New Year, New Ways to Upgrade your Money Habits!

Whether you’re hitting a specific goal or just growing your stash, pair your fresh fund cash-ins with Versa’s Auto Debit feature to build effortless discipline. It’s all about rewarding your journey toward financial wellness, all on auto.

What’s New?

- For new users (account creation from 1 January 2026 onwards): you’ll get to enjoy a limited-time promotional rate of 10%* p.a. nett on your first RM500 Auto Debit amount in Versa Save for 3 months!

- For existing users: In our 2025 campaign, rewards are awarded based on your Versa Save account balance with a cap. In 2026, this Save Booster Quest will reward you based on your fresh funds in the month of eligible and successful auto debit transaction only (which includes your Auto Debit Transaction and manual cash-ins), without any cap.

- So, the more your auto-debit amount or cash in amount is, the more you’ll earn each month. This Quest refreshes every start of the month and will help you keep track of your fresh funds status.

- The reward applies only to fresh funds deposited within the current month. Each new month will require additional fresh funds to qualify for the reward. Rewards are calculated on a daily prorated basis.

Note: If you are already auto debiting RM500 or more every month, you’ll still enjoy rewards on your auto debited amount for that month. On top of that, any fresh funds will be rewarded too!

Quest Period:

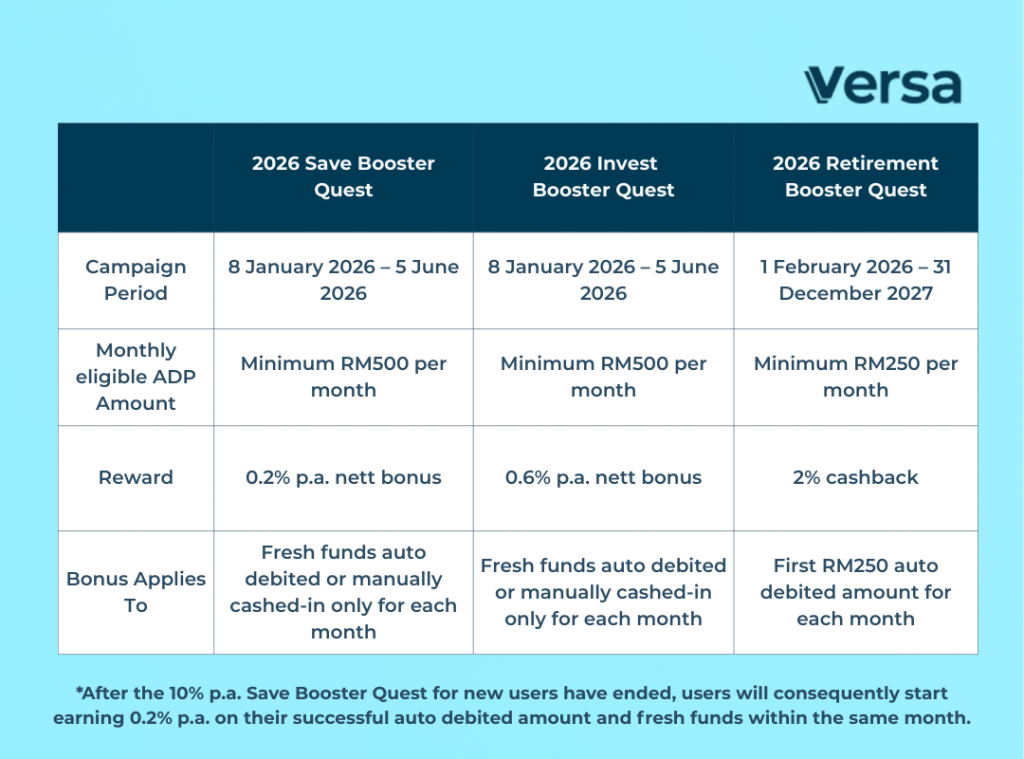

- 10% p.a. Save Booster Quest: 8 January 2026 – 5 June 2026*

(maximum of 3 consecutive months per user from the month of your first auto-debit transaction) - Save Booster Quest: 8 January 2026 – 5 June 2026

💡Pro Tip: To make the most out of this quest, complete auto debits worth RM500 or more each month. Ensure your auto debits are successfully processed every month. Then, cash in fresh funds to maximize your returns on the booster ratewithin the same month. Repeat this healthy habit consistently throughout the year 2026, and let Versa reward your commitment.

