In an unpredictable financial landscape, identifying safe avenues for long-term wealth can be both daunting and essential. For individuals in Malaysia seeking to grow their savings without incurring undue risk, a variety of investment options are available.

This article examines ten of the best low-risk investments that can assist in securing a stable financial future. From fixed deposits to private retirement schemes, each option presents unique benefits and insights to navigate the investment journey effectively. Readers are encouraged to explore the possibilities for establishing a stable and prosperous financial path.

1. Fixed Deposits

Fixed deposits represent a foundation of low-risk investing, offering beginner investors a stable investment option that guarantees consistent returns. This makes them an ideal choice for you if you’re aiming for financial independence while effectively managing risk.

By locking in funds for a predetermined period, fixed deposits ensure capital preservation and provide high liquidity, allowing you to access your savings without incurring significant penalties under certain conditions.

Financial institutions, such as Maybank, along with government-backed entities like the EPF, frequently offer attractive rates, enhancing the appeal of these deposits.

In comparison to other low-risk products, such as Sukuk or government bonds, fixed deposits distinguish themselves through their simplicity and straightforward nature, attracting those who favour a hands-off investment strategy.

This combination of security and accessibility solidifies fixed deposits as a preferred option for safeguarding one’s financial future.

2. Government Bonds

Government bonds are recognised as a stable investment option that offers capital growth potential while mitigating inflation risk. This characteristic makes them particularly appealing to investors aiming to achieve specific financial goals without substantial exposure to market volatility.

These financial instruments provide a reliable income stream, often featuring interest payments that may be exempt from federal taxes, which enhances their attractiveness for those looking to optimise after-tax returns.

In contrast to fixed deposits, which typically offer lower yields, government bonds frequently present higher dividend potential, positioning them as a more lucrative choice.

While unit trust funds offer growth opportunities, they can still be subjected to market ups and downs. Government bonds, on the other hand, provide a foundation of stability and security. By contributing to a well-balanced portfolio, government bonds play a crucial role in mitigating risks associated with more market-sensitive investments, reinforcing their value in a diversified investment strategy.

3. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) present a compelling investment opportunity, enabling you to pursue capital preservation while benefiting from dividend returns. This makes REITs an attractive option for those seeking to diversify their investment portfolios.

These investment vehicles work by pooling capital from multiple investors to acquire, manage, and sell a portfolio of income-generating real estate assets. The structure of REITs typically results in high liquidity, as they are commonly traded on major stock exchanges, allowing you to buy and sell shares with ease. This liquidity, combined with a steady stream of rental income, can lead to consistent returns that appeal to both novice and experienced investors.

In Malaysia, prominent examples such as Sunway REIT and Pavilion REIT focus on retail and commercial properties, illustrating how these instruments can effectively integrate into broader investment strategies aimed at long-term growth and income generation.

4. Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) have profoundly transformed the investment landscape, providing you with liquidity, flexibility, and access to a diverse array of low-risk products that cater to various investment strategies.

By enabling you to buy and sell shares on the stock exchange throughout the trading day, ETFs offer a dynamic alternative to traditional mutual funds. Typically associated with lower annual management fees, they represent a cost-effective choice for a wide range of investors.

This cost efficiency can significantly enhance overall returns, particularly over extended periods. Additionally, ETFs play a crucial role in managing risk within investment portfolios, as they can be tailored to target specific sectors or asset classes.

In Malaysia, popular options include the FTSE Bursa Malaysia Index ETF and the MyETF Dow Jones U.S. Titans 50, which provide investors with robust opportunities for diversification.

5. Unit Trusts

Unit trusts offer a structured approach for beginner investors to build a diversified investment portfolio, integrating financial education with the advantages of collective investment management, thereby facilitating effective risk management.

By pooling resources from various investors, unit trusts enable you to access a wider array of investment opportunities than you could independently. This collective strategy not only enhances diversification but also mitigates the risks associated with market fluctuations.

