Everything You Need to Know About Investing in Gold in Malaysia

Gold investing has long been recognised as a reliable strategy for wealth preservation and financial growth, particularly during periods of economic uncertainty. As gold investment in Malaysia continues to attract interest, the appeal of gold remains strong, serving as a safe-haven asset amidst market volatility.

In this article, we’ll talk about what gold investment is and how investing in gold works, including its advantages and risks, different gold investment options in Malaysia—from physical gold to gold unit trusts—and key factors to consider before investing in gold. Whether you’re a novice or an experienced investor, understanding these elements is essential for making informed choices. This guide explains how to invest in gold in Malaysia from an educational perspective, and how gold can play a role in long-term savings and portfolio diversification, providing clear insights into gold as an investment in Malaysia.

Introduction to Gold Investing in Malaysia

Gold investing has become increasingly popular as a way to diversify portfolios and protect wealth, especially in uncertain economic times. For those exploring gold investment for beginners, understanding the available ways to invest in gold is an important first step. With various options available—such as physical gold, gold unit trusts, and digital gold investments—it’s important to understand each method’s nuances. Knowing how much to invest in gold is also essential to building a solid investment strategy. Gold’s reputation as a safe-haven asset, offering stability and acting as a hedge against inflation, makes it appealing to those considering gold investment for long-term savings. However, you should be aware of the risks, including the impact of fluctuating gold prices on returns.

Why Invest in Gold in Malaysia?

Gold investing in Malaysia offers distinct advantages, tailored to local economic conditions. As a safe-haven asset, gold is sought after during economic instability and inflation, protecting against currency fluctuations. Malaysians can invest in gold through various methods, such as gold bars, coins, and gold unit trusts, making it accessible to both novice and experienced investors.

Here are a few reasons why gold is favoured:

1. Wealth Preservation During Economic Uncertainty

One reason gold investment in Malaysia remains relevant is its association with wealth preservation. Gold is often referenced during periods of economic instability, geopolitical uncertainty or financial stress, as its value is not directly tied to the performance of any single currency or economy. Gold is generally viewed as a store of value over long periods, helping to preserve purchasing power when inflation or currency movements affect cash savings.

2. Portfolio Stabilisation and Diversification

Gold is frequently discussed as a way to balance overall portfolio risk. Because gold prices do not always move in the same direction as equities or other financial assets, including gold as an investment may help smooth portfolio performance during volatile market conditions. For Malaysians exploring gold as an investment, gold is often introduced as part of a broader diversification approach rather than a standalone strategy.

3. Long-Term Value Retention

Another reason investors consider gold is its potential to retain value over the long term. Unlike fiat currencies, which can lose purchasing power due to inflation, gold has historically maintained relevance as a tangible asset across different economic cycles. This characteristic makes gold investment for long-term savings a commonly discussed topic, especially among individuals looking to preserve value rather than pursue short-term gains.

As a result, many investors view gold not just as an investment, but as an essential part of financial planning and risk management strategies.

Risks of Investing in Gold

While gold investing presents numerous benefits, it is essential for investors to also understand the inherent risks associated with gold as an investment. Fluctuations in gold price trends can significantly impact investment returns, and factors such as geopolitical instability, economic performance, and changes in interest rates can all influence the market. This is why it is important to understand interest rates and macroeconomics before you start making investment decisions.

Beyond physical assets, gold investment options in Malaysia also include paper gold products or gold-related securities, each of which introduces its own set of challenges. The costs of storing and insuring physical gold should be considered, along with the potential challenges in liquidating gold investments during times of market stress.

Understanding these risks is crucial for making well-informed decisions, as the gold market can be unpredictable, characterised by sudden price swings that may not align with the broader market. For instance, investors should be aware of:

- Price Volatility: Gold prices can fluctuate dramatically based on external conditions and investor sentiment.

- Market Factors: Supply and demand dynamics, along with global economic events, can drastically influence the value of gold.

