As parents, all we want is what’s best for our child. One way to set them up for the life of their dreams is by giving them quality education.

They say education is an investment in your child’s future, but from preschool all the way to university, it can take a big chunk out of your savings.

Between public and private schools, local colleges and universities abroad, do you know how much you will need to fund your little one’s education? Let’s find out!

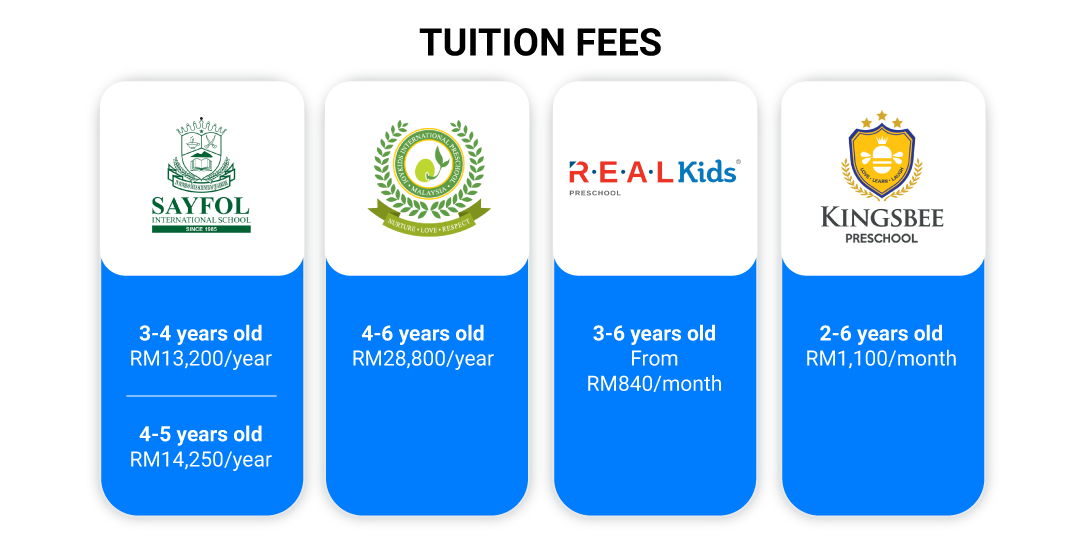

Preschool

While not compulsory, many children in Malaysia start preschool at four years old. Public preschools are provided free or at lower cost while fees for private preschools can vary, depending on factors such as the curriculum and facilities.

To get an idea of how much they can cost, let’s take a look at the tuition fees of a few private preschools:

Let’s say you decide to send your child to Sayfol International School. Looking at the current tuition fees, you will need to spend around RM27,450 (RM13,200+RM14,250) for the two years of preschool.

Keep in mind that while tuition fees will form the bulk of your education expenses, there will be extra costs for uniforms, registration, field trips, and more. These should be considered when planning your funds.

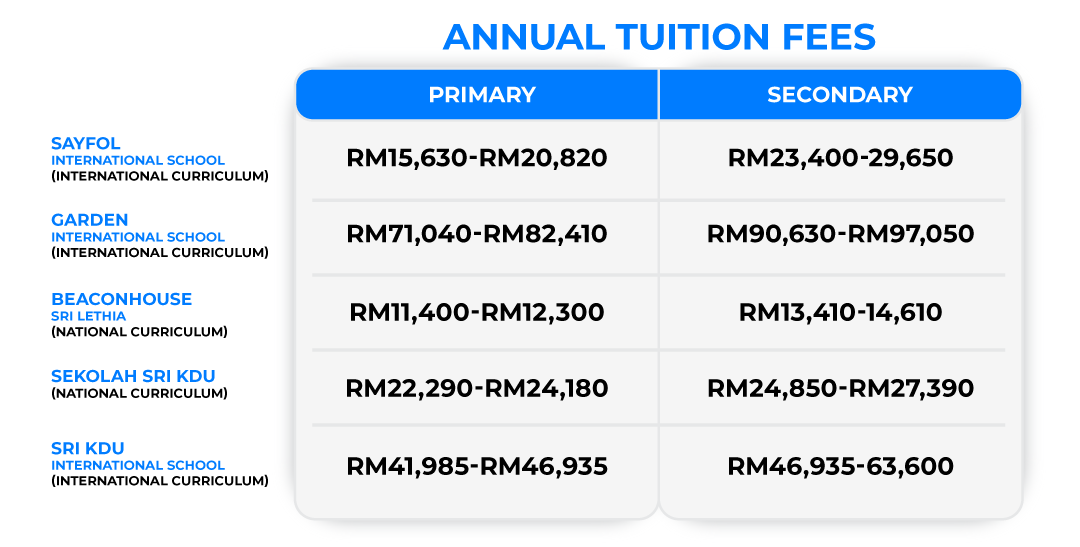

Primary and Secondary School

The primary and secondary school years make up the biggest chapter of your child’s academic journey.

