Let’s face it — the economy’s still full of twists and turns. The U.S. just postponed tariffs on most countries, including Malaysia, but kept them in place for China. It’s a bit of a relief, but the global trade scene is still shaky, and inflation isn’t going anywhere. With all that, it’s no wonder many of us feel unsure about where to put our money.

If you’re feeling a little uneasy, you’re not alone. But here’s one thing that’s stayed steady through the chaos: gold. That timeless, shiny metal isn’t just nice to look at — it’s long been a safe haven in uncertain times. Adding gold to your portfolio could be just the thing to bring a little stability to your financial game.

Why Market Uncertainty is So Stressful Right Now 😰🌍

We’re living in a time where everything feels like a rollercoaster. Trade wars, inflation, interest rates going up — it’s enough to make anyone feel like they need to hide under a rock. The U.S. tariffs have shaken up the global market, affecting everything from tech products to everyday goods. When the economy feels like it’s one bad headline away from a crash, it’s tough to figure out how to protect your savings.

Gold: The Ultimate Stress-Reliever for Your Portfolio ✨

So, what can you do in a world that feels unpredictable? Gold has been a go-to investment for centuries — and it’s still one of the most trusted assets to fall back on when markets get shaky. Here’s why gold is a total game-changer in times of uncertainty:

1. Stability When Everything Else Feels Volatile 📉⚖️

When things go south in the economy, stocks fall, bonds lose value, and everyone starts scrambling. But here’s the thing — gold often moves in the opposite direction of the stock market. So, when the market is crashing, gold’s price tends to rise, making it a solid shield against all that uncertainty.

2. It’s Your Hedge Against Inflation 💸📈

We’ve all seen prices go up recently, and that’s because of inflation. This means the value of your money doesn’t stretch as far as it used to. But gold? It’s historically been a great way to protect your wealth when inflation rears its ugly head. While the cost of goods may be rising, gold maintains its value, keeping your investment from losing power.

3. Gold’s Trust Factor: It’s Been Around Forever ⏳💎

Unlike tech stocks or cryptocurrency, which are newer and still a bit of a mystery to some, gold’s been around for centuries. From ancient civilizations to today’s investors, people have trusted gold as a store of wealth. It’s been proven time and again to hold value when other investments can’t.

Why You Should Consider Gold Right Now ⏳💥

1. Inflation is a Big Deal 💥💵

With inflation rising everywhere, the cost of living has been climbing. This means that your paycheck doesn’t stretch as far, and your savings aren’t going as far either. Gold is one of the best ways to fight back against inflation. It’s historically been a reliable asset that outpaces inflation, so your money stays protected.

2. Currency Risk is Real 💱🌎

If you’re worried about the ringgit or any other currency taking a hit, gold can be your anchor. As currencies fluctuate, gold tends to maintain its value, making it a global store of wealth. Unlike stocks or bonds, it’s not dependent on a single country’s economy.

3. Global Uncertainty: Gold Keeps You Grounded 🌍⚖️

With all the geopolitical issues happening worldwide, it’s hard not to feel a little nervous about where we’re headed. Whether it’s trade wars, political instability, or global crises, gold gives you something tangible and stable to rely on when everything else feels like it’s in flux.

The Easy Way to Invest in Gold 💡📊

So, now that you know why gold’s such a great option, you might be wondering: “How do I get in on this?” The good news is that investing in gold is easier than ever. You don’t have to buy physical gold bars or coins (unless you want to!). Instead, you can invest in gold-backed exchange-traded funds (ETFs), gold-focused mutual funds, or gold unit trusts. These options give you exposure to gold without the hassle of actually holding it yourself.

Gold-focused unit trusts, in particular, offer an easy way to invest in gold, especially if you’re new to investing. You get the benefits of gold without dealing with storage or worrying about the market fluctuations yourself.

In Conclusion: Stay Calm, Stay Gold ✨💰

With the world feeling so unpredictable, it’s easy to feel like your savings are at risk. But gold is here to give you that extra layer of protection. It’s time-tested, reliable, and offers stability when the rest of the market is in chaos. Plus, it’s simple to invest in, making it a great choice for anyone looking to add some peace of mind to their portfolio.

So, if you’re looking to weather the storm of market uncertainty, it might be time to start thinking about gold. After all, a little stability goes a long way, especially when things feel shaky.

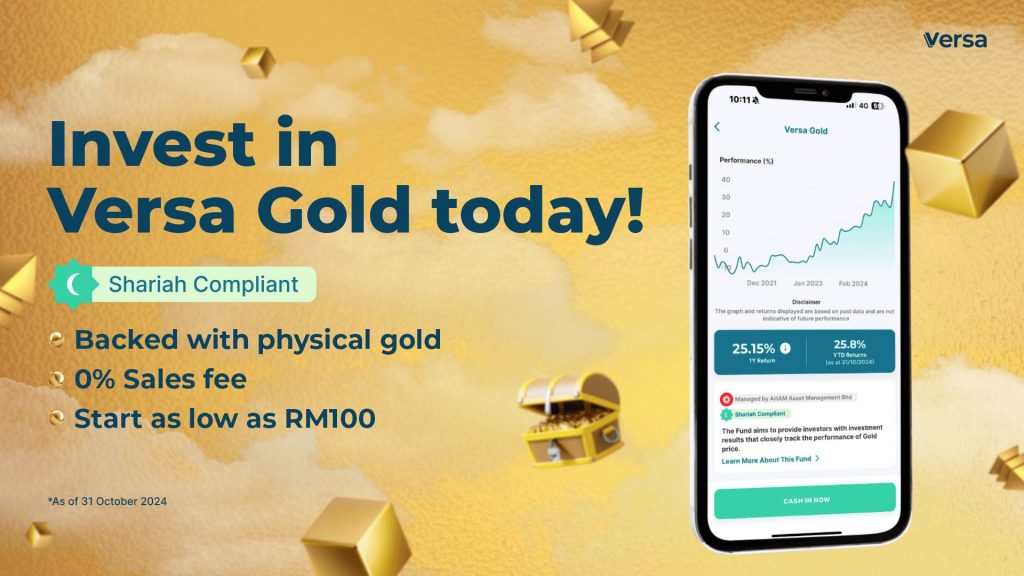

Ready to start investing in gold?

Great! Now, let us introduce you to Versa Gold. This Shariah-compliant fund invests directly in physical gold, which is safely stored in a vault. Gold often moves in a different direction than stocks and bonds, making it a smart way to diversify your investments.

Should you have any questions, please do not hesitate to reach out to us here. 💬