When the U.S. puts taxes (tariffs) on big countries like China, it can cause a chain reaction around the world, and Malaysia, which trades a lot, feels those changes.

📰 Update: Tariffs Postponed for Malaysia

Recently, the U.S. announced it will delay imposing tariffs on all countries except China. This includes the previously proposed 24% tariff on Malaysian goods, which has now been put on hold.

While this offers relief, it doesn’t mean we’re out of the woods. The uncertainty around trade policies still affects business decisions, investments, and planning.

🌍 1. Economy-Wide Impact: A Brief Breather

The postponement is good news for Malaysia’s export-driven economy. It gives companies more time to adapt and potentially renegotiate trade terms, while avoiding immediate cost increases for exports headed to the U.S.

What this means for Malaysia:

- Short-term relief for exporters and manufacturers.

- A chance to rebuild confidence in global supply chains.

- Continued need to diversify export destinations and boost domestic demand, in case tariff talks resurface.

The “China+1” strategy still positions Malaysia well—but the volatile trade environment reminds us that diversification and agility are key.

💼 2. Local Investors and Financial Markets: A Sigh of Relief

Markets responded positively to the tariff postponement, especially in tech and manufacturing sectors that were under pressure.

Recent investor behavior:

- KLSE rebounds after initial tariff concerns — but people are still cautious.

- Renewed interest in semiconductors and E&E exporters.

- Continued movement into defensive sectors (e.g. utilities, consumer staples) as a hedge against global volatility.

However, foreign investors remain cautious, as future policy reversals can’t be ruled out.

💡 Don’t Panic: Markets Bounce Back After Global Trade Shocks

Even during trade wars and major tariff moves, global and Malaysian markets have shown strong resilience:

1. U.S.-China Trade War (2018–2019)

🌍 Global: S&P 500 dropped ~6% in 2018 → rebounded +29% in 2019

🇲🇾 Malaysia: KLCI fell -5.9% in 2018 → broader market recovery followed

2. 2008 Global Financial Crisis

🌍 Global: Global markets plummeted due to the US housing crisis; US S&P 500 fell ~37% in 2008, then rebounded +23% in 2009.

🇲🇾 Malaysia: KLCI fell ~39% in 2008 → rebounded ~45% in 2009.

🌍 Global: FTSE 100 plunged post-vote → recovered in 6 months

🇲🇾 Malaysia: KLCI dropped -2.8%, rebounded +2% in 7 weeks

In short, markets tend to recover — globally and in Malaysia — especially when there’s smart policy, diversification, and investor confidence.

🛍️ 3. Malaysian Consumers: Price Pressures Eased (For Now)

With the 24% tariff paused, there’s less immediate pressure on prices for imported goods or electronics made with affected components.

For consumers:

- Prices may stabilize in the short term, especially for tech items.

- Inflationary pressures are still present, but less intense than expected.

- Consumer confidence may improve, though many still remain cautious.

🚢 4. Exporters: Back to Business, But Stay Watchful

Exporters, especially in electronics, were bracing for higher costs and tighter margins. With the delay in tariffs, they can now refocus on production and expansion without as much U.S. trade disruption—for now.

Opportunities to seize:

- Use this window to streamline operations and diversify markets.

- Stay close to supply chain developments and plan for potential future tariffs.

- Leverage Malaysia’s strong position as an alternative to China in global manufacturing.

💡 What Can Investors Do Now?

The global trade environment remains uncertain, with the U.S.-China relationship continuing to shape trade flows and future tariffs still a possibility. Against this backdrop—alongside shifting supply chains and persistent inflation—investors need a smarter strategy, one that balances growth, resilience, and diversification.

