No matter how prepared you think you are, life has its way of throwing things at you without warning. There’s no telling what and when things will happen.

What if your car suddenly breaks down?

What if you get an unexpected medical bill?

Or worse, what if you lose your only source of income?

These are all things that can happen to anyone. This is where an emergency fund can come in handy.

What is an Emergency Fund?

An emergency fund is a stash of money you set aside for any unexpected situations in the future like injury, illness, job loss, etc. As you can already tell, these emergencies can be very expensive.

The problem is many Malaysians do not have enough savings let alone an emergency fund. 53% of Malaysians do not have enough savings to last them more than 3 months!

It was not until the pandemic that we realized the importance of an emergency fund

COVID-19 has taught us that firstly, anything can happen. And secondly, an emergency fund is no longer optional; it is a necessity. As pay cuts and job losses happened, interest rates hit an all-time low – it was clear that having extra cash was extremely important.

While some of us are fortunate enough that our financial situations have not been heavily affected by the pandemic, many of us have had to deal with unfortunate situations like pay cuts, job losses, or hefty medical bills.

There’s no way to tell when a pandemic or recession like this will happen again.

Why should you start an emergency fund?

There are a few other common situations where your emergency funds can help you:

You are self-employed or a contractor

If you are self-employed or an independent contractor, there are times when your business might be slow or your income is unstable. There are also times when payment is delayed and you have to chase your clients for payment. It is important to have some extra cash to help you during those times.

Home repairs

Now that many of us stay in more often and even work from home, our house must remain in good condition.

With electrical appliances like air-conditioning being used excessively, you never know when they might break down. Repairs can cost up to a thousand ringgit so it’s good to save for these expenses before they happen.

Electronic repairs

It is safe to say that electronic devices like our phones and laptops are essential in our lives. We use them daily whether it’s for work, leisure, or both.

Let’s say you run into a situation where your laptop isn’t working. To make it worse, you have a deadline to meet in a few days. Oftentimes the cost of repairing a laptop can cost as much as buying a new laptop. You have to replace your laptop or get it fixed; either way both choices are expensive.

If you had an emergency fund, you could pay it without worrying too much. But without one, you might have to take out money from your savings.

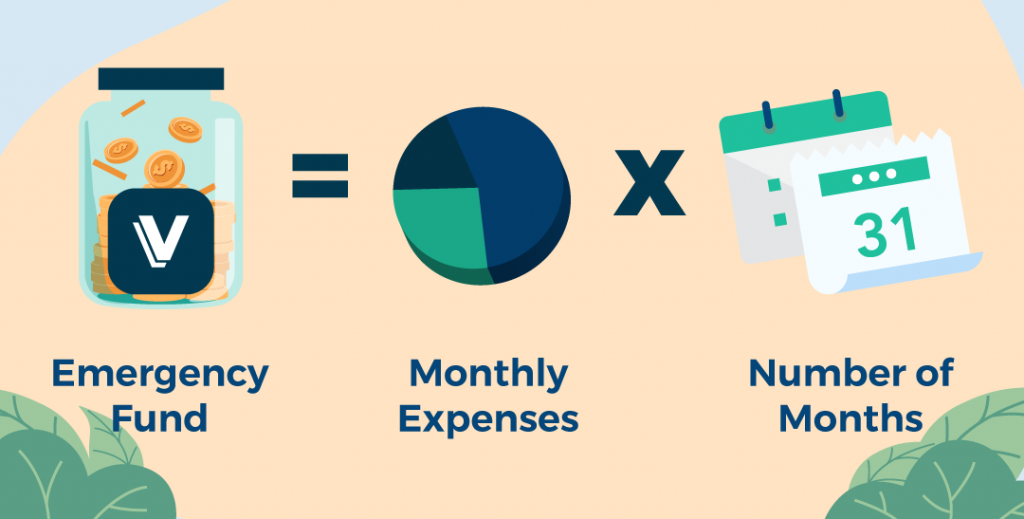

How much cash should you put in your emergency fund?

Typically, your emergency fund should cover at least 3-6 months of expenses. First, calculate your monthly expenses. These are bills that you have to pay (mortgage, car loan, utilities).

Then, multiply that amount by the number of months. That’s your emergency fund target amount.

Your emergency fund needs to be liquid, which means that you can withdraw your money anytime.

A fixed deposit is not an option as your money is locked in. A savings account could work as you can take out your money anytime. But, you get little to no interest.

Where is a good place to keep and grow your emergency fund?

Consider putting your emergency fund in a digital cash management platform like Versa. Versa allows you to withdraw your money anytime with no penalties! This is great for when you face an emergency and need cash immediately.

If you’re still thinking, what’s the point of putting money to let it sit there and do nothing?

That won’t happen! When you put your money in Versa, you earn monthly returns based on your balance! You’ll be able to see your balance grow live! A bonus for those of you who need the motivation to put your money in your emergency fund!

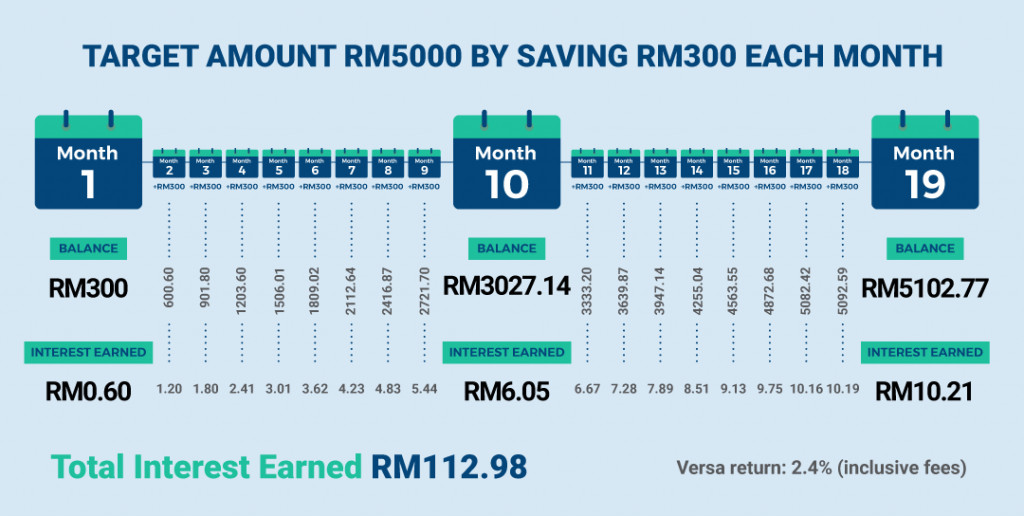

Let’s say your emergency fund target amount is RM 5,000 and you save RM 300 each month. Here’s a quick rundown of how much you earn with Versa:

It will take you approximately 1.5 years to reach your goal and you get to earn interest while you’re at it!

Overall, an emergency fund is a great safety net for any bumps you face along the way. It can also help you save money and become better at spending intentionally! Furthermore, if you put your money in a place like Versa, you’ll be able to reap the benefits.

*Annual fund returns as of 2022