Kickstart Your 2026 Healthy Financial Habit!

Welcome to Versa! If you sign up between1 January and 31 January 2026, Versa will help you build strong money habits right from the start of the year. By participating in this quest, you can earnup to 4%* p.a. fixed promotional rates on your fresh funds, and you can boost your earnings to 10%* p.a. when you save every month.

Qualifying Period:

1 January 2026 – 31 January 2026

Note: Please also refer to the Eligibility Period section below.

For new Versa joiners in February 2026, please refer to this Campaign Page.

Who’s Eligible

- New users who create a Versa account between 1 January – 31 January 2026

- Verified accounts only

Note: This is a promotional campaign sponsored by Versa. The promotional rate and bonus rate do not reflect the past nor current performance of the product.

How Does The 2026 Versa Starter Quests Work?

The 2026 Versa Starter Quest is intended to reward users who start their 2026 fresh with Versa. It is important to note that there will be a three-month rewarding period, which starts from the month you create your account, not the month you first cash-in.

The rewards are divided into two parts:

Quest 1:

The 2026 Welcome Quest

Firstly, with the 2026 Welcome Quest, you can earn a promotional rate of up to 4%* p.a. by cashing in any Versa Save products, either during onboarding with your first cash-in or through a subsequent cash-in into Versa Save after your account is verified – as long as your cash in is made during the Eligibility Period (defined below).

This promo rate applies to fresh funds up to a maximum of RM10,000. Below are the respective promo rate, depending on the product you choose:

| Product | Promo Rate | Max Cap |

| Versa Save Conventional | 4%* p.a. | RM10,000 |

| Versa Save Shariah Compliant | 3.7%* p.a. | RM10,000 |

If you choose the Versa Save Conventional product, you are eligible for a fixed promotional rate of 4%* p.a., whereas if you select the Versa Save Shariah Compliant product, you can earn a fixed promotional rate of 3.7%* p.a.

Quest 2:

The Auto-Debit Bonus Rate via 10% p.a. Save Booster Quest

After your Versa account gets approved, you become eligible to set up auto-debits in your Versa account. By setting up a monthly auto-debit of RM500 or more into any Versa Save product (or combination thereof!), you will earn a 10%* p.a. bonus on the said RM500 auto-debit amount.

This 10%* p.a bonus begins from the month of your first auto-debit transaction and continues until the end of your Eligibility Period (defined below). It is essential to maintain your auto-debit plan each month to continue earning this bonus.

Here’s a summary of the the Eligibility Period

| Account Creation Month | Eligible Reward Month for 4%* p.a. Welcome Promo Rate | Eligible Reward Month for 10%* p.a. Auto-Debit Promo Rate |

| January 2026 | January – March 2026 | 3-month period starting from the first deduction of the auto debit plan* made before the cut-off date. *Final cut-off date: 26 March 2026 |

Campaign Mechanics and Rewards*

- Step 1: Download the Versa app & create your new account between the campaign period (1 January -31 January 2026).

- Step 2: Complete your Versa profile and account verification.

- Step 3: Choose a product under Versa Save for your first cash-in. This step is essential to become eligible for the Welcome Quest Promo Rates.

