In your 20s and 30s, you may be saving for a car, your own home, or a trip abroad (COVID-19 can’t last forever, right?). On the other hand, most of your cash can only cover your brand new clothes, various beauty appointments or your weekend social life with your friends. Whatever your situation, think about how your expenses can affect you from now on, especially if mom and dad are helping you out financially. In the meantime, here are five financial mistakes to avoid in your 20s.

No Emergency Fund

Without reliable savings, unforeseen circumstances can lead to problems. It is a general rule of thumb that everyone receives emergency financial assistance. Ideally, you would need 3-6 months’ income to cover expensive surprises such as loss of a home, medical expenses, or unemployment. To create an emergency budget, make sure you save money every month. Then automate some of your salaries and put them in a separate account each month. Over time, you can create your emergency funds for maximum financial security.

Overspending

“Budgeting has only one rule: Do not go over budget.”― Leslie Tayne, Life & Debt: A Fresh Approach to Achieving Financial Wellness

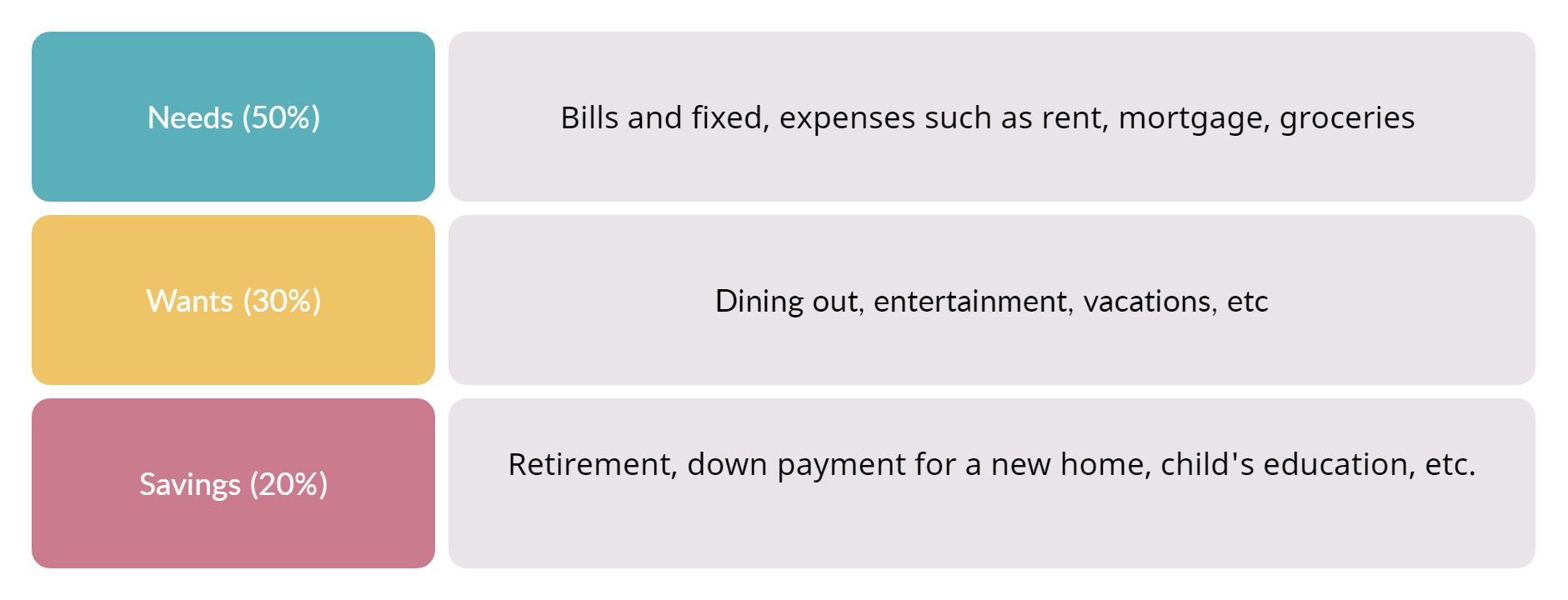

We can’t say it enough: Don’t spend more than you earn! And the best way to do this is to focus on what you spend. One simple way to track your wealth is through a percentage budget. This is a simple and straightforward concept – instead of setting a fixed amount for each line item, you establish a target percentage for each spending category. One guideline we want to use for percentage budgeting is 50/30/20. Here’s a brief breakdown of 50/30/20. You can refer to our article “Budget with the 50/30/20 rules” for more information.

Student Loan Debt

A student loan is likely to be the first loan of your life and must be managed wisely to prevent it from becoming a burden on your finances. The burden of this debt can begin in your teens, and if you don’t pay it off on time, it will build upon your records as adulthood due to a bad credit rating. Therefore, try to keep your debt as minimal as possible. I’m sure you don’t want to get stuck unable to apply for other loans in the future, like trying to buy a house or a car. Try to pay off the debt before starting a family or buying a new home. Paying off this debt allows you to move on to the next phase of your life.

Going Uninsured

When you are young and healthy, it is tempting to do it without health insurance. However, don’t take it for granted! After all, if you rarely see a doctor, why spend so much money? But the cost of a medical emergency can skyrocket and leave you bankrupt. Even a simple trip to the emergency room can leave you in unforeseen debt. And years without medical care can cost you thousands of ringgit especially when the medical problems you are facing suddenly appear.

Not Setting Financial Goals Plan

Building wealth and financial security doesn’t happen magically — it takes time and effort. Like anything else in life, if you don’t have a plan, you will face difficulties. Coming up with financial goals helps you set the boundary of your budget and gives you targets to focus on. If you want to pay off debt, buy a new computer, save for a car and put away money for retirement, you need to sit down and take a realistic look at how to make that happen.

But most importantly!

Ultimately, you need to LEARN from your mistakes. Then you will do better next time.