If you’re already using auto-debit to invest, give yourself a pat on the back.

You’ve taken a fantastic step towards securing your financial future by automating your investments – that’s commitment right there!💪

You’re Already Winning with Dollar-Cost Averaging (DCA)!🏆

Think about it: by consistently investing a fixed amount regularly, you’ve been practicing dollar-cost averaging (DCA) like a pro.

This means you’re not trying to time the market (because let’s be honest, who can predict that, right?), but instead, you’re buying units of your chosen investments at different price points over time.⏱️

Here’s a sample scenario with a hypothetical unit price to show how DCA would have helped you earn with RM300 monthly investment.

1. RM300 Monthly Investment:

| Month | Fluctuating Unit Price (RM) | Units Purchased |

| 1 | 1.00 | 300 |

| 2 | 0.90 | 333.33 |

| 3 | 1.15 | 260.87 |

| 4 | 0.95 | 315.79 |

| 5 | 1.20 | 250.00 |

| 6 | 1.05 | 285.71 |

| 7 | 1.30 | 230.77 |

| 8 | 1.10 | 272.73 |

| 9 | 0.98 | 306.12 |

| 10 | 1.25 | 240.00 |

| 11 | 1.02 | 294.12 |

| 12 | 1.18 | 254.24 |

| Total | 3343.78 | |

| Average Cost per Unit: RM3,600 / 3,343.78 units = RM1.077 per unit | ||

- Total Investment: RM300 * 12 = RM3,600

- Final Portfolio Value: 3,343.78 Units * RM1.18 = RM3,945.66

- Potential Earnings: RM3,945.66 – RM3,600 = RM345.66

If you put in RM300 a month into a fund, after a year, based on how the market goes up and down, you’d end up with roughly RM3,945.66.***💰

Note: This is still a simplified example. Real-world investment returns are subject to market volatility and cannot be guaranteed.

But It Ain’t Always The Good Times Right? 😅

There might have been times when your chosen funds didn’t perform as well as you’d hoped.

But that’s also when DCA helps!

When the market dips and the price of your investment units goes down, your regular auto-debit buys you more units for the same amount of money.

Think of it like a sale – you’re getting more bang for your buck! And that’s precisely why seasoned investors often see market downturns as opportunities to buy more.

When the market eventually recovers, and the value of those units increases, you’ll be sitting on even greater potential gains. 📈

It’s the classic “buy low, sell high” strategy in action, made easier with the discipline of auto-debit.

So Why Increase Your Auto-Debit in 2025?📆

Yes, you’ve automated your investments, and yes you’re riding the waves of the market with DCA.

However, thinking about where you want to be financially at the end of 2025, are you confident that your current RM300 monthly investment will keep pace with the increasing living cost and your new financial goals? 🤔

Let’s stop for a minute and visualize!

We’ll assume the same hypothetical unit prices for over 12 months, as used previously for the RM300 calculation.

Here’s a calculation with RM1,000 monthly investments instead.

| Month | Unit Price (RM) | Units Purchased |

| 1 | 1.00 | 1,000 |

| 2 | 0.90 | 1,111.11 |

| 3 | 1.15 | 869.57 |

| 4 | 0.95 | 1,052.63 |

| 5 | 1.20 | 833.33 |

| 6 | 1.05 | 952.38 |

| 7 | 1.30 | 769.23 |

| 8 | 1.10 | 909.09 |

| 9 | 0.98 | 1,020.41 |

| 10 | 1.25 | 800.00 |

| 11 | 1.02 | 908.39 |

| 12 | 1.18 | 847.46 |

| Total | 11,145.40 | |

| Average Cost per Unit: RM12,000 / 11,145.40 units = RM1.077 per unit | ||

- Total Investment: RM1,000 * 12 = RM12,000

- Final Portfolio Value: 11,145.40 Units * RM1.18 = RM13,151.57

- Potential Earnings: RM13,151.57 – RM12,000 = RM1,151.57

Thus, if you put in RM300 a month, after a year, based on how the market goes up and down, you’d end up with roughly RM3,693.66.***💵

But if you increase that to RM1,000 a month, you’d end up with about RM13,151.57 after a year.***📈

So, by increasing your monthly investment, you’re significantly increasing your potential gains. This is because you are buying more units when the price is low. DCA works better with higher investment amounts.***

Note: This is still a simplified example. Real-world investment returns are subject to market volatility and cannot be guaranteed.

