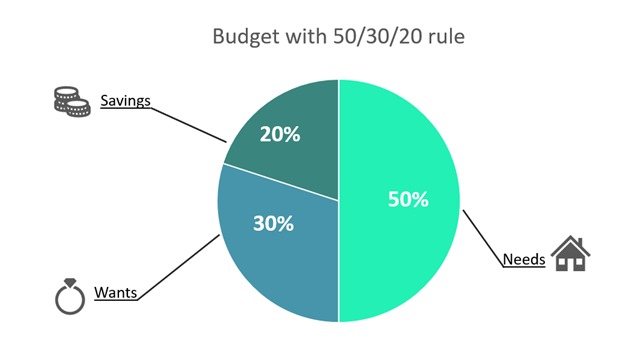

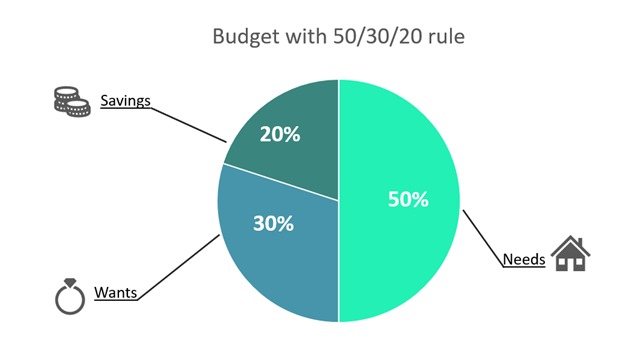

Real talk, everyone needs to budget. From the extravagantly rich to the poor, if you have income + needs, then you should learn to budget. Then again, how should you budget? There are countless tips and tricks out there available if you wanted to learn. However, right here today, we’re going to talk about the 50/30/20 rule.

Popularised by Senator Elizabeth Warren in her book, All Your Worth: The Ultimate Lifetime Money Plan. This rule basically helps you divvy up your after-tax/deductions income and allocate spending according to;

- 50% – Needs

- 30% – Wants

- 20% – Savings

In this article, we’ll take you through the motions of how to do this correctly and effectively, so you will be a budget pro in no time!

Let’s break it down.

Budgeting for Needs – 50%

If you are doing life right, then you’re probably aware of what constitutes a need for your daily routine. If it’s still a little unclear, needs are expenses you cannot run away from. Some examples include utilities, loans, insurance, etc.

These are long-term consistent expenses that you need to always make payments for on time every time, with no compromises.

The goal is to get the needs to take up not more than 50% of your income after tax. Here’s an example:

Your Income: RM 6,000

Income After Tax: RM 5,340 (-11% EPF)

50% for needs: RM 2,670 (total/2)

So your needs need to amount to RM2,670 or less. Of course, this is an ideal situation. More often than not, you have more expenses for needs than this amount.

Solution? Reduce expenditure. Look for lower premium insurance plans, or a cheaper car or home. Take the concept of living within your needs to a whole new level.

Budgeting for Wants – 30%

You guessed it! Wants are the other things that take up our expense chart. Netflix, food delivery, bubble tea, your gym membership, a staycation budget, all of these things fall into the wants category.

So following the income from earlier…

Your Income: RM 6,000

Income After Tax: RM 5,340

30% Wants: RM 1,602

Go ahead, check your receipts and transactions from last month, did you overspend? If no, great you have more wiggle room. If you did, find places to cut costs. Maybe limit yourself to the one bubble tea a week, it’s healthier, trust us.

Budgeting for Savings – 20%

Now, this 20% for savings is super important. If you find wiggle room in the wants and needs category, please do not look for a loophole in the savings. It’s important.

Following our earlier example:

Your Income: RM 6,000

Income After Tax: RM 5,340

20% Savings: RM 1,068

This amount of 20% is what you will need to put away, in a place far away from your shopaholic tendencies and spending habits. Either transfer it to a separate savings account or maybe to a short-term FD that you can top up every month. Better yet, use Versa.

Versa lets you save and earn. It’s flexible enough that you can access your savings anytime, in case of an emergency. The upside is, you get to grow your savings effectively with minimal effort.

Conclusion

The 50/30/20 rule is a super simple, very easy way to budget, especially for young earners new to employment. It can be harder to follow if you have more commitments, children or if you have heavy debts to pay. In any case, breaking down your spending will help you see how much and where you can improve your financial status.

We hope you found this guide helpful and you’re now one step closer to being a personal finance pro.