- Storage Costs: Holding physical gold entails expenses related to secure storage and insurance, which can eat into profits.

- Liquidity Challenges: During financial crises or market downturns, the ease of selling gold may decrease, making it hard to access cash quickly.

By evaluating these considerations, investors are better positioned to navigate the complexities of gold investing and safeguard their financial interests.

Gold Investment Options in Malaysia

In Malaysia, you have access to a diverse array of gold investment options that cater to different preferences and financial goals. From buying physical gold in the form of bars and coins to investing in gold unit trusts for beginners, the market offers various ways to gain exposure to this valuable asset. Whether you’re considering investing in gold in Malaysia through gold unit trusts or exploring other gold-related investment products, there are plenty of avenues suited for different investment strategies.

Additionally, digital gold investments provide alternative methods for investors who may prefer a more hands-off approach when it comes to gold investing.

1. Physical Gold: Bars vs. Coins

Regarding buying physical gold, investors often face the choice between gold bars and gold coins, each offering distinct advantages and disadvantages. Gold bars typically provide a lower premium over spot prices and are available in various weights, making them a popular choice for serious investors looking to maximise their investment in gold. On the other hand, gold coins tend to have a higher markup due to their collectable nature and are often more liquid, appealing to those who prefer to have tangible assets that can also hold intrinsic artistic value.

When comparing these two forms of gold, it’s essential to consider several factors that influence an investor’s decision-making process:

- Liquidity: Gold coins are generally easier to trade and sell due to their recognised value and demand among collectors.

- Premiums: While gold bars have a lower premium, coins often carry added costs due to their rarity and condition.

- Investment Goals: If the objective is to accumulate wealth over time, bars may be the better option. For those looking for an enjoyable blend of investment and collection, coins can be more rewarding.

Understanding these elements will give you the power to select the right form of gold that aligns with your financial strategies and preferences. Timing is also crucial, as identifying the best time to buy gold can maximise investment returns in both the short and long term.

2. Gold Unit Trust for Beginners

Gold unit trusts simplify the investment process by eliminating the need for physical possession and security concerns associated with tangible gold. For beginners, gold unit trusts present a user-friendly approach to entering the gold market, as shares can be bought or sold like a stock, reflecting real-time price changes.

Besides the ease of entry, gold unit trusts offer several other key advantages:

- The primary advantage lies in the ease of trading, which offers flexibility to respond to market fluctuations.

- They often have lower expense ratios compared to traditional gold investments, enhancing overall returns.

- Gold unit trusts can also serve as a hedge against inflation, making them a mindful choice in uncertain economic times.

In the Malaysian market, several types of gold unit trusts are available, including those that focus purely on physical gold holdings and others that invest in gold mining companies. Each option provides a unique way to integrate gold exposure to your portfolio while balancing risk and potential rewards.

3. Gold Savings Accounts and Digital Gold

Gold savings accounts and digital gold investments are innovative ways for Malaysians to invest in gold without the need to physically store the precious metal. Through these services, investors can purchase gold online and have it stored securely by a trusted provider, allowing for easy access and flexibility in managing their investments. This option not only simplifies the investment process but also presents an effective way to accumulate gold over time, making it a popular choice for those who prefer a more modern approach to gold investing.

Plus convenience, both options cater to various investment strategies and financial goals. Gold savings accounts typically allow you to save in small amounts over time, gradually building your holdings without significant upfront costs. This flexibility is particularly beneficial if you’re new to investing and wish to start small and grow their portfolio gradually.

Digital gold investments enable users to trade gold at market prices, appealing to a more active investor who might wish to capitalise on short-term price movements.

- Benefits: Easy access, flexible amounts, and potential for asset diversification.

- Potential drawbacks: Market volatility and storage fees may affect overall returns.

