Retirement planning can be daunting, but there’s no need to worry! We’re here to introduce you to a tool that can help you build your nest egg: Private Retirement Scheme (PRS). This scheme offers Malaysians a unique chance to invest for retirement while benefiting from tax reliefs and potentially higher investment returns.

Let’s begin with the tax benefits. When you contribute to PRS, you can claim tax relief of up to RM3,000 per year. This means you can save up to RM900 when you file your taxes next year, resulting in more money in your pocket and a more substantial retirement fund. It’s a win-win situation! By taking advantage of this tax relief, you can save on taxes while building up your nest egg.

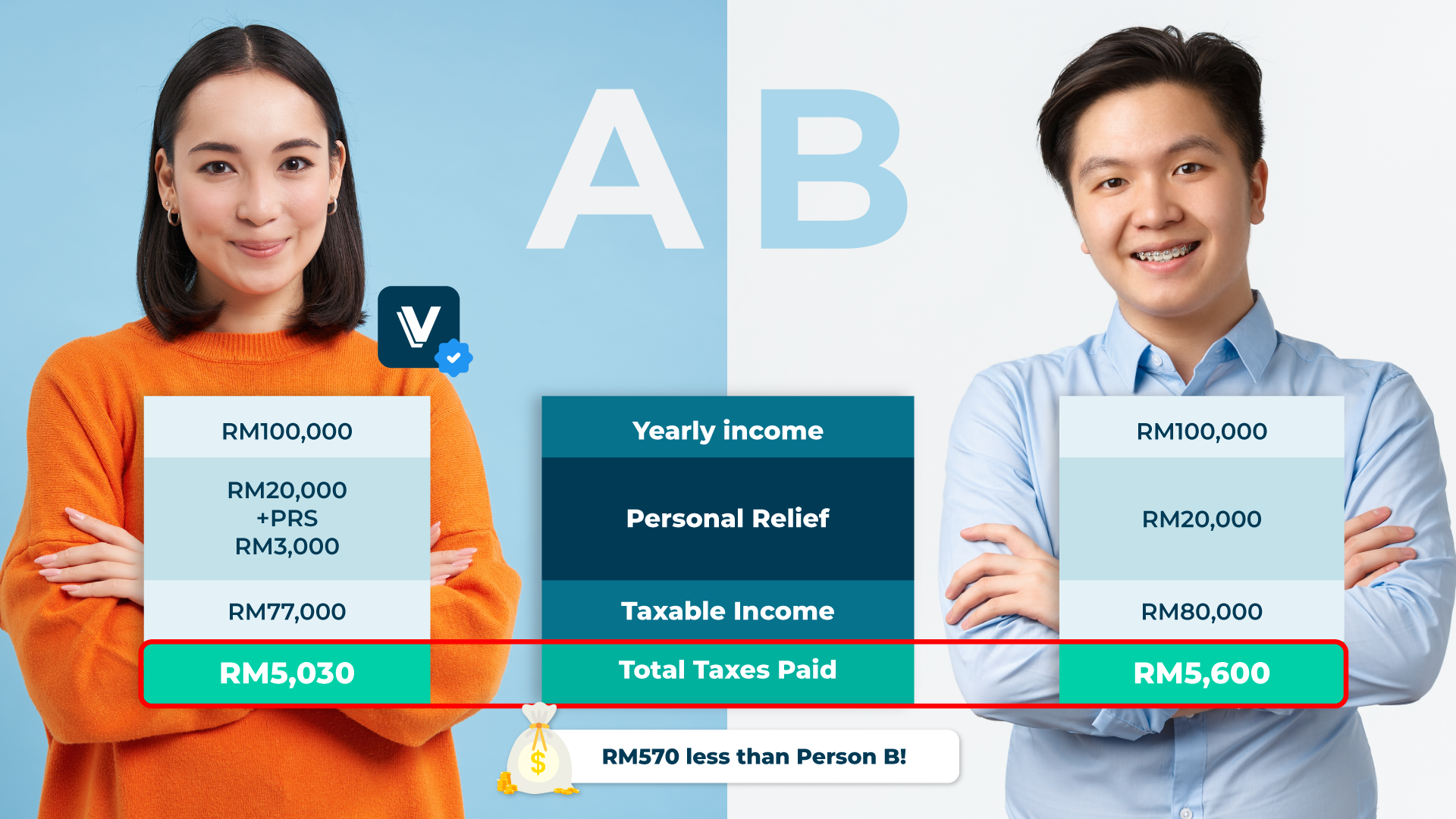

How Much Tax Savings Will I Really Get?

Now picture this: Person A and Person B both earn RM100k a year and have similar expenses, like lifestyle and insurance, totaling RM20k. So, their taxable income is RM80k (RM100k – RM20k).

But here’s the kicker: Person A decided to invest 3,000 RM in PRS, which lowers their taxable income to RM77k (RM80k – RM3k).

Now, let’s talk taxes:

– Person B paid RM5,600 in taxes for the year.

– Person A, thanks to the PRS investment, only paid RM5,030 in taxes!

That’s a cool RM570 in savings for Person A, and they can get it back from the government in April. It’s like an instant 19% return on their RM3,000 investment! 💰📊

But that’s not all! PRS also offers investment flexibility, allowing you to choose from a wide range of funds that cater to your risk appetite. This freedom enables you to decide which funds align with your risk tolerance and investment goals, diversifying your portfolio and potentially enjoying higher returns on your investments. So, while you’re saving for retirement, your money has the potential to grow!

Furthermore, PRS emphasises long-term retirement planning, not just making contributions. By consistently contributing to PRS and staying invested, you’ll be on the path to building a substantial retirement fund.

In summary, the Private Retirement Scheme (PRS) provides Malaysians with a great opportunity to plan for retirement while enjoying tax benefits and potential investment growth. By taking advantage of this tax relief, diversifying your investment options, and committing to long-term savings, you can pave the way for a financially secure retirement.