For Existing Users, Why the Change?

- Our Commitment: We’re committed to helping you build better financial habits and grow your wealth. This year, we’re fueling that mission by turning your discipline into rewards.

- Consistency Rewarded: Consistency pays off! You will now earn rewards on new funds you cash in each month.

- Unlimited Potential: Whether you’re saving RM500 or RM500,000, every ringgit of your fresh funds earns a bonus. The more you cash in (via manual or Auto Debit), the more you earn.

Some Refresher on the Terms:

- Fresh Funds: New cash-ins you make on top of your baseline. If your new cash-in pushes your balance above that amount, it counts as Fresh Funds. Auto Debit counts too!

- Baseline (for Save Booster Quest): Your cumulative nett cash-in across the Versa Save products as of the last day of the previous month.

Mechanics and Rewards*

First, choose your user type:

- New User → Download and create a Versa account on/after 1 January 2026.

- Existing User → Downloaded and created a Versa account before 1 January 2026.

Click the toggle below to see how you can earn rewards from Save Booster Quest ⬇️

For New Users

10% p.a. Save Booster Quest

*This is a limited-time Quest, only available for new users who create an account from 1 January 2026 onwards.

- Step 1: Download the Versa app & create your new account between the campaign period.

- Step 2: Complete your Versa profile and account verification.

- Step 3: During the Eligibility Period, set up a monthly auto-debit of minimum RM500 into any Versa Save products via the Save Booster Quest under the ‘Quests’ tab. The 10%* p.a. bonus is applicable on the first RM500 auto-debit amount, if you set up auto-debit plans by 26 March 2026.

- Step 4: Maintain your auto-debits every month during the Eligibility Period to keep earning the 10%* p.a. bonus on the RM500 auto-debited fresh funds.

- After the completion of the Eligibility Period, you may enjoy +0.2% p.a. booster reward on your monthly fresh funds for the remaining Campaign Period when you have an auto-debit minimum of RM500.

- Step 5: Be the first 25,000 users to fulfil the above mechanics to enjoy the rewards!

In summary, you’ll be earning 10%* p.a. promo rate for the a maximum of 3 months* on your first RM500 Auto Debit amount, inclusive of your first Auto Debit Transaction month. During this time, you may also be eligible for other rewards. Please check out Versa Starter Quest for more details.

After the 3-month rolling period has ended, you will continue earning a +0.2% p.a. booster reward on your fresh funds for the remaining Campaign Period. This includes the RM500 or more auto debit amount and your subsequent manual cash-ins, same as existing users.

*Note: To be eligible for this 10% p.a. promo rate, please ensure you have successfully set up an Auto Debit plan by the final cut-off date of 26 March 2026.

Here’s a summary of the Eligibility Period:

| Account Creation Month | Eligible Reward Month for 10%* p.a. Auto-Debit Promo Rate |

| January 2026 | 3-month period starting on the day you set up your first auto debit plan* successfully with the eligible amount. *Final cut-off date: 26 March 2026 |

Already with Versa

Save Booster Quest

Step 1: From Versa’s homepage, click on “Quests”.

Step 2: Open the “Save Booster Quest”.

Step 3: Set up one or more Auto Debit Plan(s) into Versa Save, totalling RM500 or more. *This task will be deemed completed once the auto-debit transaction is reflected in the app.

Step 4: After your Auto Debit transaction is completed, cash in more fresh funds into Versa Save to earn more rewards!

Your reward:

- You will earn +0.2% p.a. booster rate

- Applied on the eligible fresh fund amount (this includes your Auto Debit Transaction and manual cash-ins after the Auto Debit Transaction is completed)

- Reward will be credited to your Versa Save product with the highest balance

Cash in as much fresh funds as you want, as there is NO max cap for this Quest!

Already on Auto-Debit? You’re all set!

Sit back and relax! Your upcoming monthly deduction counts as Fresh Funds, which means it automatically qualifies for the bonus rate the moment it lands. No manual transfers needed. 🍵

Rewarding Period and Fund

Campaign Rewards for the successful transaction will be credited in the subsequent month into Versa Save product (Versa Save Shariah Compliant as the default), whichever with the highest available balance at the end of the Campaign Period.