4. Gold Certificates and Paper Gold

Gold certificates and paper gold represent alternative methods for you to gain exposure to gold without the challenges associated with physical ownership. Gold certificates are issued by banks and represent a specific amount of gold, while paper gold allows investors to speculate on gold prices through financial instruments, such as futures and options. Both options provide convenience and liquidity but come with distinct risks compared to holding physical gold.

In exploring these options, it is crucial to consider their unique advantages and disadvantages.

For instance, gold certificates offer the benefit of authenticity, as they are backed by tangible gold holdings stored securely, while paper gold typically involves less stringent regulations and can be more volatile due to market speculation.

- Benefits: Investors can manage risks more effectively with gold certificates, as the likelihood of counterparty risk is reduced through bank issuance.

- Risks: Conversely, paper gold exposes traders to leverage, leading to amplified gains or losses, which is a significant consideration in a broader investment strategy.

Factors to Consider Before Investing in Gold

Before embarking on investing in gold in Malaysia, it is vital for you to consider several key factors that could influence your success. Understanding the risks of investing in gold, including market fluctuations, storage costs, and liquidity, is essential for building a more balanced perspective on gold as an investment.

Additionally, aligning one’s investment objectives with the benefits of gold, such as its role as a hedge against inflation and its use in gold investment for long-term savings, can significantly enhance overall investment outcomes. Considering these factors supports a more informed approach when exploring how to invest in gold in Malaysia:

1. Understanding Market Conditions and Trends

A thorough understanding of market conditions and gold price trends is crucial for making informed investment decisions.

Factors such as geopolitical events, economic indicators, and Bank Negara policies can significantly impact gold prices, making it essential for you to stay updated on these developments. To grasp the nuances of the gold market, not only must you observe the fluctuating price movements but you must also consider how external variables interact within the global economy. For instance, inflation rates, currency strength, and interest rates are all indicators that can foreshadow changes in demand for gold. Let’s dive in a little deeper:

- Geopolitical Tensions: Crises can lead to safe-haven buying, thus driving prices up.

- Economic Indicators: Employment rates and GDP growth often correlate with investor confidence in alternative assets.

- Bank Negara Policies: Decisions on interest rates can influence gold’s opportunity cost, altering investment flows.

By recognising these trends and potential risks, you can better navigate the gold market and optimise your investment strategies. Active monitoring of such indicators not only helps in identifying the right entry and exit points but also aids in mitigating risks associated with market volatility.

2. Aligning with Investment Objectives

Aligning gold investments with your financial objectives is key to achieving long-term success in the market. Determining how much to invest in gold based on personal risk tolerance and investment goals can help you create a balanced portfolio that leverages the benefits of gold, such as wealth preservation and inflation hedging. By establishing clear objectives, you can more effectively evaluate the role of gold in your overall financial strategy.

Identifying financial objectives begins with considering various aspects of one’s financial life. For instance, an investor might create a checklist that factors in:

- Retirement planning

- Emergency savings

- Major purchases within a defined timeline

- Long-term wealth accumulation

Once these goals are outlined, it becomes essential to assess how gold can be integrated to help mitigate risks associated with market volatility. Understanding the benefits of gold, such as its historical stability during economic downturns, will further guide you in deciding the appropriate investment amounts.

Gauging your risk appetite allows for a more tailored approach, ensuring that gold investments align seamlessly with your personal financial aspirations.

3. Assessing Your Financial Situation

Assessing your financial situation is an essential step in determining the feasibility of investing in gold and understanding how much to invest. You should evaluate your current financial health, including savings, debts, and existing investments, to ensure that allocating funds to gold aligns with your overall financial strategy. Acknowledging the risks of investing in gold will enable you to make more informed choices regarding your investment amounts and strategies.

This assessment begins with a thorough analysis of income streams and expenditures. It is crucial for you to consider your liabilities, such as outstanding loans and credit card debts, as these financial burdens can significantly impact available capital for investment.

Evaluating cash reserves helps in determining your emergency funds, which should remain untouched for investment purposes. Here are further considerations to have before investing in gold:

- Understanding asset allocation is vital.

