Image by Nattanan Kanchanaprat from Pixabay

This post is brought to you by Versa.

One of the most important factors we consider when investing and saving our hard-earned money is the return on investment. Since we worked hard to earn this money, it’s time for the money to work for us. So, homegrown digital wealth management platform, Versa is offering to make your money work a little over time.

Since 2021, Versa has offered attractive rates on their Money Market Funds under Versa Save to create a pathway for high returns and quick withdrawals to onboarding various investment funds, such as Versa Global-i and Versa SGD under Versa Invest. Their latest vertical, Retirement, further helps Malaysians maximise their income tax reliefs and retirement planning via Private Retirement Scheme funds.

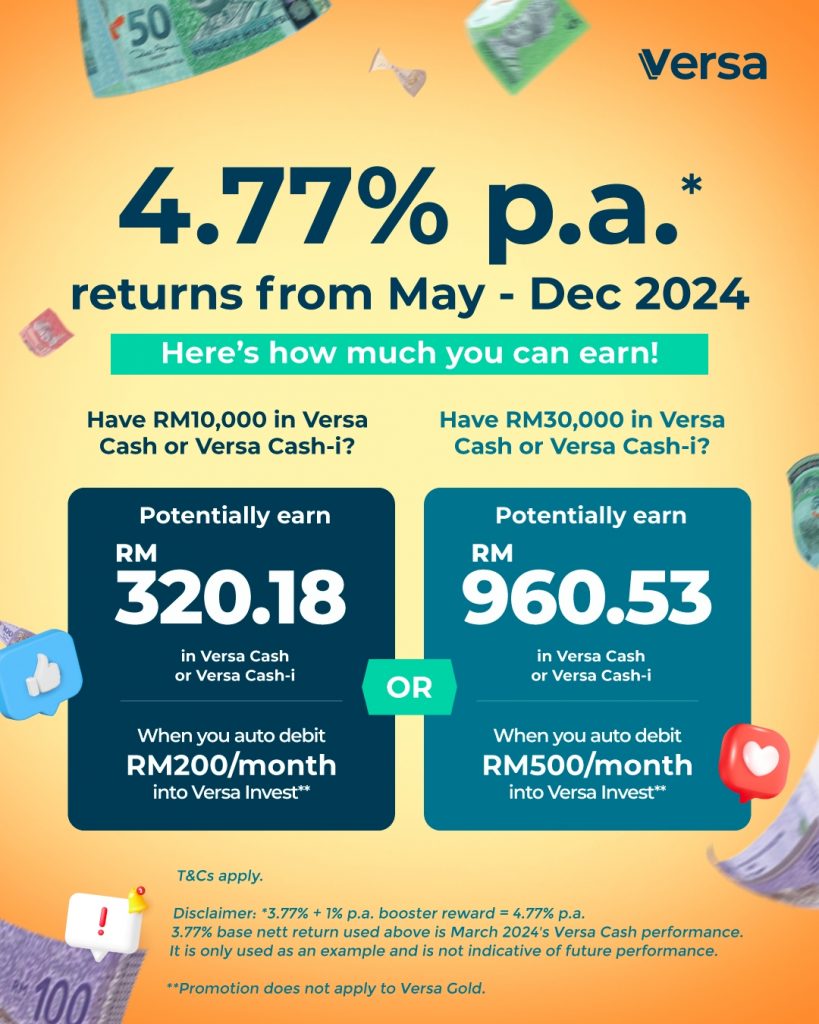

Starting from 1st May 2024 until 31st December 2024, Versa is offering you an additional 1% p.a. return every month on your Versa Cash or Versa Cash-i for activating an auto debit plan to any Versa Invest fund – except for Versa Gold, find the eligible list of funds below.

So for example, the base nett return for Versa Cash in March 2024 was 3.77% p.a. nett, and with the additional 1% p.a. nett provided by Versa, the total rate would have been 4.77% p.a. nett.

