By Kuek Ser Kwang Zhe / The Edge Malaysia

03 Feb 2025, 12:00 pm

This article first appeared in Wealth, The Edge Malaysia Weekly on January 27, 2025 – February 2, 2025

Versa Asia Sdn Bhd (Versa), the first online platform licensed to distribute investment products digitally, has made a difference in the financial landscape of the country, particularly in the youth segment, says its co-founder and CEO Teoh Wei-Xiang.

Four years after its official launch in January 2021, the financial technology (fintech) start-up has captured about 270,000 registered users, with 90% aged 40 and below. Breaking the numbers down further, 59% of its total users are aged 30 and below and 20.4% are university students. Gender-wise, 40% of its total users are female. “We helped Malaysians, especially the youth, save almost RM500 million in 2024 alone,” Teoh says.

In an interview with Wealth, Teoh expects the Versa mobile application (app) to gain more traction after the official launch of Versa Quest on Jan 18.

The event, held at Atria Shopping Gallery in Petaling Jaya, was attended by several key individuals, including Science, Technology and Innovation Minister Chang Lih Kang, Deputy Digital Minister Datuk Wilson Ugak Anak Kumbong, Tengku Ariff Temenggong of Pahang Tengku Abdul Fahad Mua’adzam Shah, Versa ambassador Khairy Jamaluddin and AHAM Capital managing director and executive director Datuk Teng Chee Wai.

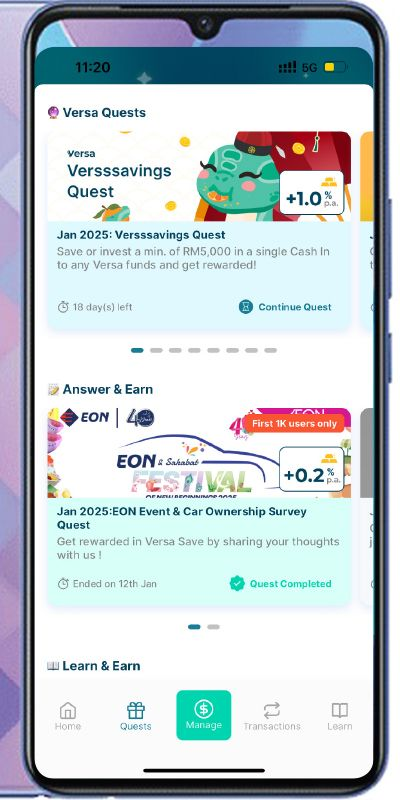

Versa Quest is a new feature in the app that allows users to boost their money market fund returns by filling out surveys or reading digestible marketing content aimed at raising financial awareness.

For instance, Versa users with up to RM10,000 deposited in the AHAM Enhanced Deposit Fund — distributed under the Versa Cash label via the app — were rewarded with an extra 0.1% per year after answering the “Ouch! Funeral Planning Article Quest”. The quest, introduced last November, discussed the cost of funerals in general and how Malaysians could better prepare themselves by, for example, buying insurance policies such as Ouch Pusara Pro — sold by Ouch Protect Bhd, an insurance technology (InsurTech) start-up.

Another recent quest, which expired on Jan 9, was the “Event & Car Ownership Survey Quest”, which rewarded users who answered the survey with a 0.2% annual return on a RM1,000 deposit placed with Versa Cash.

Versa users can also earn a bonus by setting up automated debit (auto debit) payments to invest part of their monthly savings in Versa Save, Versa Invest, Versa Gold, private retirement schemes and several other thematic products.

Experiential platform to help achieve financial goals

Teoh says Versa Quest is part of the start-up’s roadmap to position itself as the preferred wealth platform that helps users achieve their financial goals.

He cites, for example, the car ownership survey quest, which provided Versa and its vendors with insights on meeting the financial needs of its users.

He says Versa can help users achieve their goal of buying a car in several ways. For instance, they can gain extra returns if they consistently save up and invest via Versa through auto debit payments. They are also rewarded with extra returns when reading articles and filling up surveys in the app.

In addition, a car distributor that obtains valuable insights from Versa’s surveys can offer users solutions through Versa Quest. The car distributor could collaborate with Versa on a campaign encouraging users to visit showrooms featuring their desired vehicles and then reward them with bonuses as an incentive. During the visit, promotions and deals, such as attractive financing options, are then offered that best suit their needs.

For now, Versa’s quests are mostly limited to filling surveys and reading content. Quests that involve other activities are slated to be launched later in the year, says Teoh.

“We will incorporate AI (artificial intelligence) elements in the process as we want to ensure that our quests are relevant to our users. The type of content that appears on the app will be customised. [Based on the results of the surveys], what one user sees on the app can be very different from another, as everyone has very different financial goals.”

Teoh expects Versa Quest to attract more users to Versa. In fact, it has already shown positive results before its official launch this month.

“About 10,000 users have engaged with our quests in the last two months. Interestingly, our app was rated 4.1 to 4.2 (out of 5) on the Apple App Store and Google Play Store. After the launch of Versa Quest, the rating shot up to 4.6 to 4.7 on both platforms,” he says.