- Gold investments can serve as a hedge against inflation.

- They can offer diversification but require careful planning.

By weighing these considerations, investors can determine how gold fits into their broader financial goals and risk tolerance, ultimately paving the way for knowledge-based decision-making.

How to Invest in Gold Stocks and Unit Trusts

Investing in gold stocks and unit trusts presents another avenue for those looking to capitalise on the gold market’s potential, especially if you prefer equities over physical assets. Gold stocks involve purchasing shares of companies engaged in gold mining and production, while gold unit trusts pool investments into a diversified portfolio of gold-related assets.

This approach allows you to benefit from the growth potential of the gold sector while mitigating some of the risks associated with direct gold investment. For beginners exploring gold investment in Malaysia, gold unit trusts are often referenced as a more accessible way to gain exposure without managing physical gold.

Investment Strategies and Considerations

Investing in gold requires a strategic approach to maximise its benefits, whether you’re looking to hedge against economic uncertainty or enhance your portfolio. Here are key strategies to consider when investing in gold:

- Gold as a Hedge Against Inflation and Economic Uncertainty: Use gold to protect your wealth during economic downturns and rising inflation, as it tends to retain its value when other assets fluctuate.

- Incorporating Gold in a Diversified Portfolio: Integrate gold into your portfolio to reduce risk. Its low correlation with stocks and bonds makes it an effective tool for balancing risk and improving financial security.

- Best Time to Buy Gold: Market Timing Tips: Timing is crucial for maximising returns. Monitor market conditions, such as inflation and geopolitical events, to identify the best times to invest in gold.

For beginners looking to invest in gold, determining how much to invest is a crucial aspect of developing a sound investment strategy. It’s essential to consider personal financial goals, risk tolerance, and the benefits of gold as a safe-haven asset when deciding the appropriate investment amount. Many first-time investors explore gold unit trusts and digital gold investments for ease of entry into the market.

For seasoned investors seeking to leverage their gold investments, gold futures and options represent advanced strategies that can amplify potential returns. These financial instruments allow investors to speculate on the future price of gold and hedge against market risks, offering unique opportunities to capitalise on price movements. Understanding physical gold vs paper gold can also be beneficial for advanced strategy planning.

Taxes and Fees in Gold Investing

Understanding taxes and fees associated with gold investing in Malaysia is crucial for maximising returns and minimising potential losses. Depending on the country and local regulations, investors may encounter various fees related to storage, transaction costs, and capital gains taxes when selling gold. These considerations are vital when exploring gold investment benefits and strategies.

Safe Storage Solutions for Gold Investments

Ensuring the safe storage of gold investments is paramount to protecting one’s assets and mitigating the risks associated with investing in gold. Whether you choose to store your physical gold at home or in secure vaults, understanding the various storage options available can help safeguard against theft, loss, and damage. This is a critical aspect of buying physical gold and comparing gold bars vs. gold coins.

1. Options for Storing Physical Gold

Regarding storing physical gold, you have several options to choose from, each offering unique benefits and levels of security. Choosing the right storage method can significantly impact both the safety of the investment and your overall peace of mind.

Investors typically consider various storage methods, such as:

- Home Storage: Keeping gold at home provides immediate access, enabling quick transactions. This method poses risks like theft, fire, or other damages that could compromise the investment.

- Bank Safety Deposit Boxes: This storage method offers enhanced security and institutional protection against risks. While the costs can add up over time, the peace of mind often justifies the expense.

- Private Vault Services: These facilities offer advanced security measures and insurance options, making them ideal for those who prioritise maximum protection. The downside may be related fees, but many consider them a worthwhile investment for serious investors.

2. Digital Storage and Safety for Gold Investments

Digital storage for gold investments offers a modern and convenient alternative to traditional physical storage methods, providing safety and accessibility for investors.