Here are the 2 easy steps on how you can enjoy the additional 1% p.a. nett reward:

STEP 1

Create a Versa account and make a cash-in of RM1,000 into Versa Cash or Versa Cash-i.

Versa is offering an exclusive sign-up promo for Soyacincau.com readers! Use the code VSOYACINCAU2 to receive an RM10 bonus when you create an account and cash in a minimum of RM100 into any funds in Versa.

STEP 2

OPTION 1: Set up an auto debit plan of a minimum of RM200 per month into any Versa Invest fund (except for Versa Gold) to enjoy +1% for the first RM10,000 available balance in Versa Cash or Versa Cash-i.

OPTION 2: Set up an auto debit plan of a minimum of RM500 per month into any Versa Invest fund (except for Versa Gold) to enjoy +1% for the first RM30,000 available balance in Versa Cash or Versa Cash-i.

These are the eligible Versa Invest funds that users can set auto debit into to be eligible for the +1% p.a. nett booster rate:

✅ Versa Global-i

✅ Versa SGD

✅ Versa Growth

✅ Versa Growth-i

✅ Versa Moderate

✅ Versa Moderate-i

✅ Versa REITs

And that’s all! You won’t have to do anything else, as Versa will automatically apply these rate adjustments to your investments. Moreover, by enabling auto debit, Versa says that it will help you work better towards achieving your long-term financial goals.

How to start saving and investing with Versa?

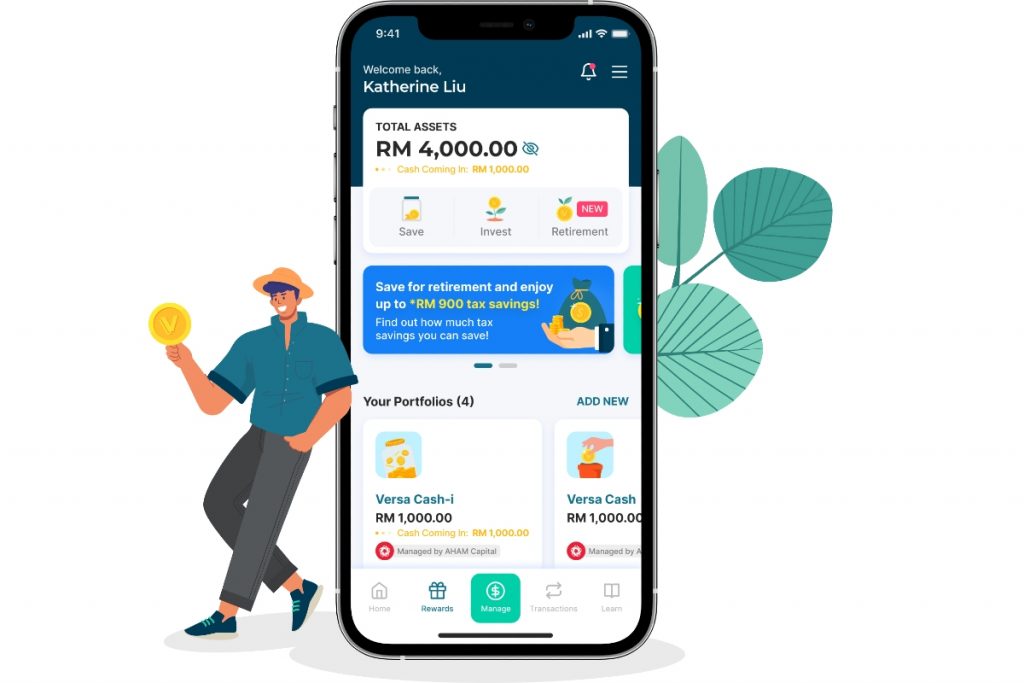

Ease of use is something Versa aimed to achieve when designing its digital wealth management platform. As such, its user-friendly mobile app puts a focus on simplicity and allows you to easily manage your financial portfolios.

Featuring a pleasing aesthetic, a vibrant colour palette, an organised UI, and easily digestible information, the Versa app offers a gentle learning curve to just about anyone who’s remotely tech savvy.