Basically you should increase your auto-debit amount NOW because:

1. You Can Buy More When It’s Low

Remember those market dips we talked about? Yup, that’s what’s happening currently in the first half of 2025.

It’s the best time to increase your auto-debit, so you’ll be able to purchase even more units when prices are lower, setting you up for potentially bigger returns when the market bounces back.

But remember! Invest based on your own risk profile.

2. Inflation is Real

With much uncertainty in the world economy right now, the cost of things have been expected to go up this year. This isn’t just us saying but of course backed by analysts.

What RM300 buys you today might not buy you the same amount in the future.

By increasing your auto-debit contributions, you’re essentially ensuring that your investment efforts keep pace with inflation in the long run.

3. You Can Boost Your Rewards

Versa is now offering exciting Booster Quests that reward you for increasing your auto-debit investments.

By increasing your auto-debit amount, you might be able to meet the requirements for higher reward tiers in these quests, giving your returns an extra boost.

It’s like getting bonus points for something you’re already doing!

Versa’s Got Your Back with New Booster Quests!🎯

Yup, you read that right! Versa is making it even more rewarding to boost your investments with their new Booster Quest mechanics.

These quests give you the chance to earn even more on your Versa Save balance just by increasing your auto-debit into various funds in Versa.

Read more about Save Booster Quest here.

Read more about Invest Booster Quest here.

How to Join the Quests and Earn More:

- Head over to the “Quests” section in your Versa app to see the latest available Booster Quests.

- Maintain a minimum balance of RM1,000 in your Versa Cash or Cash-i.

