We can’t deny that the global pandemic has changed our lives while giving us a cold dose of reality on how we handle our money.

Due to Movement Control Order (MCO), many people have started to spend more money on food, buying groceries and shopping via mobile apps such as FoodPanda, Shopee and Grab.

The problem is that with modern payment technology such as Financial Process Exchange (FPX), shopping has become a click away. So, although it is convenient, it also leads us to mindless saving habits.

Therefore, this is where the Kakeibo method can help you!

What is Japanese Kakeibo Saving Method?

A long long time ago, Kakeibo was created by a Japanese journalist named Hani Motoko back in 1904. Kakeibo is used as an accounting system for housewives in organising their finances. This way, they can have a lifestyle aligned with their budget.

Derived from a Japanese term meaning “household financial ledger”, basically, a Kakeibo offers an easy and effective solution to mindless spending habits through keeping a physical journal for budgeting. It’s simply a notebook where you keep track of your income and expenses. You’d be surprised at how much this simple act can improve your relationship with money!

Kakeibo Saving Method to Curb Impulsive Spending Habits

Kakeibo works by combining both tracking purchases and habits of mindfulness to help you save more and curb unnecessary spending. Honestly, it’s a simple system that asks users four questions:

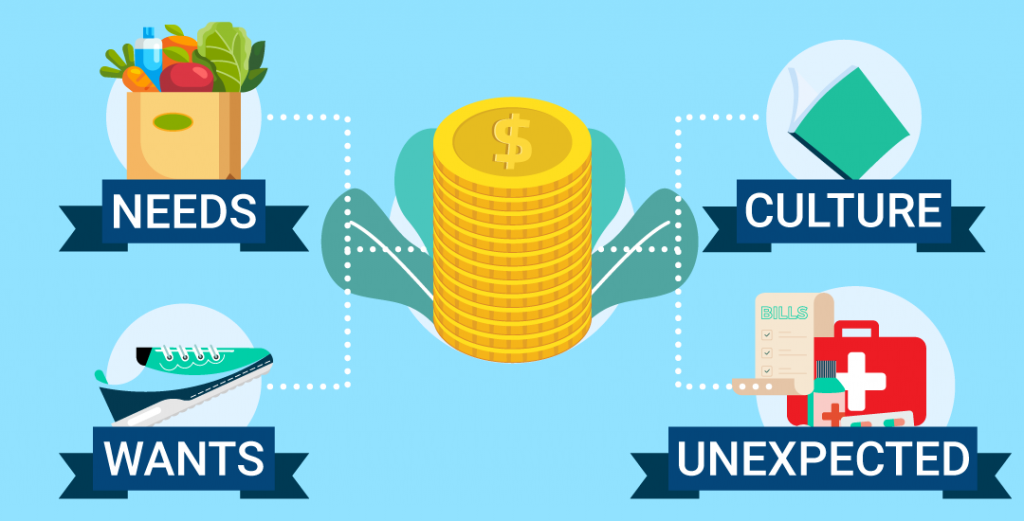

And then, you are to write down everything you buy and streamline your budget by grouping purchases into four “pillars” or categories:

Needs.The essential items you can’t live without like food, toilet paper and shampoo.

Wants. Purchases you enjoy but don’t need like takeout food, buying a new pair of shoes and entertainment.

Culture. Any expenditure on cultural activities such as books and museum fees.

Unexpected. Other expenses that arise unexpectedly like medical bills or car repairs.

With this, the four category system helps kakeibo users learn to become more mindful of their spending habits and avoid wasting money on things that don’t align with their goals.

How to Practice Kakeibo Budgeting System?

If you want to learn how to use Kakeibo, grab your pen and paper now or simply download Kakeibo from the app store! Here’s how to get started:

Step 1: Write down your total income for the month and deduct any fixed expenses (rent, bill, etc.)

Step 2: Deduct the amount you wish to save this month from the total (put it aside!)

Step 3: Divide the remaining figure by the number of weeks until payday to give you a weekly sum. Log your expenses.

Step 4: Review your spending to see where improvements can be made.

That’s it! Easy Peasy!

Grow Your Money with Kakeibo, The Japanese Art of Saving

Now that you know about the Kakeibo Method in managing your finances with these little savings you have in hand, you now have the opportunity to grow your savings. Additionally, if you put your savings in a digital cash management tool like Versa , you get to earn monthly returns. There is no minimum deposit, so even if your savings amount may be small for that month, you can still put in your money and earn interest. This is a great way to cultivate the habit of saving money and to get a reward while you’re at it. Fret not, you can withdraw your money whenever you want with no penalties, and you will still earn interest based on the duration your money was kept in Versa.