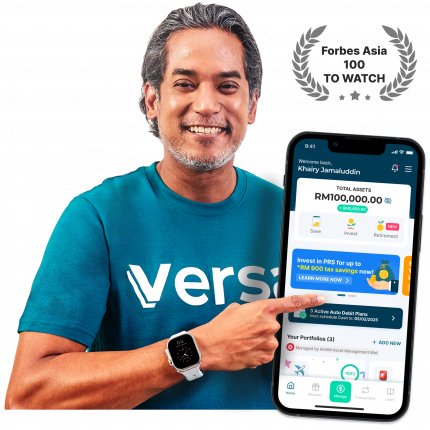

3 reasons to build wealth the Versa way

Gamifying wealth management via Versa Quest

Participate in fun and rewarding Quests. Stack up to 9% p.a. in bonus returns and hit your wealth goals at record speed.

No sales charge, more in your pocket

With Versa, thee’s no upfront sales fee, so more of your money works for you from day one.

Tools to Automate your short and long term goals

Experience investing on autopilot, building wealth bit by bit through our auto debit programs

All products are managed by our trusted partner

Founded in 2001, AHAM Asset Management Berhad is Malaysia’s top 3 independently-managed, institutionally-owned asset management firm.

Meet the experts behind the mission

“Our partnership with Versa will provide a solution for investors to diversify their investments and maximise the potential of their cash reserves in their portfolio”

“Versa has a good mix of conventional and syariah products and has the tools to help everyday Malaysians with building financial behaviors.”

“We’re reshaping how young Malaysians save and invest—making the journey simple, rewarding, and built for you.”

We offer Conventional and Shariah-compliant options

At Versa, there are conventional and shariah-compliant products to help you achieve your financial goals. You can now invest in offerings that are aligned with Islamic principles.

We offer Conventional and Shariah-compliant options

At Versa, there are conventional and shariah-compliant products to help you achieve your financial goals. You can now invest in offerings that are aligned with Islamic principles.