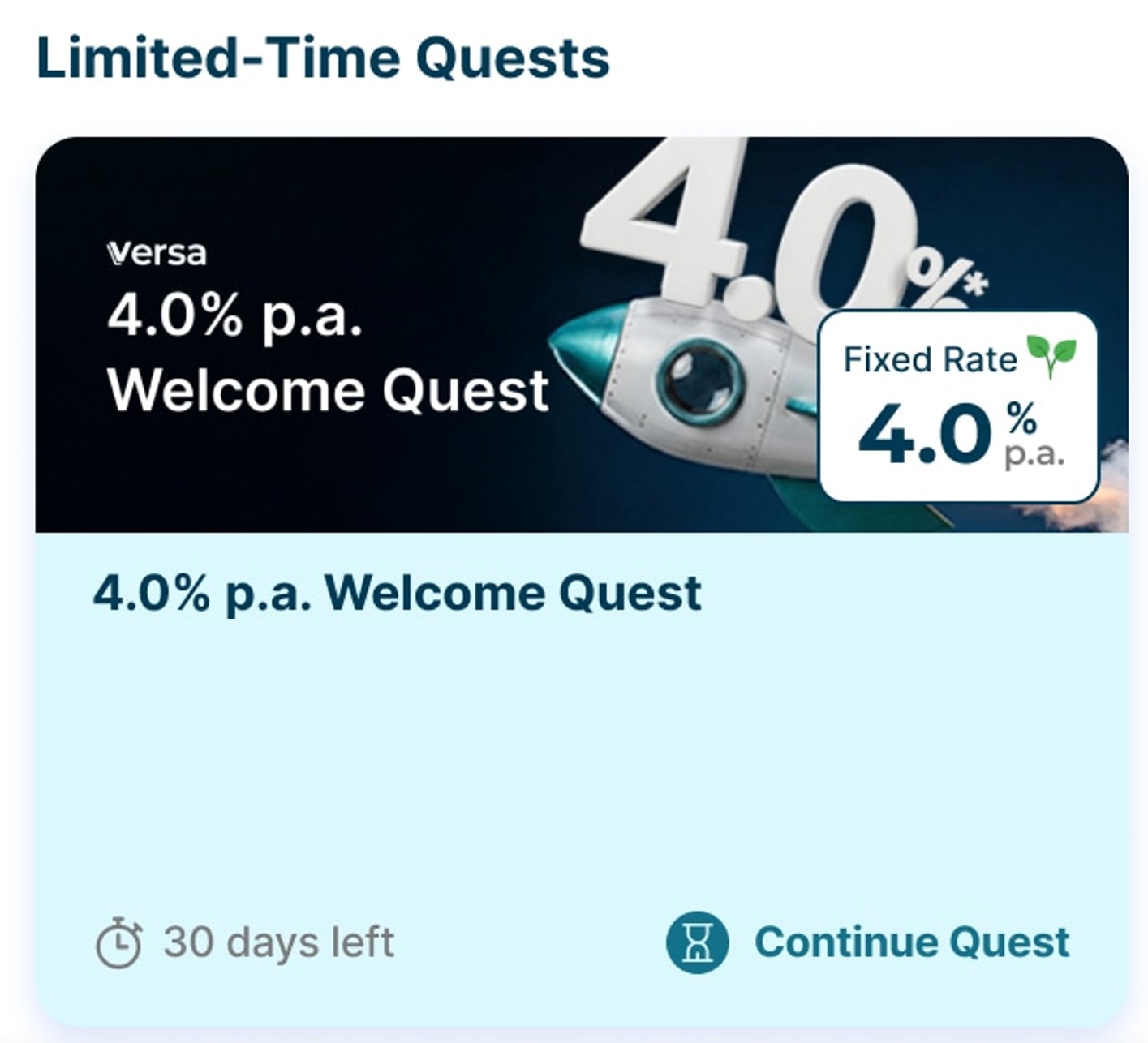

💡 Tip: You can cash in a total of up to RM10,000 to maximise your earnings. Make sure your cash-in is reflected in your account balance! - Step 4: Check your progress for ‘Welcome Quest’ under the ‘Quests’ tab in your Versa app.

- Step 5: Earn the fixed promo rate (4%* p.a. or 3.7%* p.a.) on your Versa Save balance.

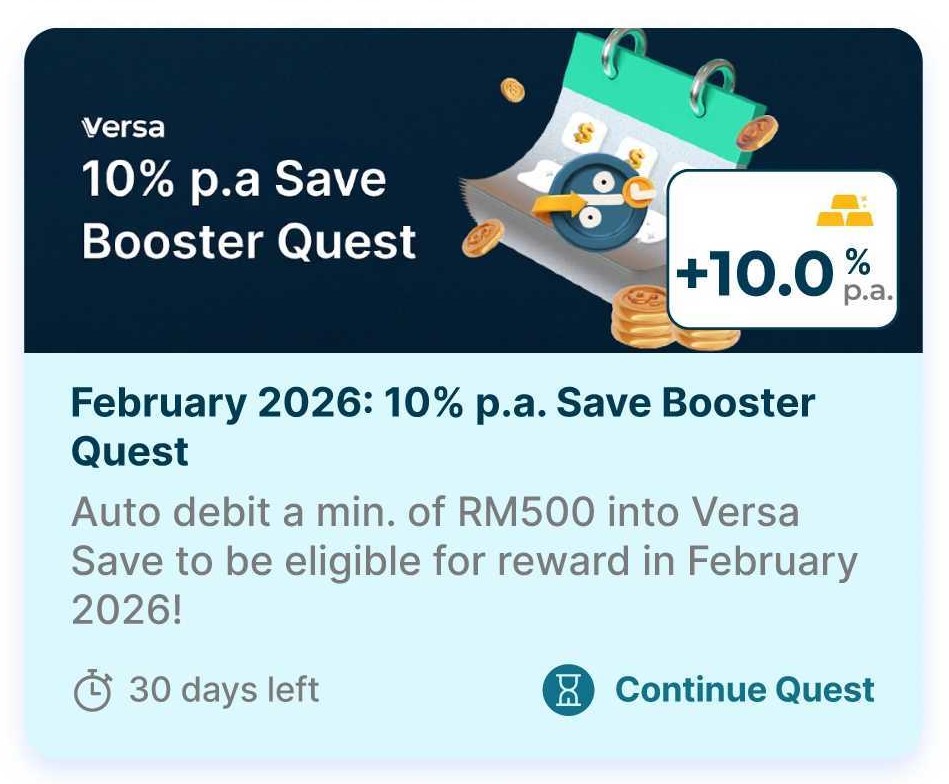

- Step 6: During the Eligibility Period, set up a monthly auto-debit of RM500 or more into any Versa Save products via the Save Booster Quest under the ‘Quests’ tab. The 10%* p.a. Bonus is applicable on the first RM500 auto-debit amount.

