You might be saving for your financial goals right now. Where do you keep your savings?

Under a mattress? In a savings account with 0.2% p.a. interest? Or all locked up in Fixed Deposits?

If you’re looking for a Shariah-compliant option that allows you to Cash Out anytime and gives you Fixed Deposit-like returns, then meet Versa Cash-i.

Where does your money go when you save with Versa Cash-i, our Shariah-compliant Islamic money market fund?

When you Cash In to Versa Cash-i, your money will be invested in a low-risk Islamic money fund called Affin Hwang Aiiman Enhanced i-Profit Fund. 90% of the funds are invested in short-term sukuk, short-term Islamic money market instruments and/or Islamic fixed deposits.

The remaining 10% of the fund is invested in long-term high quality sukuk, units or shares in other Islamic money market collective investment schemes and Islamic derivatives.

How do you earn from Versa Cash-i?

When you make a Cash In to Versa Cash-i, you are purchasing units from the Affin Hwang Aiiman Enhanced i-Profit Fund.

You earn when the unit price of the fund increases and it is reflected in your Versa Cash-i balance as you’ll see your balance increase. Your money and its earnings will then be reinvested into the fund once more, so you can earn returns from your previous returns.

Over the long term, your money along with its returns will constantly be reinvested to generate even more returns. This is known as the power of compounding.

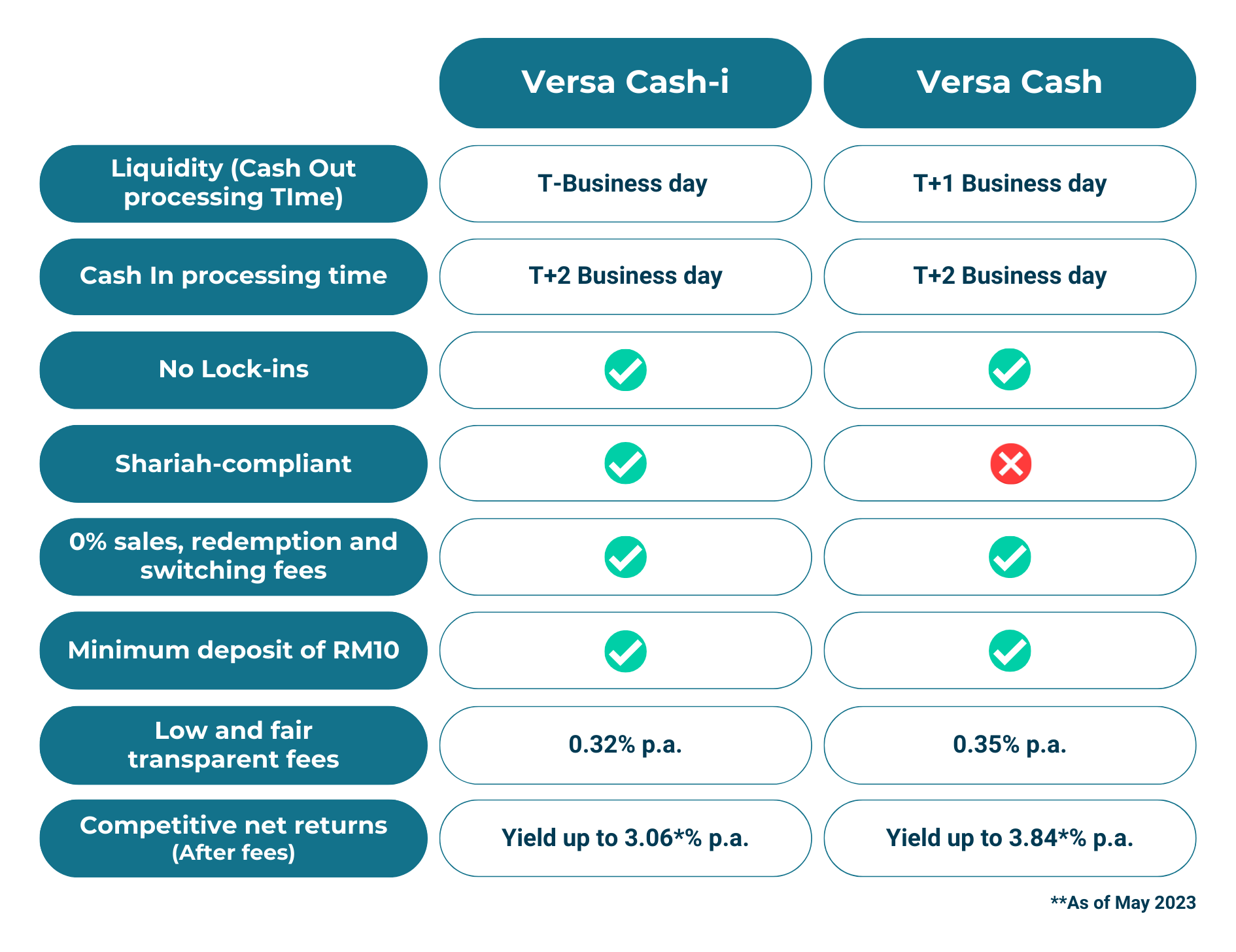

What’s the difference between Versa Cash and Versa Cash-i?

With Versa Cash-i, you enjoy the same liquidity as Versa Cash. In fact, Versa Cash-i offers same business day Cash Out if you complete it before 10.00 am.