Your security matters to us

Regulated by The Securities Commission (SC) Malaysia

SC has not reviewed this website and takes no responsibility of the contents

Your money is held by independent registered trustee

Provides 2-factor authentication and data encryption

We are proud to help our users throughout their financial journey

⭐️ 4.8 Apple Store

⭐️ 4.8 Google Play

⭐️ 5.0 Huawei Gallery

⭐️ 4.8 Apple Store

⭐️ 4.8 Google Play

⭐️ 5.0 Huawei Gallery

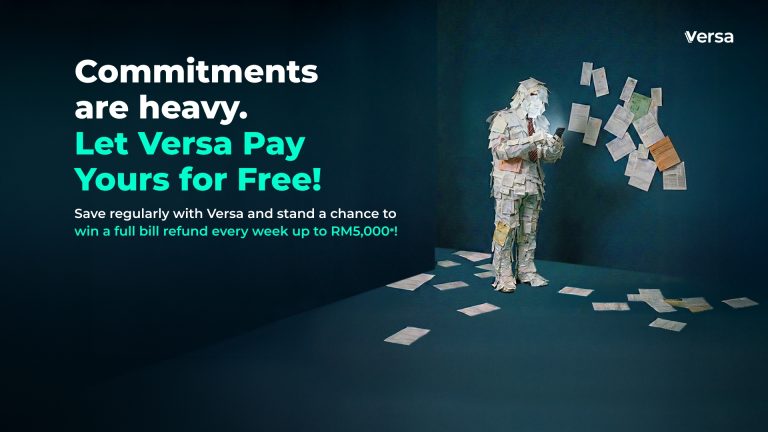

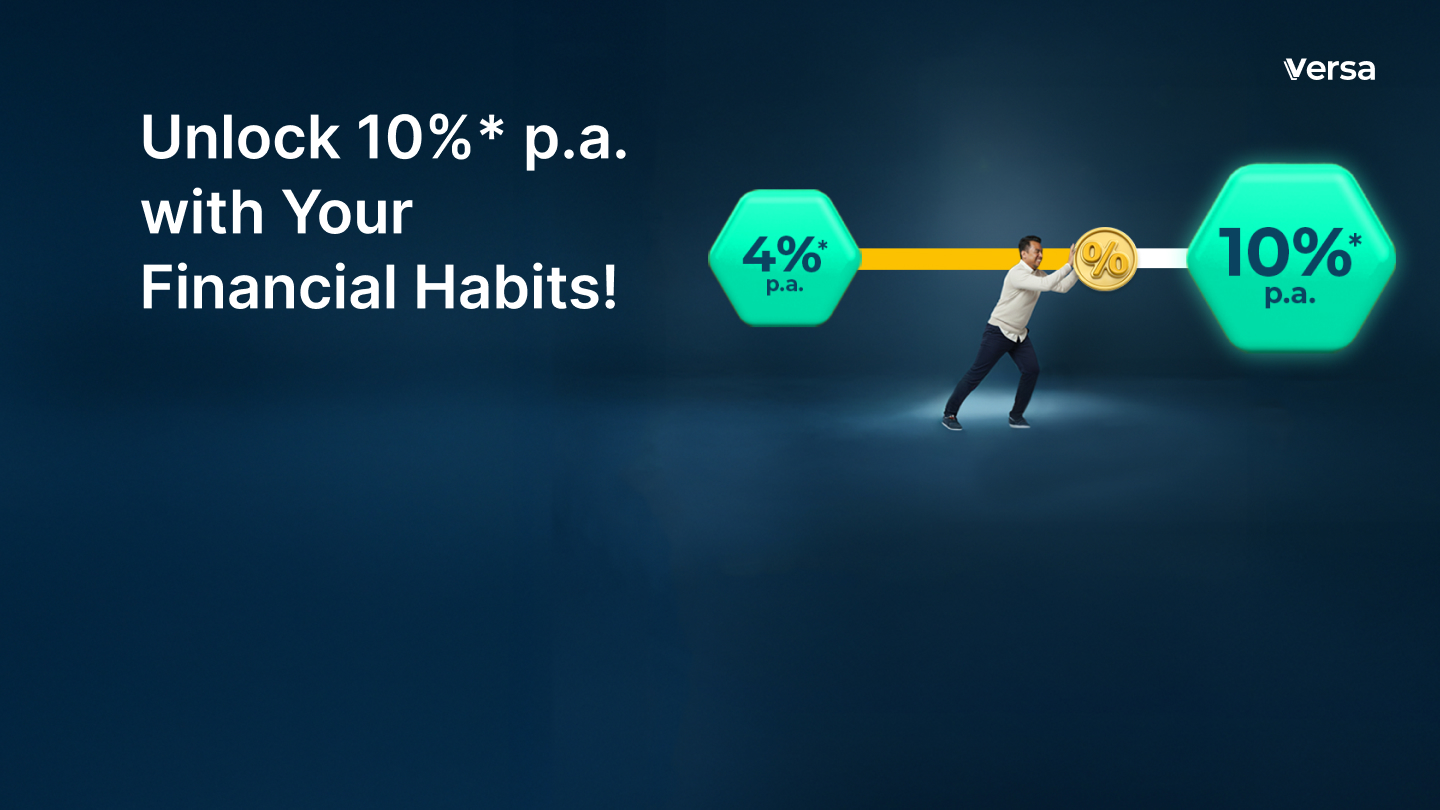

All-New 2026 Versa Starter Quests

Kickstart your 2026 financial journey with Versa with a 4.0%* p.a. fixed promotional rates on your fresh funds, and you can boost your earnings to 10%* p.a. when you save every month.

Campaign Period: 1 January 2026 until 31 January 2026

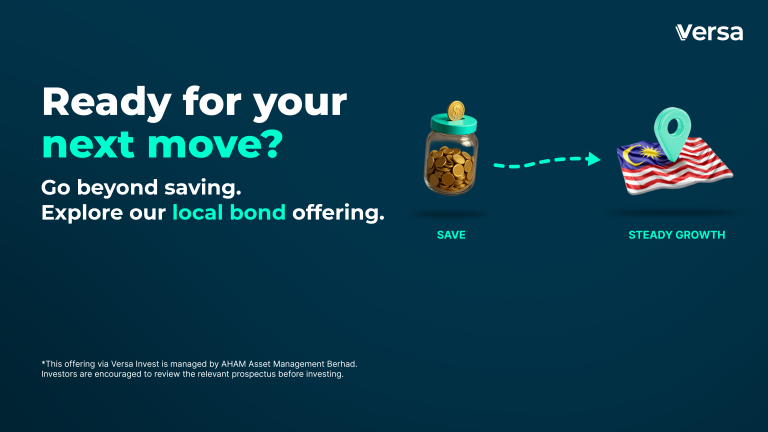

Not sure where to invest your money?

We make it simple and easy for you to invest. Discover the right investment plan for you.

Save Portfolio

Earn higher returns with our high-yield save portfolios, compared to traditional savings accounts.

Invest Portfolio

Our expert-managed portfolios make it easy for your long-term goals. Begin with just RM100 and automate your investing using Auto Debit.

Retirement Portfolio

Optimise your tax returns by investing in PRS, claim up to RM3,000 of tax relief today.

Frequently Asked Questions

Only Malaysian citizens who are 18 years old and above and have an NRIC/MyKad can open a Versa account. Malaysian Permanent residents are not eligible for a Versa account.

The Versa platform does not charge any fees to their user. However, there are management fees, trustee fees and fund-level fees paid to the fund managers, which differs based on the portfolios.

Please refer to respective prospectus.

Money market funds are not protected by PIDM. However, the Versa Fund places / diversifies our customer’s funds in multiple short term deposits of multiple Malaysian banks. In an unlikely case that one bank were to go under, it would only slightly affect the return of the fund.

Yes. Versa currently provides seven Shariah Compliant funds, which are Versa Cash-i, Versa Gold, Versa Growth-i, Versa Moderate-i, Versa Global-i, PRS Conservative-i, PRS Moderate-i, and PRS Growth-i.

The minimum amount required to Cash In into a Versa Save account is RM10, while the minimum Cash In for Versa’s investment and PRS portfolios is RM100. No minimum balance is required to maintain the account.