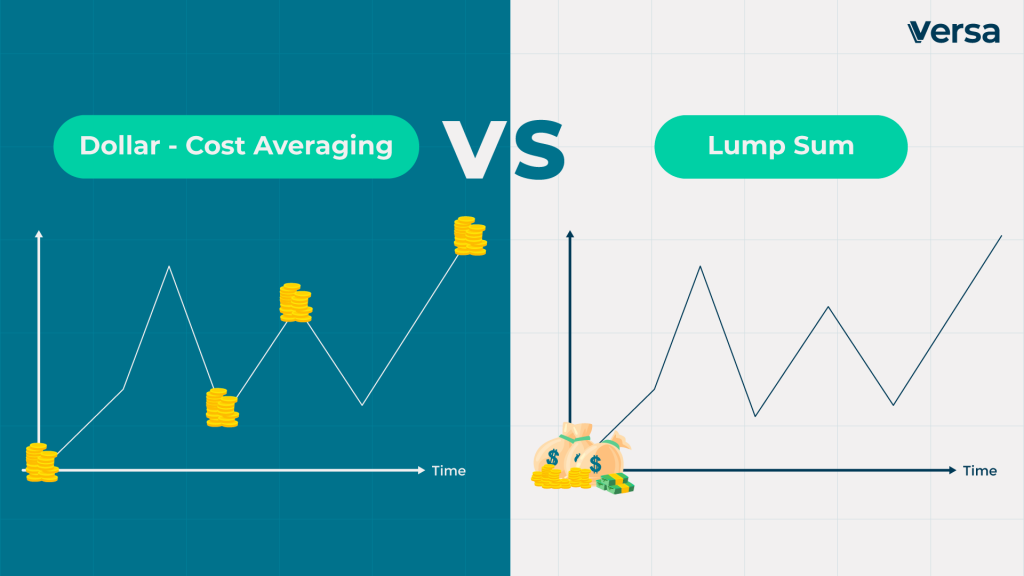

If you have money to invest, you need to decide if you want to space it out ? (Dollar-Cost Averaging) or put it all into an investment now (lump-sum investing). ?

While research has shown that returns on lump-sum investing outperforms Dollar-Cost Averaging (DCA) investing, the difference of returns is not significant. ?

So how do you decide which is best for you? ?

Here’s a couple of questions to ask yourself first:

Question #1: How well do you sleep during market volatility? ?

Seeing your investments take a dip can be scary. ??

If you have a high-risk tolerance, lump-sum investing is a great option for you. While you run the risk that the markets can tank immediately after investing, there’s also the possibility of huge gains.

On the other hand, DCA works well for investors with lower risk tolerance. By spreading your investments in smaller chunks, you minimise risk.

Question #2: How much do you have? ?

If you have limited capital, DCA is a great option as you can start investing immediately. You’ll also be able to park some cash aside for emergencies until the next interval to invest.

Whereas for lump sum investing, you need a good financial foundation. If you have the money and are okay with the risk, then lump sum investing might be for you.

Ultimately, the decision is yours

While investing can be challenging, it’s also an incredibly rewarding journey. Everyone’s financial journey is different, and what matters most is that you are consistent in saving and investing over a long period of time. Accumulating wealth is a slow process. As the saying goes, sikit-sikit lama-lama jadi bukit. #YouCanDuit ?