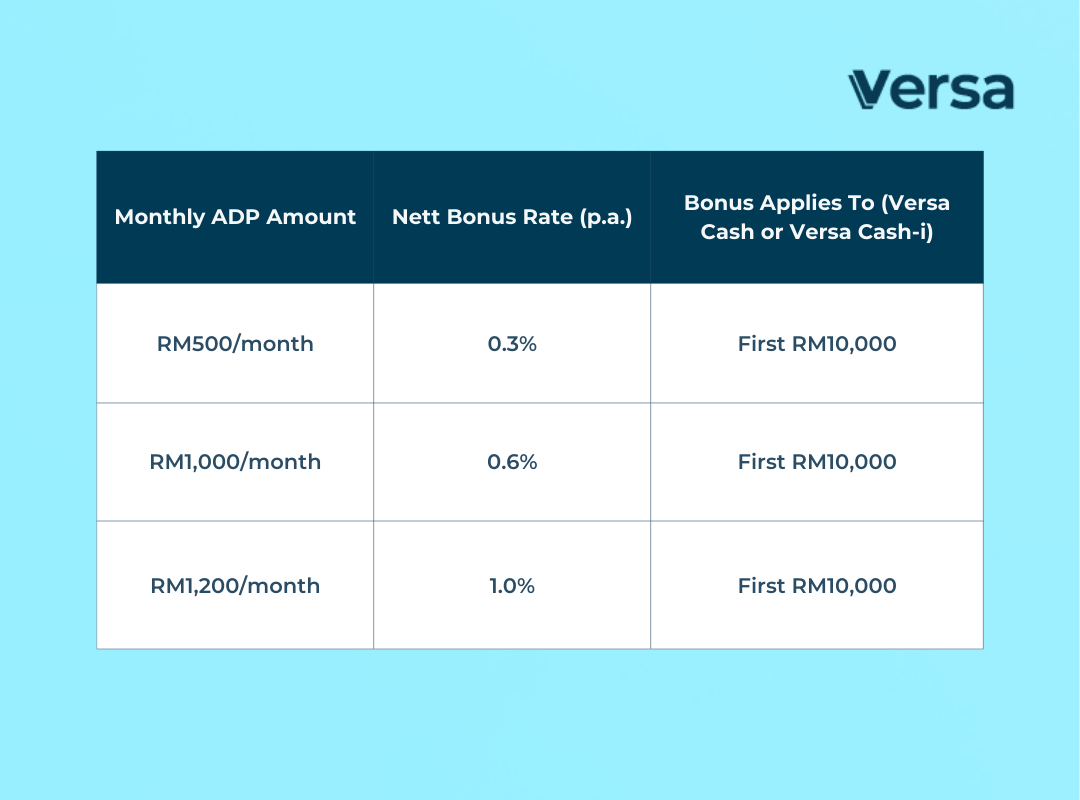

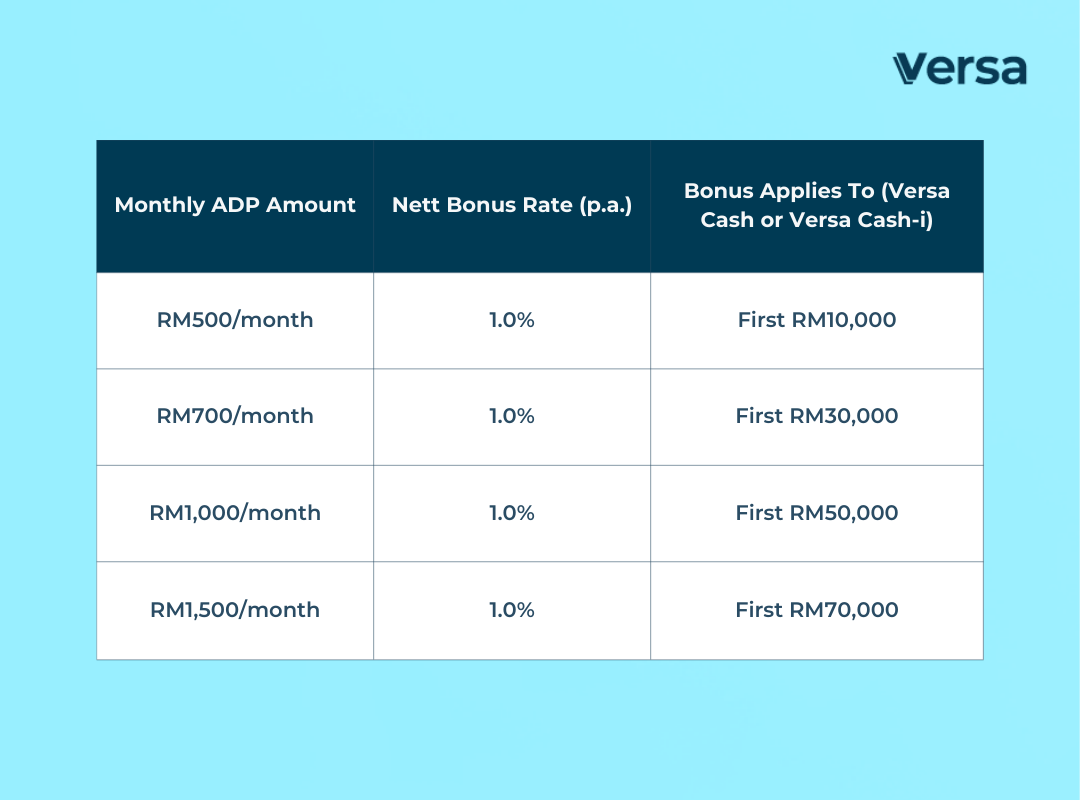

- Increase your auto-debit amount of RM500/ RM1,000/ RM1,200 into Versa Save funds or RM500/ RM700/ RM1,000/ RM1,500 into Versa Invest funds.

- Earn booster returns of +0.3%*/ +0.6%*/ +1.0%* p.a nett on the respective capped Versa Save balance!

New Versa Save Booster Quest Tiers 👇

Read more about Save Booster Quest here

New Versa Invest Booster Quest Tiers 👇

Read more about Invest Booster Quest here

So, take a look at your current financial situation and see if you can comfortably increase your auto-debit investment amount.

It might just be the smartest financial move you make in 2025! 💡

Head over to your Versa app today, explore the Booster Quests, and start earning more rewards while building a brighter financial future. You’ve got this!

Find out more about Versa Save Booster Quest here, Versa Invest Booster Quest here and Versa Retirement Booster Quest here.

*T&Cs apply.

**Past performance is not indicative of future results. Please make sure to always read the fund details before investing.

***Figures and calculations provided are for example/illustrative purposes only and do not reflect the real performance of any fund.