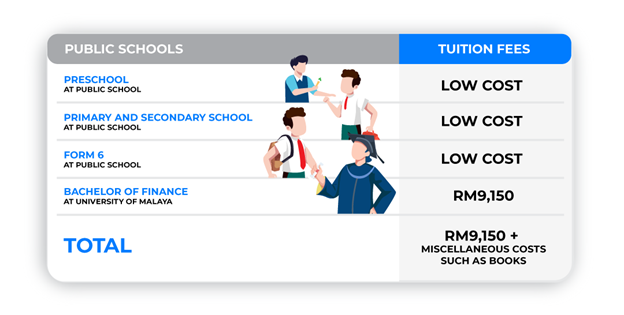

At this crucial stage, Malaysians can choose to enter the public or private school system. Public schools are funded by the Malaysian government and are free, except for miscellaneous costs such as for books.

For parents of means, private and international schools have become increasingly popular. Private schools follow the Malaysian National Curriculum while international schools follow international curricula, such as those from the UK and America. Some schools in Malaysia are both private and international.

Here are the tuition fees of five schools:

As you can see, fees vary widely from school to school. Within a chosen school, fees can also vary from year to year. Fees for a Year 1 student will be lower than for one in Year 11.

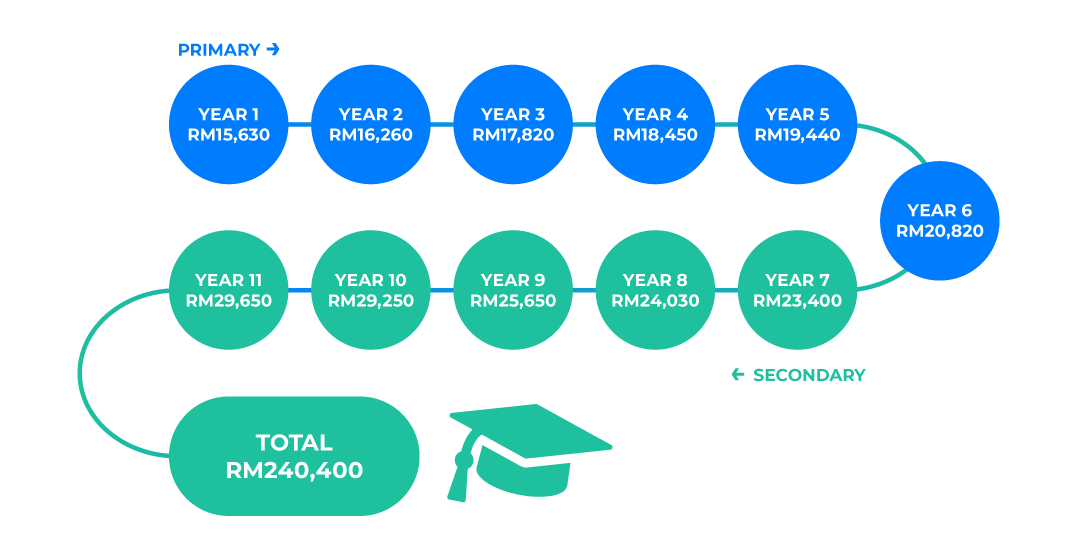

Here’s the breakdown of fees for Sayfol International School:

Remember our example from the preschool years? Let’s build on that scenario and imagine that so far, you’ve spent RM27,450 on your child’s pre-school education at Sayfol for 2 years. If you decide to have your child stay in this school throughout their primary and secondary years, your total tuition fees will come up to RM267,850 (RM27,450+RM240,400).

The only step left now is sending your child to university.