The Versa app is available for download on the Google Play Store, Apple App Store, and Huawei App Gallery.

Who is Versa?

Founded in 2019, Versa is a Kuala Lumpur-based financial technology company backed by AHAM Asset Management Berhad (formerly known as Affin Hwang Asset Management), one of Malaysia’s top 3 asset management firms. The company launched its digital wealth management platform in early 2021, which is regulated by the Securities Commission Malaysia.

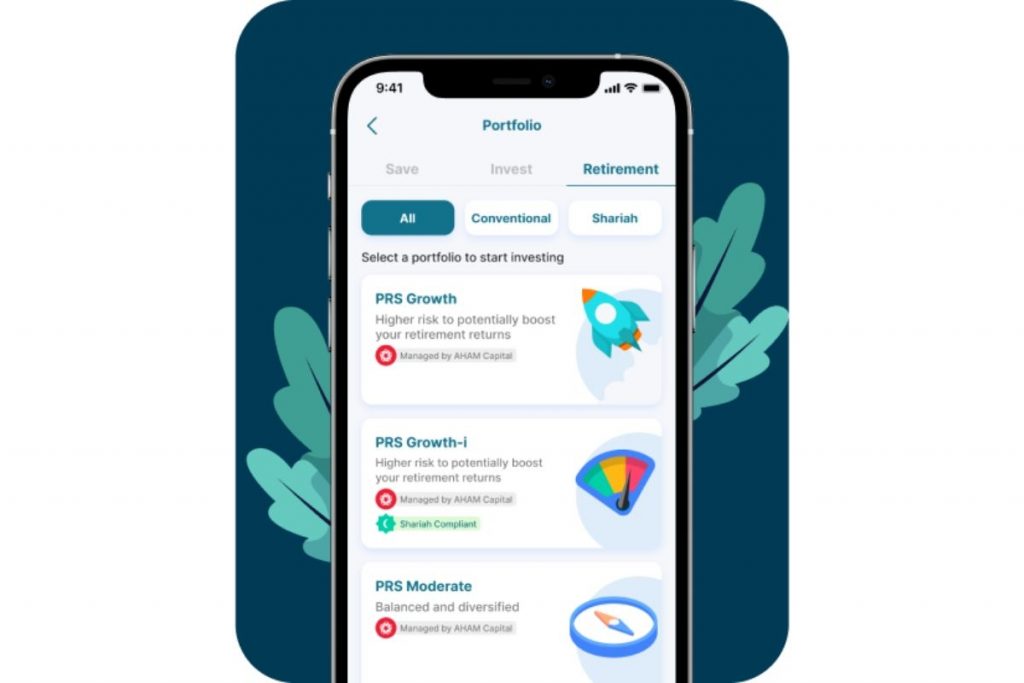

Versa offers savings and investment portfolios that include conventional and Shariah-compliant funds, with the private retirement scheme (PRS) being the company’s latest addition to its portfolio. These are:

Savings

- Versa Cash

- Versa Cash-i

Investment

- Versa Global-i,

- Versa SGD,

- Versa Growth,

- Versa Growth-i,

- Versa Moderate,

- Versa Moderate-i

- Versa REITs

Private Retirement Scheme

- PRS Conservative

- PRS Moderate

- PRS Growth

- PRS Conservative-i

- PRS Moderate-i

- PRS Growth-i

CEO and co-founder of Versa, Teoh Wei-Xiang said, “We recognise that many Malaysians face the emotional weight of financial challenges and Versa aims to alleviate some of that anxiety and burden with our auto debit feature. Versa’s goal is to foster financial peace of mind and confidence in Malaysians to manage their finances effortlessly and stress-free. We are excited to introduce the Money Booster Campaign as part of our ongoing commitment to providing innovative and rewarding solutions to our users.”

Learn more about the Versa digital wealth management platform today and find more information on the Money Booster Campaign on their official website.

Disclaimer: The information contained in this article is not intended as, and shall not be understood or construed as, financial advice. The information contained in this article is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.