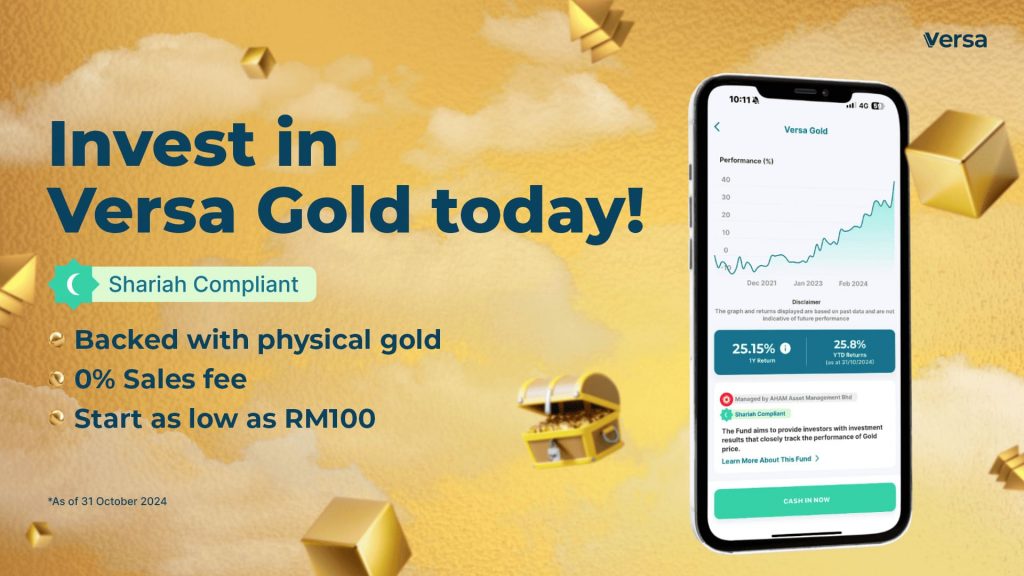

1. Add Resilience with Gold

Gold continues to shine as a hedge against economic uncertainty and inflation. It offers protection when markets are volatile or when currencies weaken. Investors can consider a Gold Tracker Fund to add this layer of protection without needing to buy physical gold.

One such avenue for Malaysian investors is Versa Gold. It is a Shariah-compliant fund that closely tracks the performance of Gold price. This fund is backed by physical gold, and stored in a secured vault. With Versa Gold, you can start investing with just RM100!

2. Diversify with Singapore

Singapore remains one of Asia’s most stable and investor-friendly markets. Its strong banking sector, mature REIT market, and role in regional supply chains make it a safe income-generating option. A Singapore-focused equity or REIT unit trust gives investors access to this steady growth and income — perfect for balancing a Malaysia-heavy portfolio. One such fund to consider for Malaysian investors looking to tap into Singapore’s strengths is Versa SGD.

Versa SGD is a fund that allows you to invest in assets priced in Singapore Dollars (SGD) using Malaysian Ringgit (MYR). Think about the potential profits if SGD strengthens against MYR! Through this fund, you can potentially invest in companies like Oversea-Chinese Banking Corp (OCBC Bank), United Overseas Bank Ltd (UOB Bank), and CapitaLand Ascendas REIT* – all major players in Singapore’s thriving economy.

(*fund allocation as of 28 Feb 2025)

3. Stay Liquid with Money Market Funds

In uncertain times, flexibility is key. Money Market Funds offer a low-risk, stable option for parking your cash — while still earning better returns than a regular savings account. They’re ideal for short-term needs, emergency buffers, or simply waiting for the right investment opportunity.

Looking for a convenient way to access the benefits of a Money Market Fund? Now, let us introduce you to Versa Save!

✨ Minimum cash-in amount of only RM10!

Yes, we believe that sedikit-sedikit jadi bukit, start saving from as low as RM10

🔓 No tenures or lock-in periods

Yes, withdraw anytime and keep your gained interest!

💰 Better-than-FD interest rates

Versa Save has 2 accounts available: Versa Cash (conventional) and Versa Cash-i (Shariah-compliant).

New to Versa? Come build better financial habits with us!

We are a user-friendly digital wealth management app, offering a range of investment options to grow your wealth:

- Versa Save: A low-risk option for potentially higher returns than your conventional bank savings accounts and fixed deposits.

- Versa Invest: Grow your wealth with diversified portfolios tailored to your risk tolerance and investment goals.

- Versa Retirement: Secure your retirement with the Private Retirement Scheme funds designed to complemen your EPF. You can also benefit from up to RM3,000 tax relief!

Ready to kickstart your financial adventure? All new Versa users can enjoy a special +3%* p.a. nett returns boost via our Welcome Quest! Simply maintain a minimum balance of RM1,000 in any Versa fund to unlock this special reward.

Should you have any questions, please do not hesitate to reach out to us here. 💬