In contrast to fixed deposits, which provide lower returns and guaranteed capital, and Sukuk, which may involve varying levels of risk tied to Islamic principles, unit trusts present a more dynamic potential for growth. This characteristic makes them particularly attractive for those pursuing capital appreciation over time while benefiting from professional fund management, thus accommodating a range of risk appetites and investment objectives.

💡 Use Versa, a digital wealth management app that makes saving and investing simple via our partnership with AHAM Asset Management Berhad (formerly known as Affin Hwang Asset Management). It’s highly accessible by introducing low entry amounts, low fees and flexibility that allows users to withdraw anytime without incurring penalties. Versa is also registered by the Securities Commission (SC) of Malaysia to operate as a Recognized Marketing Operator (RMO) under guidelines as an E-Services platform!

6. Peer-to-Peer Lending

Peer-to-peer lending has emerged as a notable investment opportunity, enabling you to lend directly to borrowers while effectively managing risk and pursuing capital growth through interest returns.

These platforms connect borrowers in need of funds with investors seeking better returns than those offered by traditional bank accounts or bonds. Unlike conventional investments, peer-to-peer lending allows investors to diversify their portfolios by selecting from a variety of loans with different risk profiles.

Participation in this sector necessitates a comprehensive risk assessment, as default rates can vary significantly. A thorough understanding of the factors influencing borrowers’ repayment capabilities is essential, allowing for informed decisions that strike a balance between potential risks and attractive returns.

7. Gold and Silver

Investing in gold and silver remains a time-honoured strategy for capital preservation, particularly during periods of economic uncertainty. These precious metals provide a stable investment that mitigates inflation risk while offering diversification within an investment portfolio.

Gold and silver have long been recognised for their capacity to maintain value, even as other asset classes experience significant fluctuations. Historically, they serve as a hedge against currency devaluation and geopolitical instability. Market behaviour demonstrates that during economic downturns, gold typically appreciates, while silver often follows suit with greater volatility, reflecting shifts in industrial demand.

Recent market trends indicate a growing interest in these metals, as investors seek refuge from inflationary pressures and stock market turbulence. Methods for investing in gold and silver include:

- Physical ownership

- Exchange-traded funds (ETFs)

- Mining stocks

Each of these options presents unique benefits, contributing to a diversified investment strategy.