As the world becomes increasingly digital, the allure of storing precious metals like gold in a secure online platform is gaining significant attention. With digital vaults managed by reputable institutions, you can benefit from enhanced features such as real-time tracking, instant liquidity, and the ability to easily manage portfolios from anywhere in the world.

- One of the primary advantages of digital storage is the reduced risk of physical loss, which can stem from burglary or natural disasters.

- Measures such as insurance coverage and high-level encryption protocols provide an additional layer of security, ensuring assets are well-protected.

- In contrast to traditional storage which often incurs ongoing fees for vault maintenance, digital options frequently present a cost-effective solution.

Gold vs. Silver: Which Precious Metal to Choose?

When considering an investment in precious metals, many investors face the decision of choosing between gold and silver, each of which has its unique qualities and investment potential.

Gold is often seen as a safe-haven asset with a history of retaining value during economic downturns, whereas silver can be more volatile and is heavily influenced by industrial demand.

From an investment perspective, gold as an investment is often associated with stability and capital preservation, while silver is more closely linked to economic cycles and industrial activity. This difference means that silver prices may experience sharper fluctuations during periods of economic expansion or slowdown.

Understanding the differences between gold and silver investments is crucial for making informed decisions and aligning with one’s financial goals. Aligning these characteristics with personal financial goals and risk considerations is an important part of deciding how to invest in gold in Malaysia or whether to explore other precious metals.

Potential Returns of Gold Investments in Malaysia

The potential returns of gold investments in Malaysia can vary widely based on market conditions, global economic factors, and individual investment strategies. Historically, gold has provided investors with a hedge against inflation and a means to preserve wealth, making it a favoured asset during periods of economic instability.

Understanding the historical gold price trends and potential risks associated with these investments can help you make informed decisions about your portfolios.

Ready to start investing in gold?

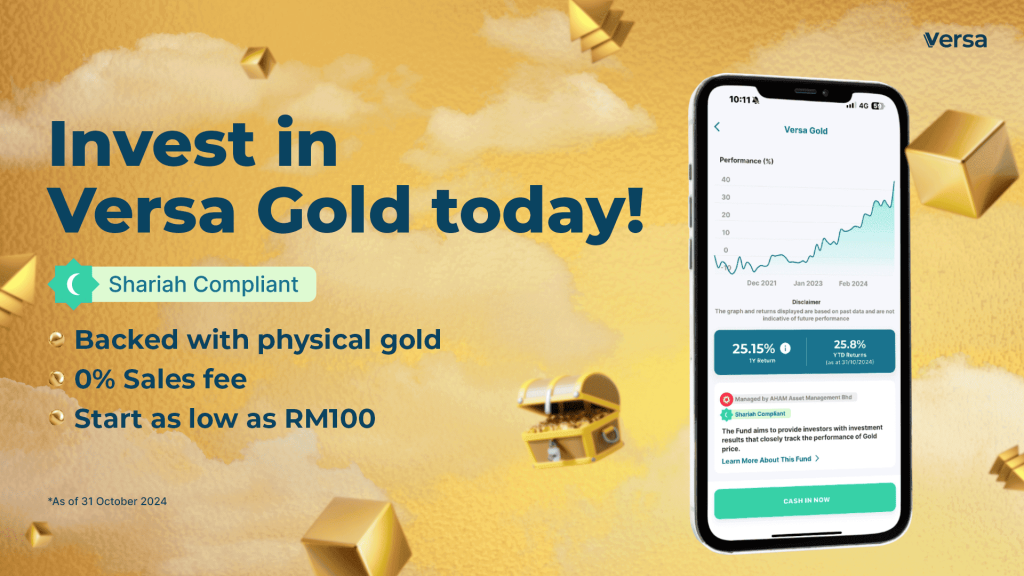

Great! Now, let us introduce you to Versa Gold. This Shariah-compliant fund invests directly in physical gold, which is safely stored in a vault. Gold often moves in a different direction than stocks and bonds, making it a smart way to diversify your investments.

Should you have any questions, please do not hesitate to reach out to us here. 💬