Eligible Versa Products

Below are the only eligible Versa Save products you can auto debit into to earn the booster rates:

✅ Versa Save Conventional

✅ Versa Save Shariah Compliant

Important Note!

Rewards are only credited upon the successful completion of your Auto Debit. Please ensure your bank account is ready for the transaction.

Pausing or deleting your auto debit plans will pause your eligibility for this Campaign. The Eligibility Period for the Auto-Debit Promo Rate is calculated when your auto debit plan is successfully created.

The final cut-off date to create an Auto Debit plan for new users to be eligible for the 10% booster promo rate will be 26 March 2026.

Click here to view the scenario-based examples for this Campaign.

*All campaigns are subject to Versa’s Platform Terms and Conditions.

Looking for more rewards? Check out our Latest Auto Debit Quests!

Frequently Asked Questions (General)

1. Can I only manually cash into Versa Save every month without setting up a Versa Save auto debit plan?

No, manual cash-ins to Versa Save (Versa Save Conventional or Versa Save Shariah Compliant) without a successful Auto Debit Transaction do not make you eligible to enjoy the booster rewards on your Versa Save fresh funds.

2. Can I set up more than 1 auto debit plan in Versa Save?

Yes, you can set up more than 1 auto debit plan into Versa Save. The key is to have a minimum of RM500 Auto Debit amount in total.

For new users (who create account from 1 January 2026 to March 2026), you’ll be eligible to enjoy our promotional 10% p.a. rate on your first RM500 Auto Debit amount in Versa Save, subjected to the respective Eligibility Period, if you successfully set up an Auto Debit plan by the final cut-off date of 26 March 2026..

For existing users, you’ll be eligible to enjoy our promotional +0.2% p.a. nett booster on your RM500 or more Auto Debit amount plus your fresh fund cash-ins (after successful Auto Debit Transaction).

