This time we’re rewarding directly to your PRS accounts. 💪💸

Building your retirement doesn’t have to feel hard or far away. With the all‑new Retirement Booster Quest, your monthly PRS auto‑debit now comes with a little thank you — 2%* monthly cashback, credited straight into your Versa Retirement account.

ELIGIBILITY NOTICE: This Quest is personalized based on your recent account activity. If it isn’t visible in your tab, this specific offer doesn’t apply to your current account status. Keep an eye out for future rewards!.

This Quest helps you:

- Build a long‑term retirement habit

- Practise disciplined monthly investing (hello, DCA 👋)

- Get rewarded for staying committed

- Grow both your PRS balance and rewards together

Small monthly actions today = a more comfortable future tomorrow.

Campaign Period:

1 February 2026 – 31 December 2027

How this Quest works

- Step 1: Open the Versa app and head to the ‘Quests’ tab. Tap on Retirement Booster Quest.

- Step 2: Set up (or maintain if you already have one) a monthly auto debit of at least RM250 into any PRS products via Versa Retirement.

- Step 3: This Quest is refreshed at the start of each month so keep your auto debit active every month to keep earning cashback.

- Step 4: Earn 2%* monthly cashback (applicable to maximum RM250 cash-in amount) credited directly into your PRS balance.

Did you know? You are earning a 2%* monthly cashback on the first RM250 transacted every month. Keep your auto debit active to earn RM60 in reward over the next 12 months.

Rewarding Period and Fund

Campaign Rewards for the successful transaction will be credited in the subsequent month into Versa Retirement product, whichever with the highest available balance at the end of the Campaign Period.

Please note that if the user has closed their PRS account at the time of reward crediting, campaign rewards will be credited to their Versa Save product (Versa Save Shariah Compliant being the default), whichever with the highest available balance.

Eligible Versa Products

Below are the only eligible Versa Retirement products you can auto debit into to earn the booster rates:

✅ PRS Growth

✅ PRS Growth‑i

✅ PRS Moderate

✅ PRS Moderate‑i

✅ PRS Conservative

✅ PRS Conservative‑i

Ready to boost your retirement?

📲 Join the Retirement Booster Quest 2026 in the Versa app today

🔁 Set up your auto debit

💸 Earn 2%* cashback every month.

*All campaigns are subject to Versa’s Platform Terms and Conditions.

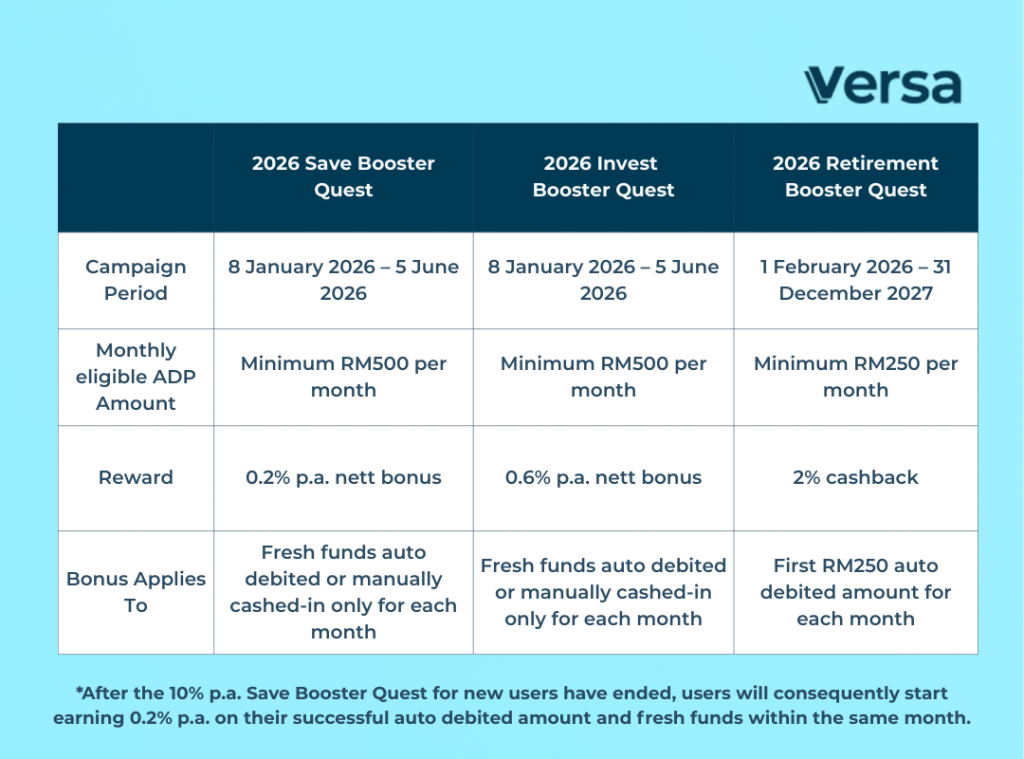

Looking for more rewards? Check out our Latest Auto Debit Quests!

Frequently Asked Questions

1. Can I only manually cash into Versa Retirement products every month instead?

No, manual cash-ins to Versa Retirement products do not make you eligible to enjoy the promotional cashback.

2. Can I auto debit more than RM250 in Versa Retirement?

Yes, you can auto debit more than RM250 every month.

However, the 2%* monthly cashback is calculated only on the eligible amount, which is capped at RM250 per month.

That means:

- Auto debit RM250 → Earn 2%* cashback

- Auto debit RM500 or RM1,000 → Cashback still applies only on the first RM250

You’re welcome to invest more for your retirement, just note that the maximum monthly cashback applies only on the first RM250 auto debited amount.

3. Are Versa Quests’ rewards before or after fees?

All stackable return rates shown in the app are not subjected to Management Fees or Trustee Fees. However, the base nett return rates displayed are after fees, meaning the nett returns you receive each month is after the deduction of these fees.

4. Will I be eligible for this quest, if I have previously cashed out from my PRS account in Versa?

No, you are not eligible for the 2% monthly cashback reward, as this promo is limited to users who have not made any prior cash-outs from any PRS products via Versa in 2025.

5. What happens when my bank account balance is less than the amount set in my Auto Debit plan?

All Auto Debit transactions will automatically fail, and hence for that month, you will not be eligible for the booster rewards. Therefore, we encourage you to ensure that your bank account balance is higher than the total amount of your auto debit plan.

6. What happens if the name on my Versa account doesn’t match the name on my bank account?

All Auto Debit transactions will automatically fail, and hence for that month, you will not be eligible for the nett booster rate. Therefore, we encourage you to ensure that you use a bank account registered to your name to sign up for Versa’s auto debit.

Join the Retirement Booster Quest today!

Should you have any questions, please do not hesitate to reach out to us here.