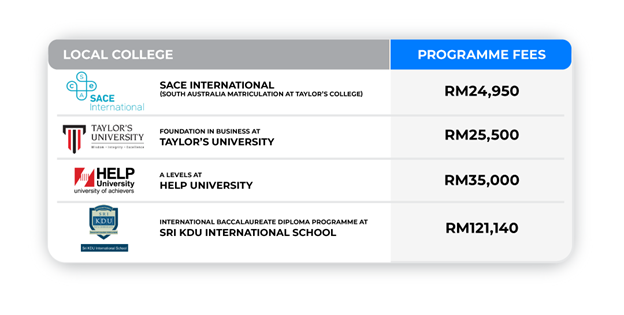

College and University

After graduating from secondary school, your child will be greeted by a world of possibilities.

But before jumping into a degree, they will need to take a pre-university course for one to two years. At this level, students have several options, including the free Form Six programme, the A Levels programme, and the International Baccalaureate Diploma Programme.

Here are some of the programmes available in local colleges and their fees:

Continuing with our scenario from before, you’ve spent RM267,850 so far on your child’s education from preschool to secondary school. It’s been quite a journey, hasn’t it? Now, say your child pursues the SACE International programme with hopes of furthering their studies in Australia. This will bring your expenses to RM292,800 (RM267,850+RM24,950).

Moving on to the last stop before your child enters the workforce, let’s talk universities! Malaysian students can choose from local public universities, private universities, and universities abroad. Local public universities are the most affordable but competition for spots can be tough. As for private universities, you can opt for local private universities or the pricier foreign institutions with a local campus.

With the exchange rate and higher cost of living overseas, studying abroad is the most expensive way to go, potentially costing over a million ringgit. Many universities overseas also charge international students higher tuition fees.

Another popular and more affordable option is the twinning programme where students can split their time studying locally as well as overseas with a partner campus.

There are many options out there and ultimately, the choice is yours – well, yours and your now-not-so-little-one’s.

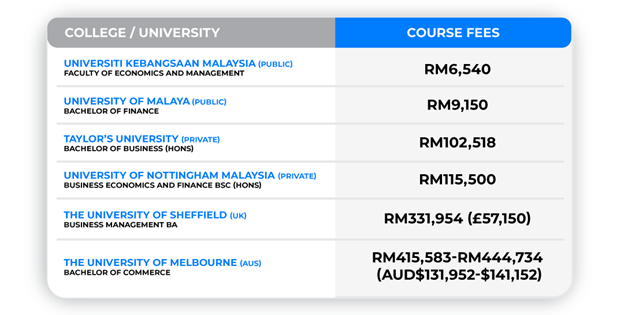

Let’s take a look at the fees of some business and economics-related undergraduate courses:

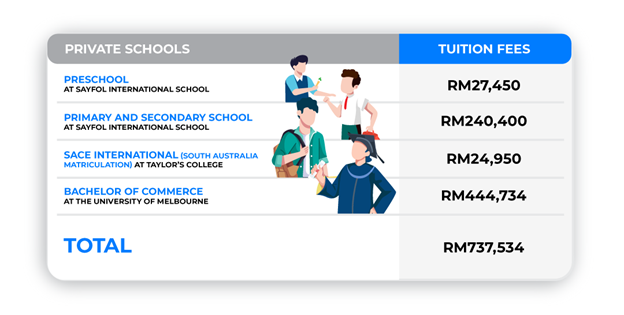

Going back to our scenario one last time, you’ve spent RM292,800 this far on your child’s education, yes? They are now ready to go out into the world and pursue a Bachelor of Commerce at the University of Melbourne! With an estimated fee of up to RM444,734 for the course, all in all, the total amount you will need for your child’s tuition fees can come up to RM737,534.

Here’s a little recap:

While this number is merely an example and tuition fees can differ greatly from school to school, what we can be sure of is that the fees will rise as the years go by.

The Best Thing You Can Do Is Start Saving Now

Taking inflation into consideration, it’s a good idea to start growing an education fund as soon as you decide to grow your family.

Remember, the earlier you start, the more you can earn from compound interests and the more choices you and your child can have.

If you’d like to get started today, one easy way is to sign up for Versa, a digital cash management platform offered in partnership with AHAM Capital Asset Management. By investing in money market funds, Versa gives you the right balance of higher interest rates and withdrawal of T+1 with no lock-in period. Find out more here.

Note: All tuition fees detailed in this article are based on research as of the time of writing and may not reflect current pricing. In some cases, prices are estimates only.