3. Can I adjust my Auto Debit amount after joining the Quest?

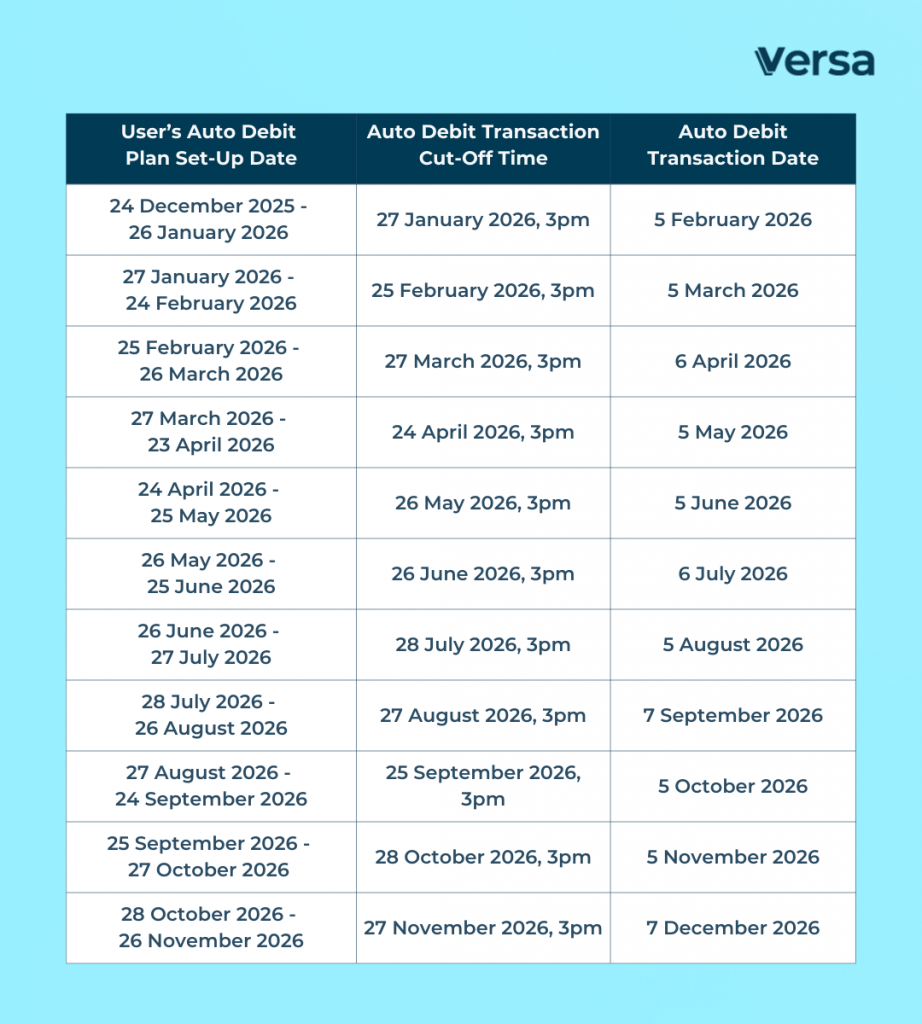

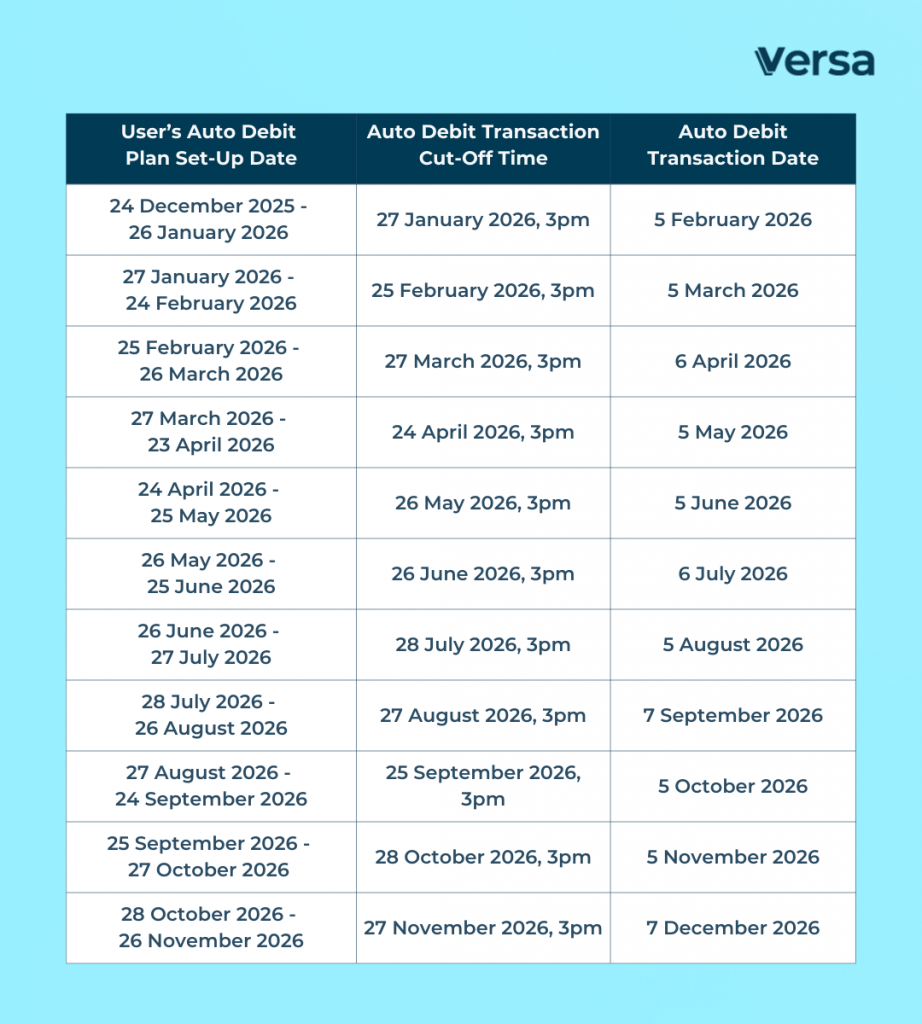

Yes, you can adjust your Auto Debit anytime except during the blackout period. Please refer to the table below for the monthly cut-off time to set up auto-debit transactions.

*Please note that Auto Debit Deduction from the bank account via Maybank will be on the 5th of the month, regardless of whether it’s a Public Holiday or a weekend.