Versa Quest also aims to encourage users to interact more with the app for extra returns upon performing tasks aimed at helping them in their financial journey.

“It is a form of gamification. We want to provide users with the experience and be the app that helps them achieve their financial goals the fastest,” says Teoh.

Even before the launch of Versa Quest, the app had recorded about 50,000 sessions, or the number of times that users log in to the app daily. Meanwhile, 15,000 to 20,000 unique users log in daily, says Teoh.

Snapshot of Versa Quest on the Versa app

Who are the vendors?

Teoh says Versa owes its achievements so far to its positioning as an “experiential” wealth app that prioritises user experience ahead of most other things, complemented by its flagship product, Versa Cash, which provides investors with steady income and bonuses.

The start-up’s main goal is to shape the financial behaviour of the masses by nudging them into saving and investing consistently over the long term, and rewarding them with steady and fixed returns. It prioritises user experience over other things, such as introducing new products and thematic plays.

Versa is a licensed e-service platform that distributes investment products online, similar to the Touch n’ Go (TnG) app. It is not a robo-advisory firm, whose strength lies in managing investment portfolios and curating investment ideas for users. This understanding of its purpose allows Teoh and his team to be laser-focused on the user experience.

“We realised that some players in the financial space also ‘throw rates’ [subsidise users by providing them with higher-than-average deposit rates] to attract new users,” he says.

“We wanted to find a sustainable way for our users to stay and engage with us. That’s how we prioritise user experience, and we reward them with stackable bonuses when they start adopting good financial behaviour through our app.”

Teoh also attributes Versa’s achievements to his professional background as a digital marketer who wants to provide consumers with a pleasurable and frictionless online transaction journey.

Unlike someone from an asset management industry, who could be more focused on growing its assets under management (AUM) through superior returns and offering the newest products in town, Teoh’s focus is mainly on curating a digital environment that encourages users to transact more on the Versa app.

“As a digital marketer, we always find out where the friction is when users transact with us. We then reduce it so that our users feel comfortable and return for more.”

He adds that the Versa app was built from scratch by an in-house team with the help of its chief technology officer Nelson Wong. “We measure everything and we constantly do surveys with our users for their feedback. We do it through Versa Quest sometimes and we respond quickly to them,” he says.

Playing the long game

Like most fintech start-ups, Versa Asia Sdn Bhd (Versa) was a loss-making entity in its financial year 2024 (FY2024) ended March 31, 2024. According to the CTOS report, Versa recorded revenue of RM873,107 in FY2024, up 152.3% year on year from RM345,996. It recorded losses of RM7.15 million, however, up from RM4.23 million in the previous corresponding period. The report also shows that Versa has total assets of RM6.65 million and total liabilities of RM654,874.

Among Versa’s notable individual investors are Hartalega Holdings Bhd executive chairman Kuan Kam Hon and property developer Majestic Gen Sdn Bhd executive director Ta Wee Dher.

Other institutional investors include Hibiscus Fund LP, a series A/B fund focused on investing in high-growth start-ups in Southeast Asia that is managed by venture capital firm RHL Ventures and South Korea investment firm KB Investment; OSK Capital Partners Sdn Bhd; and fund houses AHAM Asset Management Bhd (AHAM Capital) and Areca Capital Sdn Bhd. All products offered by Versa are either managed by AHAM Capital or fall under its label.

Teoh says the firm is in the midst of closing its series-A fundraising round, which will provide the start-up with “significant financial stamina” to achieve its business objective. Having grown its user base to its current size, he says, it is now “activating its revenue streams”.

Prior to the launch of Versa Quest, the start-up generated revenue by attracting users to its platform to invest in a suite of products offered by AHAM Capital and taking a cut from the latter’s annual management fee.

With Versa Quest, Versa starts generating revenues by partnering with vendors and matching their products and services to its users who need them the most. Teoh says Versa has pivoted away from its initial plan of offering users a card for making puchases using their money invested in money market funds because it was not feasible.

He adds that his initial plan was to encourage users to save and invest in a money market fund consistently via auto debit payments, where Versa would charge a fixed fee on those payments made. Its users would be encouraged to do so to earn daily returns with their money parked in the fund and spend that money on purchases with the card whenever they want.

Some overseas fintech start-ups have done well with such a business model but Teoh says it does not work in Malaysia because it is not the norm for users to pay a higher fee for the auto debit payment feature, which is provided with only a minimal charge in most cases.

With its current trajectory, Teoh says the firm is ambitious and in it for the long run. The hundreds of thousands of young users whom it has gained in the past four years will grow their wealth and contribute to the start-up’s profits and revenues in the years to come.

“Having garnered a pool of young users puts us in a good place to play the long-term game. If you don’t have young users who follow you through your journey, you won’t be able to do that,” he says.

As to whether Teoh will go for an IPO if Versa manages to grow as intended, he says that has always been his goal for the start-up. His aim for now is 2028.