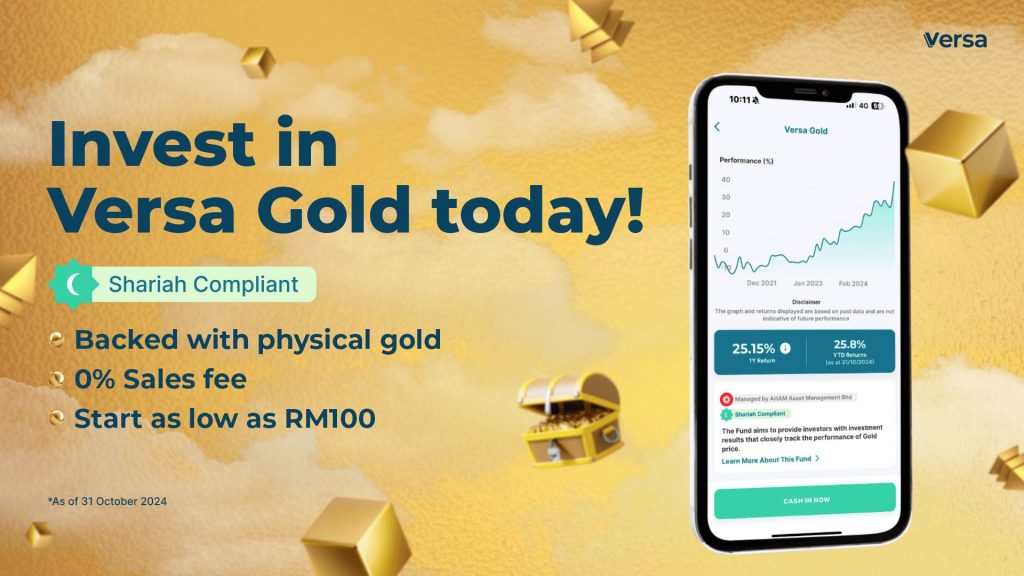

💡 Check out Versa Gold! This Shariah-compliant fund closely tracks the performance of Gold price with the fund’s investments held in physical gold that are safely stored in a secure vault. Just like any gold investments, Versa Gold has low correlation to other asset classes – equities, bonds and real estates, making it a good alternative asset to add to your investment portfolio!

8. Blue-Chip Stocks

Blue-chip stocks represent a category of well-established companies recognised for their strong investment performance and reliability. They frequently offer investors steady dividend returns and the potential for long-term capital growth.

These companies typically demonstrate a proven track record of stability, robust financial health, and a leading position within their respective industries. As a foundational element in a diversified investment portfolio, blue-chip stocks can help mitigate risk while still providing opportunities for appreciation over time.

When evaluating their performance, investors may compare blue-chip stocks against other asset classes, such as bonds, which are generally perceived as safer but tend to deliver lower returns, and unit trust funds, which offer diversification but may incur higher fees.

This analysis enables investors to make informed decisions tailored to their financial goals and risk tolerance.

9. Employees Provident Fund (EPF)

The Employees Provident Fund (EPF) serves as a critical element of Malaysia’s retirement savings framework, providing tax-exempt returns and a secure avenue for contributors to achieve financial peace of mind as they plan for their futures.

This system is designed to promote long-term saving habits, encouraging individuals to allocate a portion of their salaries towards retirement savings, thereby fostering a culture of financial responsibility and financial independence. By integrating various investment options, individuals can better achieve their financial goals.

Contributors benefit from a well-structured plan that not only maximises savings through competitive interest rates but also provides liquidity flexibility in accessing funds under specific circumstances. This includes options such as fixed deposits and money market funds, which offer high liquidity and stable investment returns.

When compared to other investment opportunities, the EPF frequently offers competitive returns while ensuring the safety of the principal amount. Financial institutions like Maybank and Kenanga Investment Bank play a vital role in managing these funds, overseeing investments, and optimising strategies, including risk management and asset diversification, to guarantee the sustainability and growth of the EPF. This process ensures a reliable safety net for future generations and aligns with the broader investment landscape.

10. Private Retirement Schemes (PRS)

Private Retirement Schemes (PRS) are becoming increasingly popular among individuals seeking financial independence, as they offer tailored investment strategies that enhance retirement planning and supplement traditional savings methods, such as the Employees Provident Fund (EPF) and Amanah Saham Bumiputera (ASB). These strategies often include Shariah-compliant funds and low-risk products, providing a diverse range of options.

These schemes typically provide a variety of fund options, including equity, fixed income, and balanced funds, along with unit trust funds, government bonds, and Sukuk. They cater to different risk appetites and financial objectives, offering tax-exempted returns. Participants can take advantage of tax deductions on their contributions, maximising savings while preparing for future financial peace of mind.

PRS can be seamlessly integrated into a comprehensive retirement strategy, complementing existing savings plans like Tabung Haji and providing additional layers of financial security. By carefully selecting funds, individuals can effectively manage risk, target expected returns, and address inflation risk, ensuring that their retirement portfolio aligns with lifestyle aspirations and financial needs in the long term. This involves utilizing investment tools and receiving investment advice to enhance investment performance.

💡Wondering where to start? Versa Retirement is here! You’ll have the flexibility to choose a PRS fund based on your risk appetite while also allowing your wealth to bloom.

For more information on financial education and strategies for beginner investors, follow our social media channels for the latest updates on investment campaigns and economic conditions affecting the investment portfolio landscape.

Should you have any questions, please do not hesitate to reach out to us here. 💬