4. What happens when my bank account balance is less than the amount set in my Auto Debit plan?

All Auto Debit transactions will automatically fail, and hence for that month, you will not be eligible for the booster rewards. Therefore, we encourage you to ensure that your bank account balance is higher than the total amount of your auto debit plan.

5. What happens if the name on my Versa account doesn’t match the name on my bank account?

All Auto Debit transactions will automatically fail, and hence for that month, you will not be eligible for the nett booster rate. Therefore, we encourage you to ensure that you use a bank account registered to your name to sign up for Versa’s auto debit.

6. When do I earn my Versa Quests rewards?

As long as you complete your Versa Quests within the stated campaign duration, your rewards will be credited to your Versa account by the end of the following month.

7. Are the Save Booster Quest’s booster rates stackable with other Quests?

Yes, they are! Join as many Quests as you’d like and accumulate more boosters.

Check out all available Quests on our Promotion Page to see how you can stack your efforts and earn more as you build better money habits.

https://versa.com.my/versapromotions/

8. Are Versa Quests’ rewards before or after fees?

All stackable return rates shown in the app are not subjected to Management Fees or Trustee Fees. However, the base nett return rates displayed are after fees, meaning the nett returns you receive each month is after the deduction of these fees.

Frequently Asked Questions (Technical)

1. During the Quest period, do switches count as part of Fresh Funds?

No, switches involve moving existing funds within Versa, so it’s not considered as Fresh Funds for the Save Booster Quest. However, switching out from the product will reduce the fresh funds amount for the Quest.

2. I decided to cash out during the Quest period. Will this transaction be counted towards the Fresh Funds calculation?

Yes, the cash out amount will deduct your eligible Fresh Funds. The reward will be prorated based on the days you’re eligible.

3. When will my Auto Debit Plan be deducted from my bank account?

Your auto debit amount will be deducted from your bank account on the 5th of every month. For non-Maybank users, the deduction will be on the next working day if the 5th is a holiday or weekend. Funds will be deposited into your Versa fund within 2-3 business days after the deduction is successful. Maybank users will always be deducted on the 5th. Please refer to table below for specific dates for non-Maybank users.

4. As a new user, if I set up multiple auto-debits to different Versa Save products, does each product get its own 3-month rolling bonus?

The 10%* p.a. is applicable to the total auto debit amount of Versa Save (cap at RM500). If a user sets up RM500 Versa Save Conventional auto debit, and another RM500 Versa Save Shariah Compliant auto debit, the 10%* p.a. only applies to first RM500 fresh funds, and the reward goes to the highest balance product in Versa Save.

5. I decided to cash out after my Auto Debit Transaction in February was completed, dropping my fresh funds below my baseline. What do I need to do in the following month(s)?

Firstly, you won’t be eligible for the reward in March if your fresh funds don’t exceed your baseline. However, in April, your baseline will be refreshed according to the last day of March instead, making it easier for you to top up and recover your baseline. For example:

| Scenario Eligibility | Rewards Eligibility |

| User created a Versa account, and the account got approved before 1 January 2026. User held RM10,000 in Versa Save in January 2026, and set up a RM500 monthly auto-debit into Versa Save Conventional on 10 January 2026. The RM500 auto-debit amount transacted on 5 February 2026. On 15 February 2026, user cashed out RM3,000 from Versa Save, reducing their Versa Save’s Cumulative Nett Cash Ins* to RM7,500. On 28 February 2026, user’s baseline was updated to RM7,500 in preparation for the next month’s participation. They maintained their auto-debit plan throughout the eligibility period, without further manual top-ups. | User earns 0.2%* p.a. Auto-Debit promo rate on the RM500 or more auto-debit amount for February. User is not eligible for 0.2%* p.a. promo rate in March 2026, as the RM3,000 withdrawal resulted in a negative Fresh Funds amount due to user only had RM500 of Auto Debit fresh funds contributing towards Versa Save. User is eligible for the 0.2%* p.a. promo rate again from April to June 2026, as April’s baseline revision to RM7,500 allows the recurring auto-debit transaction to once again qualify as Fresh Funds. |

Join the Save Booster Quest today!

Should you have any questions, please do not hesitate to reach out to us here.