- Step 7: Maintain your auto-debits every month during the Eligibility Period to keep earning the 10%* p.a. bonus on the auto debited fresh funds.

- Step 8: Be the first 25,000 users to fulfil the above mechanics to enjoy the rewards!

Rewarding Period & Details

Welcome Quest Promo Rates:

- The rewarding period rolls for 3 months from the date of account creation until the last day of the 3rd month.

- The promo rate applies on fresh funds cashed in up to RM10,000 within that 3 months.

- Rewards are calculated on a daily pro-rated basis.

- Rewards will be credited at 30 days after the end of the Eligibility Period.

Note: Remember, your fresh funds must remain in the eligible account to receive the reward. If you cash out (withdraw) or switch out all the fresh funds from the product at the end of the 3-month period, all the eligible rewards will be voided.

Auto Debit Bonus via Save Booster Quest:

- The 10%* p.a. bonus will be credited to your highest balance Versa Save portfolio within 30 business days after the auto debit transaction has occurred each month.

- This promo rate will run for a maximum of 3 consecutive months (based on your Eligibility Period) inclusive of the first auto debit transaction month.

- This rate applies only to the RM500 auto debit amount.

- The reward will be credited as long as your auto debit transaction during the Eligibility Period is successful.

Note: Pausing or deleting auto debit plans will pause this 10%* p.a. bonus.

The Eligibility Period for the Auto-Debit Promo Rate is calculated when your auto debit plan is successfully created. Final cut-off date to create an Auto Debit plan will be 26 March 2026.

Click here to view the scenario-based examples for this Campaign.

*All campaigns are subject to Versa’s Platform Terms and Conditions. Versa sponsors the bonus rate as well as the difference between the specified Promo Rate and the base nett returns of your chosen product! Do note, it might take 5 working days or more to ensure your account is verified, given your information is accurate up to your best knowledge.

Frequently Asked Questions (General)

1. How do I find out if I’m eligible for the rewards of Welcome Promo?

On the Versa app, head to the ‘Quest’ page. Select your preferred ‘Welcome Quest’. Check the task status in the ‘Welcome Quest’ page. If all the tasks listed are completed, then you will be eligible for the promo rate.

Notes:

Fresh Funds refer to New cash-ins you make when you sign up. If your new cash-in pushes your balance above that amount, it counts as fresh funds. Simply put, the money you bring into your Versa account from your bank account.

❗Switch ins are not counted as fresh funds, switching out and withdrawal from the products will reduce your fresh fund value.

2. How do I find out if I’m eligible for the rewards of Save Booster Quest?

On the Versa app, head to the ‘Quest’ page. Find ‘Save Booster Quest‘ and check the task status on the page. If all the tasks listed are completed, then you will be eligible for the 10%* p.a. promo rate.

3. Is there any minimum amount of cash in for these Versa Starter Quests?

To join Versa, the minimum cash-in amount required is RM10. You can make minimum cash in of RM10 for Welcome Quests and set up a minimum of RM500 auto-debit amount for Save Booster Quest.

4. Is the campaign open to users who previously had Versa accounts but closed them and are now rejoining?

No, only users creating their first-ever Versa account within the campaign period are eligible for the Welcome Quest rewards.

5. What happens if I cashed in multiple times after onboarding? Does the Welcome Quest Promo Rate apply to all cash-ins or only the first?

The Welcome Promo Rate applies to the total cash-in amount up to RM10,000. Multiple smaller cash-ins can be combined, but the promotional rate will not apply to any amount exceeding RM10,000. Users can earn the base nett return on the exceeding amount.

6. When will I receive my rewards?

You will receive your Welcome Quests reward 30 days after your eligibility period, which varies based on your account creation month (you may refer to your eligibility period in the table above). For the Save Booster Quest, rewards are distributed monthly.

7. Is there a cap to how many users can join the Quests and earn the rewards?

Yes. Both the Welcome Quest and Save Booster Quest are limited to the first 25,000 users who meet all eligibility criteria, or until the campaign reaches RM200,000,000 in total new cash-ins, whichever happens first. This means spots are taken on a strict first-come, first-served basis, so users should join early to secure their eligibility.

