the dip: The Indian equity market has seen a recent dip (down 16% from its peak). But savvy investors know that dips can be golden opportunities.

💥 Policy catalysts – rebound driven: Recent government initiatives, including tax cuts and increased infrastructure spending, coupled with the central bank’s rate cuts, are setting the stage for a strong rebound.

🤝 Government support – economic stimulus: Tax cuts and spending, along with lower interest rates, are designed to stimulate the economy growth.

📈 Profit potential: Strong earnings growth projected, and current valuations offer an attractive entry point.

👐 Accessible investment: Access booming India’s economy right where you are and with affordable entry points.

🏅 Expert fund management: Benefit from the expertise of leading fund managers with a strong track record in investing.

Extra Benefits with Versa

💰 0% Sales Charge*

📱 Fully Online via the Versa App

🚫 No Brokerage Fees

- Investors should be aware of other fees including management fees and other charges that may apply. For further details on all fees and expenses, refer to the Fund’s prospectus.

Ready to Get Started?

Discover Versa India Equity on the Versa app today and invest in India’s exciting growth journey. 📲

WARNING STATEMENT

Investors are advised to read and understand the contents of the AHAM World Series – India Equity Fund’s Prospectus dated 8 November 2024, and the corresponding PHS before investing. There are fees and charges involved when investing in the offering. Investors are advised to consider and compare the fees and charges as well as the risks carefully before investing. Investors should make their own assessment of the risks involved in investing and should seek professional advice, where necessary. The price of units and distribution payable, if any, may go down as well as up and the past performance of the offerinh should not be taken as indicative of its future performance. The Securities Commission Malaysia has not reviewed this marketing/promotional material and takes no responsibilities for the contents of this marketing/promotional material and expressly disclaims all liability, however arising from this marketing/promotional material.