8. Are the Welcome Quests stackable with other existing Quests?

Yes, the Welcome Quest can be stacked with other available Quests! Explore other Quests here: https://versa.com.my/stack-and-earn-more-more-than-9-pa-nett-returns-with-versa-quests/

9. What is the latest date to set up a Versa Save Auto Debit plan to enjoy the 10%* p.a. Promo Rate?

To enjoy the 10%* p.a. Promo Rate, you must set up your auto-debit plan successfully by 26 March 2026.

Please note, if you don’t already have an Auto Debit Bank Account, it may take 3–5 working days to successfully set up your plan.

Frequently Asked Questions (Technical)

1. During the Quest period, do switches count as part of Fresh Funds?

Nope! Switch ins to the eligible portfolio are just moving your money between funds in Versa, so they don’t count as fresh funds for this Quest. However, any switch outs will reduce the fresh funds amount.

2. I just completed my cash-in but why isn’t my task marked completed yet?

Task progress is updated after your unit purchase is confirmed, which usually is T+ 2 business days. You will be eligible for the Campaign Reward based on the completed cash-ins made in accordance with the Campaign mechanics!

3. I did not see and tap the “CASH IN NOW” button in the Welcome Quest page. Instead, I went to the fund page and cash-in directly. Am I still eligible for the Quest reward later on?

Yes, you are still eligible as long as you have cashed in the right amount to meet the reward criteria. To verify, please check the task status in the ‘Welcome Quest’ page in the ‘Quest’ tab. If all the tasks listed are completed, then you will be eligible for the Welcome Quest reward.

4. How does the Welcome Quests allow users to enjoy the 4.0%* p.a. and 3.7%* p.a. nett returns?

During the Quest period, the monthly base nett returns of Versa Save (Conventional) and Versa Save (Shariah Compliant) will continue to change based on the performance of the respective products. Versa ensures you are rewarded with the specified promo rate by subsidising the difference between the specified Promo Rate and the monthly base nett returns in these Quests.

5. Can I switch between Conventional and Shariah-compliant products after onboarding? If yes, does that affect the Welcome Promo Rate?

Users can transfer or switch funds between Versa Save products, but doing so will cause the original cash-in amount to lose eligibility for the Welcome Promo Rate, and the new product will not receive the promo rate, because switches are not considered fresh funds. However, if users make a new cash-in from the user’s bank account into a different product under Versa Save within the campaign period (1 January to 31 March 2026), that new cash-in will be eligible for the Welcome Promo Rate for that product, subject to the same limits and conditions as the initial cash-in. To continue earning the promo rate on the initial funds, users are advised to leave their first cash-in in the original product.

6. Are the Welcome Promo Rate and Auto Debit Promo Rate stackable?

Yes, they are fully stackable.

For example, if a user registers and cashes in RM9,000 on 1 January, AHAM will take around T+2* working days to verify the account. The user can then set up an Auto Debit Plan (ADP) once the account is verified. The user will earn the 4%* p.a. Welcome Promo Rate on the RM9,000 from 6 January to 7 February.

After the RM500 auto debit is transacted, the user will continue to earn the same 4%* p.a. Welcome Promo Rate on the new RM9,500 balance from 8 February to 31 March.

At the same time, the RM500 auto debit contribution will also earn the 10%* p.a. Auto Debit Bonus Rate for February. This means the RM500 effectively enjoys both promotional rates, resulting in a combined reward of 14%* p.a. for that period.

7. If I set up multiple auto-debits to different Versa Save products, does each product get its own 3-month rolling bonus?

The 10%* p.a. is applicable to the total auto debit amount of Versa Save (cap at RM500). If a user sets up RM500 Versa Save Conventional auto debit, and another RM500 Versa Save Shariah Compliant auto debit, the 10%* p.a. only applies to first RM500 fresh funds, and the reward goes to the highest balance product in Versa Save.

8. When will my Auto Debit Plan be deducted from my bank account?

Your auto debit amount will be deducted from your bank account on the 5th of every month. For non-Maybank users, the deduction will be on the next working day if the 5th is a holiday or weekend. Funds will be deposited into your Versa fund within 2-3 business days. Maybank users will always be deducted on the 5th. Please refer to table below for specific dates for non-Maybank users.

| User’s Auto Debit Plan Set Up Date | Auto Debit Transaction Cut Off Time | Auto Debit Successful* |

| 1 January 2026 – 26 January 2026 | 27 January 2026, 3pm | 9 February 2026 |

| 27 January 2026 – 24 February 2026 | 25 February 2026, 3pm | 10 March 2026 |

| 25 February 2026 – 26 March 2026 | 27 March 2026, 3pm | 8 April 2026 |

| 27 March 2026 – 23 April 2026 | 24 April 2026, 3pm | 7 May 2026 |

| 24 April 2026 – 25 May 2026 | 26 May 2026, 3pm | 9 June 2026 |

Should you have any questions, please do not hesitate to reach out to us here. 💬